Across the total consumer packaged goods (CPG) landscape, we’ve been tracking a handful of key shifts taking place that are paving the way for growth for savvy manufacturers and retailers. In the fresh food space, the four trends offering the most opportunity at a macro level are transparency, convenience, health, and snacking.

Let’s look at each trend and the impact they had on the CPG landscape in 2018.

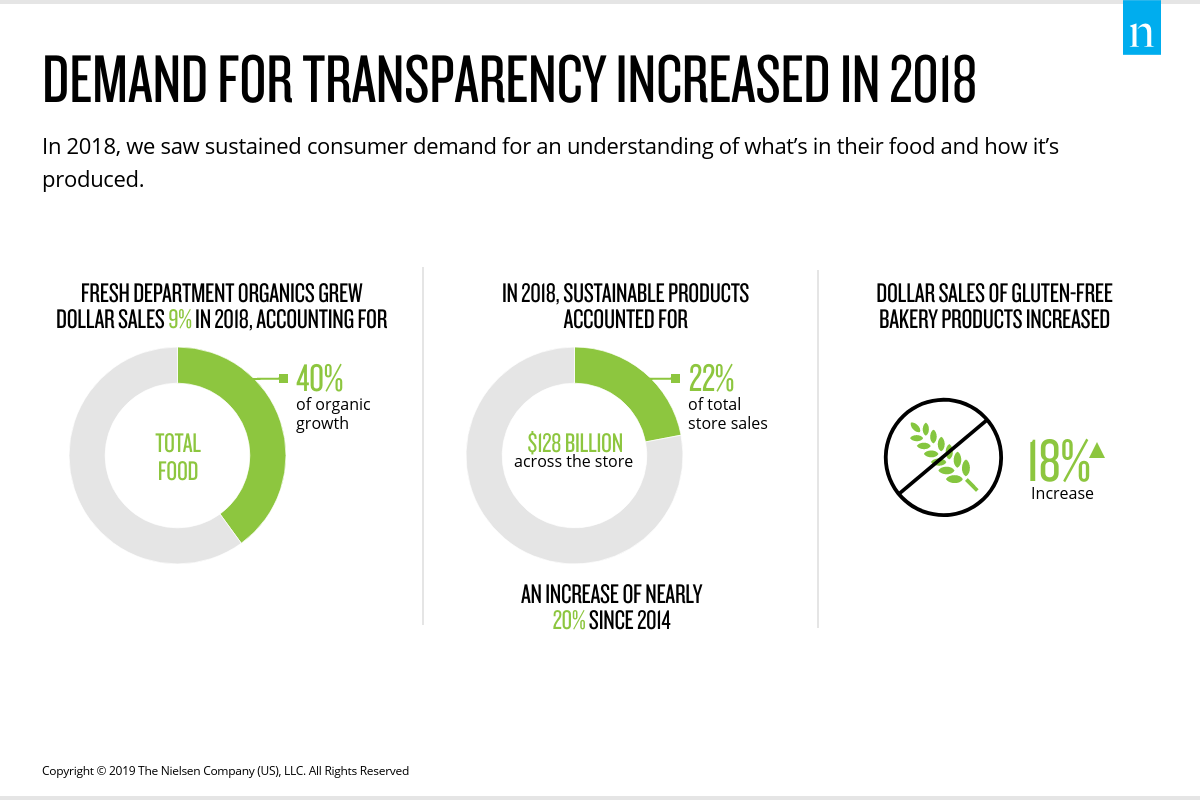

Transparency, which spans well beyond ingredient listing on products, remains one of the biggest influencers driving consumer purchase behavior today. And sustainability, which sits within the broader topic of transparency, is becoming increasingly important to many consumers—and the sales figures prove it: We’ve seen a 20% increase in sustainable product sales since 2014.

