South African consumers are facing an increasingly stressful, time-starved lifestyle which has created a burgeoning demand for convenient solutions that can help simplify their lives and points to a host of untapped opportunities for South African manufacturers and retailers.

This stems from our latest report, which focuses on the Quest for Convenience and explores changing global consumer needs and highlights the rapidly growing demand for convenience in markets around the world.

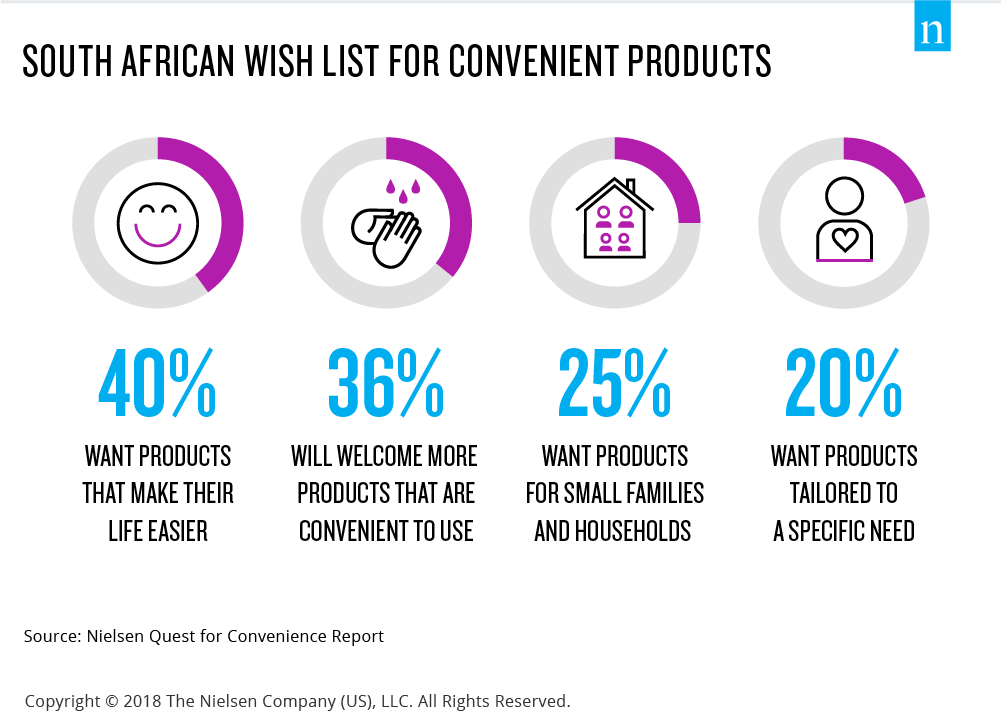

Clear proof that South African consumers are desperate to simplify their lives, is that when asked which products they “wish were on the market but are not”, 40% want products that make their life easier, 36% say they would welcome more products that are convenient to use, while 25% said they want products for small families and households and 20% said products tailored to a specific need.

When it comes to convenience, it means different things to different consumers around the world, depending on their circumstances, culture, location, market maturity, and access to technology. These are some of the key influencers that are driving the need for companies to offer solutions that address the growing need for convenience. Overall, consumer’s convenience choices are underpinned by their search for ease, utility, and simplicity in three areas: consumption, shopping, and engagement experiences.

Meals on demand

In light of this, it’s no surprise then that some of the biggest interests shown by South African consumers in their quest for convenience has occurred within the ready prepared and on-the-go meal solutions, home or office grocery delivery offerings, and tech-driven “on-demand” services. For example, one-third (34%) of South African consumers are now using restaurant delivery (e.g. Uber Eats and Mr Delivery) or meal kit services (e.g. UCook and Daily Dish) up from 29% in 2017, and 19% in 2016.

Grab-and-go meals from quick-service, fast food, and street vendors are also on the rise in South Africa, with 63% of local consumers having visited a fast food outlet in the past six months, 55% opting for casual dining and 34% visiting a formal restaurant. Lunch and dinner are the meals most likely to be substituted with out-of-home dining options, with 50% of South Africans opting to eat outside on a monthly basis, 18% weekly and 31% less often.

Shopping shifts & Ecommerce opportunity

Shopping experiences for consumers are driven by an evolving retail landscape, e-commerce, and omnichannel facilities. A NielsenIQ e-commerce study across 30 countries indicates FMCG online sales are growing an estimated five times faster than offline sales, and by 2020 global FMCG e-commerce will be worth more than US$400 billion and comprise 10% – 12% of overall FMCG market share.

In South Africa, the e-commerce market is not as developed, despite the saturation of mobile devices. This indicates an opportunity to tap into the ability of consumers to now be connected anytime, anywhere. This prevalence of connectivity provides multiple touchpoints for manufacturers and retailers to interact with consumers, and leverage localization to improve engagement through personalized and in-the-moment recommendations.

Looking at how South African grocery retailers can solidify their online e-commerce presence, some of the factors that would encourage respondents to definitely buy online include, 45% who said retailers who provide same day product replacement service for products that aren’t currently available, 43% said a precise delivery window (at 30 minute intervals) to fit their schedule and 41% said a website that provides real time detailed progress on the status of their order. In terms of customization, 36% said that they would like to see online retailers who would allow them to make special product requests to suit their needs.

What is clear is that omnipresent technology adoption is providing an ever-increasing array of consumer data, enabling greater customization. As a result, FMCG players need to adapt to circumstances and provide integrated shopping experiences that allow consumers the freedom of greater choice of solutions that meet their needs.

Convenience is a fast emerging trend and is impacting the way consumers shop and interact with products and brands. Successful manufacturers and retailers of the future will be the ones who embrace this trend and offer innovative solutions for consumers’ rising quest for convenience.

Shopping experiences for consumers are driven by an evolving retail landscape, e-commerce and omnichannel facilities. A Nielsen e-commerce study across 30 countries indicates FMCG online sales are growing an estimated five times faster than offline sales, and by 2020 global FMCG e-commerce will be worth more than US$400 billion and comprise 10% – 12% of overall FMCG market share.

In South Africa, the eCommerce market is not as developed, despite the saturation of mobile devices. This indicates an opportunity to tap into the ability of consumers to now be connected anytime, anywhere. This prevalence of connectivity provides multiple touchpoints for manufacturers and retailers to interact with consumers, and leverage localisation to improve engagement through personalised and in-the-moment recommendations.

Looking at how South African grocery retailers can solidify their online eCommerce presence, some of the factors that would encourage respondents to definitely buy online include, 45% who said retailers who provide same day product replacement service for products that aren’t currently available, 43% said a precise delivery window (at 30 minute intervals) to fit their schedule and 41% said a website that provides real time detailed progress on the status of their order. In terms of customisation, 36% said that they would like to see online retailers who would allow them to make special product requests to suit their needs.

What is clear is that omnipresent technology adoption is providing an ever-increasing array of consumer data, enabling greater customization. As a result, FMCG players need to adapt to circumstances and provide integrated shopping experiences that allow consumers the freedom of greater choice of solutions that meet their needs.

Convenience is a fast emerging trend and is impacting the way consumers shop and interact with products and brands. Successful manufacturers and retailers of the future will be the ones who embrace this trend and offer innovative solutions for consumers’ rising quest for convenience.