China’s rebound from COVID-19 has been unique. It came faster and with more demonstrable economic tailwinds for the economy than other markets. But it has also been a bellwether that has helped point to consumer behaviors elsewhere that have inevitably followed China’s lead. An example is the rebalancing of retail playing out around the world.

Pandemic-led shifts to further online adoption and an increased focus on neighborhood and small-format stores have become an ongoing normal. Though different from other markets, China helps us understand consumer attitudes and responses as they head into 2021 with the prospect of COVID-19 vaccine distributions at scale.

Historically, China has demonstrated a mature omnichannel shopping base, with consumers that are already years ahead of the majority of other markets in online shopping. In third-quarter 2020, online sales in China grew by 27% for the year to date, while physical store sales declined by 4%. The declines at physical stores were largely due to COVID-19-related closures, and there has been some recovery in the remainder of the year. China has four main city tiers, based on inputs such as population size, growth levels, location, and infrastructure. Key cities (including Shanghai, Beijing, and Guangzhou) and A cities (including Chongqing, Tianjin, and Dalian) saw the highest closure rates, while B cities and C cities were less impacted. Online has continued on its growth trajectory.

“Due to Chinese New Year [late January], population outflow, and strict pandemic control policies, upper-tier cities experienced heavier impact during the height of the pandemic, and only 50–60% of stores were still open for business,” said Tina Ding, Chief Commercial Officer, CPG, NielsenIQ China. “But due to market resilience and robust foundations, by August, around 80% of stores reopened, signaling both a rebound in physical, and some fascinating new developments in the e-commerce space.”

In addition to sales growth, online shopping in China saw huge category expansion among shoppers during the onset of COVID-19. While e-commerce growth in China prior to the pandemic was primarily led by personal care categories, consumers began purchasing in categories like dairy, staple foods, beverage, and liquor. For example, online growth for dairy has surged from 34% to 55% for the year to date October 2020, versus the same time a year ago and staple foods jumped from 30% to 48% growth for the same period.

An adjacent trend that rapidly accelerated in China during COVID-19 was online to offline (O2O) shopping. Offering the best of both worlds, consumers purchase items online and have their items selected (often by third parties) and delivered within a short delivery time of one to two hours. During the initial days of the epidemic, consumers valued the convenience and safety of these services, and the O2O growth rate jumped up to 20% from January to March. Between March and June, although COVID-19 was under control and consumers could return to normal, O2O growth continued at a rate of 6%.

“The rapid adoption of online-to-offline shopping has driven an element of physical-store fragmentation seen in China. Given that O2O transactions are executed in physical stores, O2O purchases—a majority of which are made in small-format stores, are captured within physical in-store purchases. These O2O sales are contributing to the growth being seen in small format channels.” said Ding. “O2O was already a fast-emerging trend in China prior to COVID-19, but it has definitely accelerated its usage. At the same time in 2019, consumers were more likely to shop in person before, but now their loyalty is driven by the outlets and brands that make themselves available for purchase in an O2O environment. In this world, convenience, proximity, and safe access are key things that matter to consumers.”

But amid the growth has been upheaval in the physical retail sector. Some stores that were once the biggest contributors to total sales in the industry are now seeing sales declines, while those that may have been previously viewed as “underachievers” are overperforming against previous benchmarks.

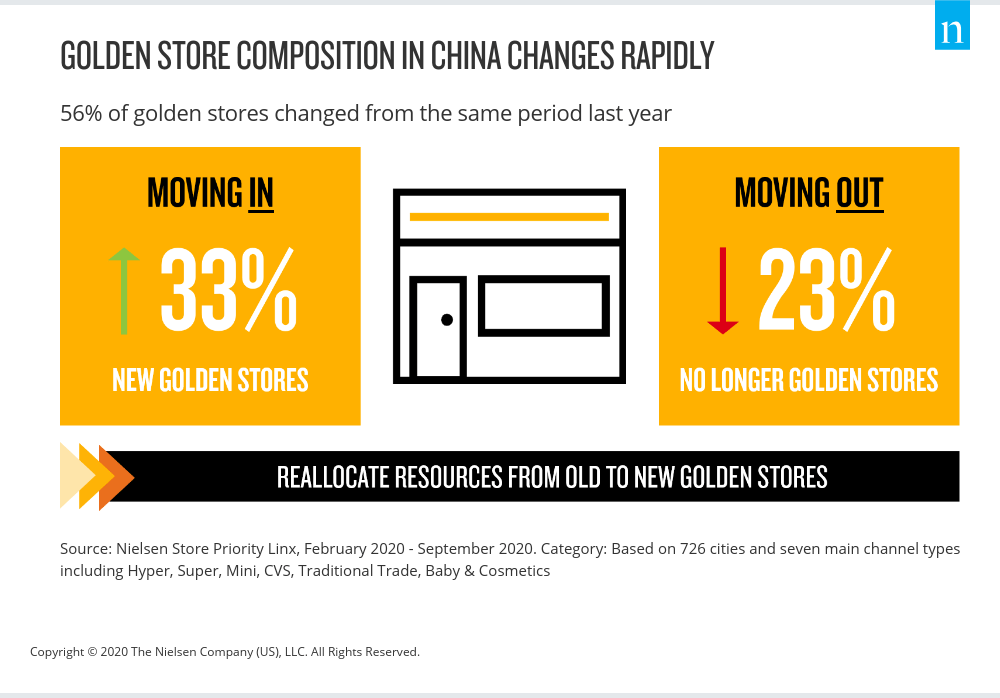

The concentration, or number of stores, that account for 80% of FMCG sales, often referred to as “golden stores,” changed in China between February and September. More than half (56%) of the stores in this universe of golden stores changed from the same period last year. Thirty-three percent of stores are new golden stores, and 23% of stores that used to be golden are no longer. The rotation of golden stores in and out is even greater in small-format channels, with mini market (58%) and convenience (42%) seeing higher changeover than supermarkets (37%) and hypermarkets (20%).

Within the 33% of new golden stores, 71% are brand new entrants (that did not operate before COVID-19). 26% of these brand-new entrants have jumped straight into top-performing stores. The scale of the changes is unprecedented and will have far-reaching implications for retailers and brands. Similar trends have played out in Paris and London.

Retailers and brands that have resisted adapting to COVID-19-shifted spending, perhaps hoping for a return to old habits, now find themselves lagging behind faster-moving competitors that adjusted for the ongoing change.

Those that have embraced the change in shopping preferences and pivoted their offerings to suit new consumer needs are already gaining traction. Areas they have addressed include distribution efficiencies, sales force optimization, innovation planning, assortment, and pricing.

For more on how consumer behavior is evolving throughout this global pandemic, visit NielsenIQ’s Content Hub for the latest insights.