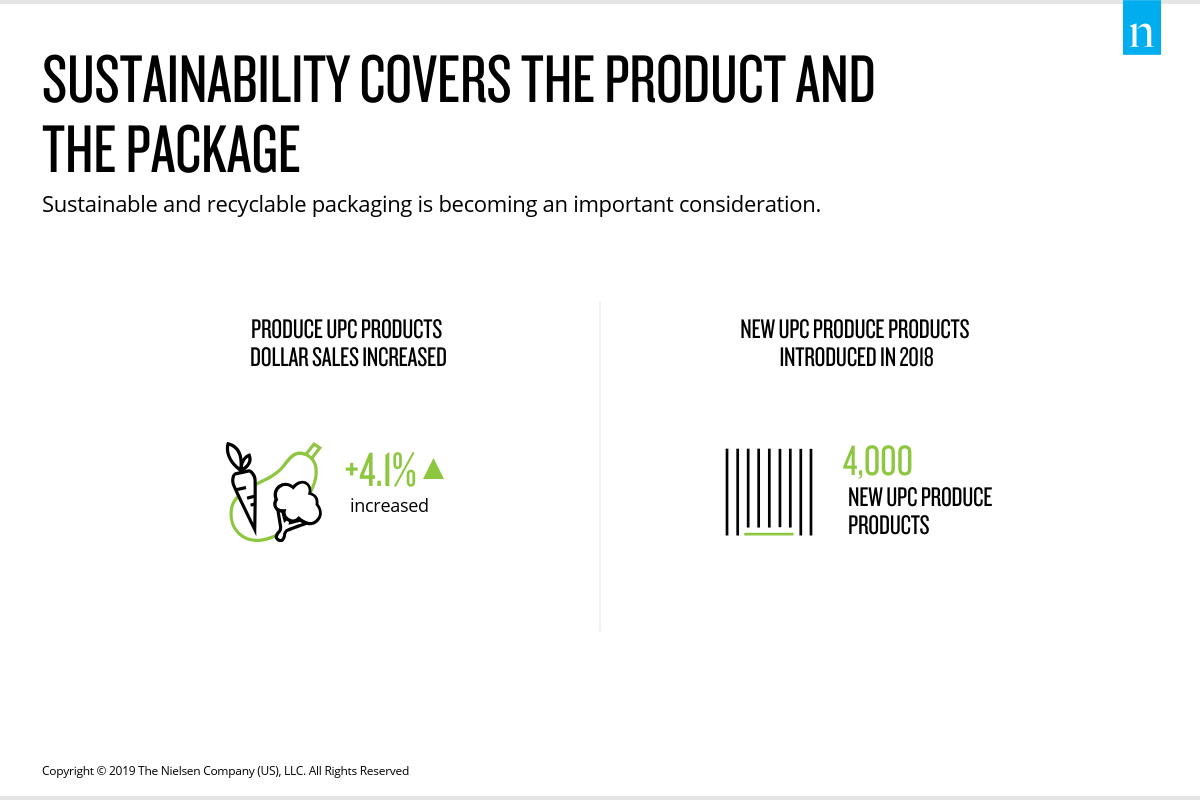

It’s also worth noting that sustainability spans well beyond what we eat. As we see more value-added products come to market for added consumer convenience, their packaging is just as much of a consideration as the food they contain.

Consumers’ quests for convenience is a global trend that we’re tracking across industries and categories. As we noted in our global Quest for Convenience report, consumers around the world are seeking new ways to get things done faster, easier, and through a combination of on- and offline channels. And in the U.S., retailers of all types are seeing upticks in everything from pre-made food offerings to meal kits.

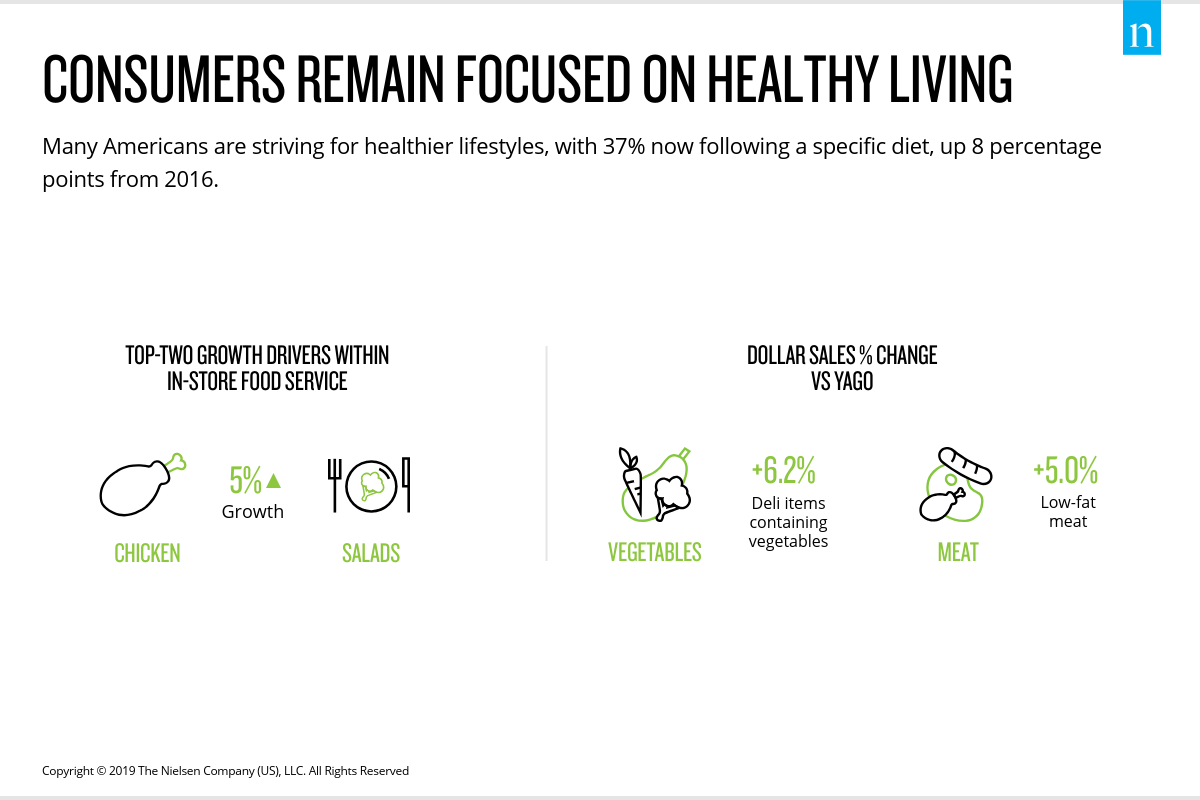

Much like the word “TV,” the word “healthy” can mean different things to different people. That said, however, diet is a common element for most health-focused consumers, and their purchasing behaviors are clear indicators that they’re following through on their desires to eat better.

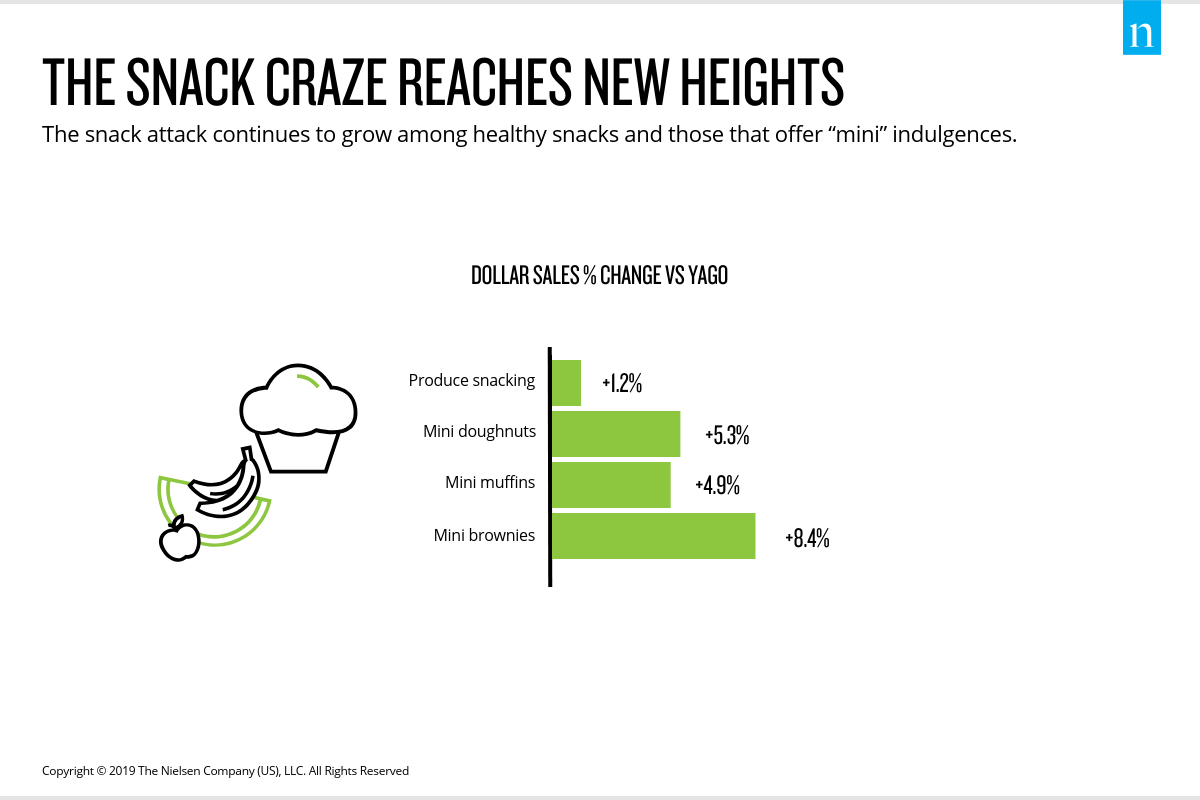

In line with our quest for shortcuts and time-savers, many consumers have adopted regular snacking regimens given that they can be quick, easily prepared, and take less time to eat than a full meal. In some cases, consumers are replacing full meals with snacks. And while we do see some growth for healthy snacks, we’re tracking even greater growth for indulgent snacks that come in small sizes.

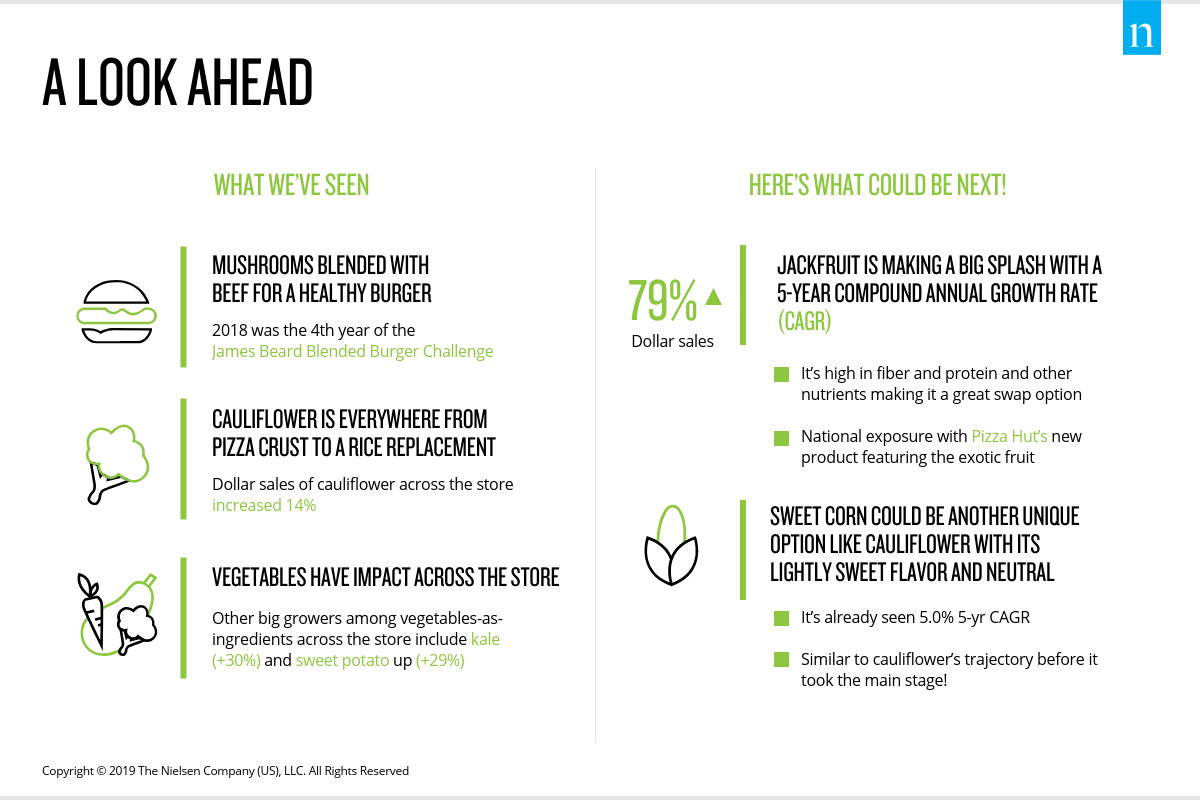

So with nearly a quarter of 2019 already in the history books, it’s important to look ahead and plan for what’s on the horizon. As the year progresses, we expect consumers’ focus on fresh to sharpen a bit as they seek to make their indulgent choices a little better for them. Examples of “healthy swaps” could include rice-based pizza dough and jackfruit-infused smoothies.

But the future of fresh spans beyond sustainability and healthy swaps. Specifically, the U.S. is growing more culturally diverse as each new year comes along, and that diversity is having a notable impact on food preferences. In addition to seeing greater Hispanic influence across American flavor profiles, we’re also seeing the influence of Asian products as well. We’ve tracked a 5% growth in sales of Asian products across the store, and Middle Eastern influences are gaining momentum as well, particularly with respect to fruits and herbs:

- Sales of guava (used for Mexican, Latin/South American, Asian, and Middle Eastern dishes) increased at a compound annual growth rate of 15% over the past five years.

- Sales of pitaya, commonly known as dragon fruit (used in Mexican, Latin/South American, and Asian dishes), have increased at a compound annual growth rate of 33% over the past five years.

- Sales of fresh ginger (used in Asian and Middle Eastern dishes) have grown at a five-year compound growth rate of 9%.

- Sales of fresh epasote, an herb native to Mexico, and Central and South America, have grown at a five-year compound annual growth rate of 10%.

- Sales of fresh turmeric have grown at a five-year compound annual growth rate of 76%.