In a year unlike any other, even Thanksgiving is not immune to polarization in the U.S.

As we confront ever-rising COVID-19 cases and physical and financial restraints, this year’s Thanksgiving festivities will look and feel drastically different, depending on location, generation, and the financial impact of the pandemic. Yet from online shopping to price hikes, consumers share commonalities in confronting a Thanksgiving unlike any other.

Thanksgiving highlights COVID-19 divide

Americans are almost perfectly split on whether they’re planning to alter or bypass their traditional Thanksgiving celebrations this year, or carry out their celebrations similarly to last year, as revealed in NielsenIQ’s Holiday Planning Consumer Survey.

Travel constraints and local health regulations will cause most of those who celebrate to do so in smaller groups, as 70% are planning a Thanksgiving gathering with fewer than six people, and 39% plan to prepare a meal at home for just household members. Retailers and brands can take solace in the fact that smaller gatherings won’t necessarily equate to less spend this Thanksgiving. They will, however, result in a more evenly distributed spend among consumers. Pandemic-conscious shoppers in particular will look toward the omnichannel landscape to meet their altered needs, reinforcing the importance of retailer capabilities such as click-and-collect, home delivery, and curbside pickup.

On the other hand, plenty of shoppers are planning to celebrate Thanksgiving as usual this year, and most of these consumers plan to maintain or increase their overall spend—providing some peace of mind for retailers. Those most likely to carry out their usual festivities include consumers living in rural areas, households with children, and younger shoppers belonging to the Gen Y and Millennial generations. In an effort to make up for lost entertainment and travel plans, this group will look to supplement with small luxuries like premium meal delivery options, imported spirits and wines, and large package formats meant for entertaining guests.

Omnichannel takes center stage for the holidays

Thanksgiving week historically yields higher CPG sales in brick-and-mortar stores than any other week except for Christmas week, but purchases will be more evenly distributed across the omnichannel landscape this year than ever before. The onset of the pandemic turned online grocery’s potential into reality, leading us to a Thanksgiving run-up that promises to be a true omnichannel experience for the first time.

While we can still count on Americans to increase their in-store spending relative to normal weeks, COVID-19 reduced the barrier to online entry for 18 million first-time online CPG buyers in the U.S. since March. Grocery e-commerce became wildly popular this year, with household penetration increasing by 68% compared to pre-COVID levels, according to NielsenIQ’s Omnichannel Shopper Fundamentals Survey.

Consumers’ shift towards e-commerce was highly accelerated by the pandemic, and we can anticipate an additional uptick in online consumption this Thanksgiving as half of consumers have indicated that they will be shopping online to some extent for seasonal food and household items. Retailers must prepare their online and offline assortments to accommodate for out-of-stocks, convert impulsivity into additional dollars, and allow for speedy delivery and pick-up.

A tale of two spenders

Household income is taking on outsized importance in determining how consumers plan to celebrate Thanksgiving. Consumers with income levels of less than $50,000 have exacerbated the movement toward smaller or bypassed festivities, as their purchasing power has significantly decreased due to loss of income and higher prices for common household and grocery items. And low-income shoppers who are still celebrating have indicated that they will spend less than the average consumer both in-store and online. Although lower-income Americans have expressed that they will be spending (and celebrating) less overall, there’s still an opportunity for retailers to capture these shoppers through value brands and smaller serving formats.

Consumers looking to save are having a hard time staying within their budgets, as in the month of October, they paid +3.7% more than they did last year for popular seasonal items correlated with Thanksgiving. With less financial flexibility and sparse opportunities to save, constrained shoppers looking to celebrate will be motivated by promotions, plan purchases ahead of time, and use e-commerce as a price aggregating tool to find low-priced, high-value products that can be delivered or picked up at their convenience. Retailers need to make sure their online and offline assortments include smaller serving sizes, offer a wide array of value brands, and are available at the push of a button.

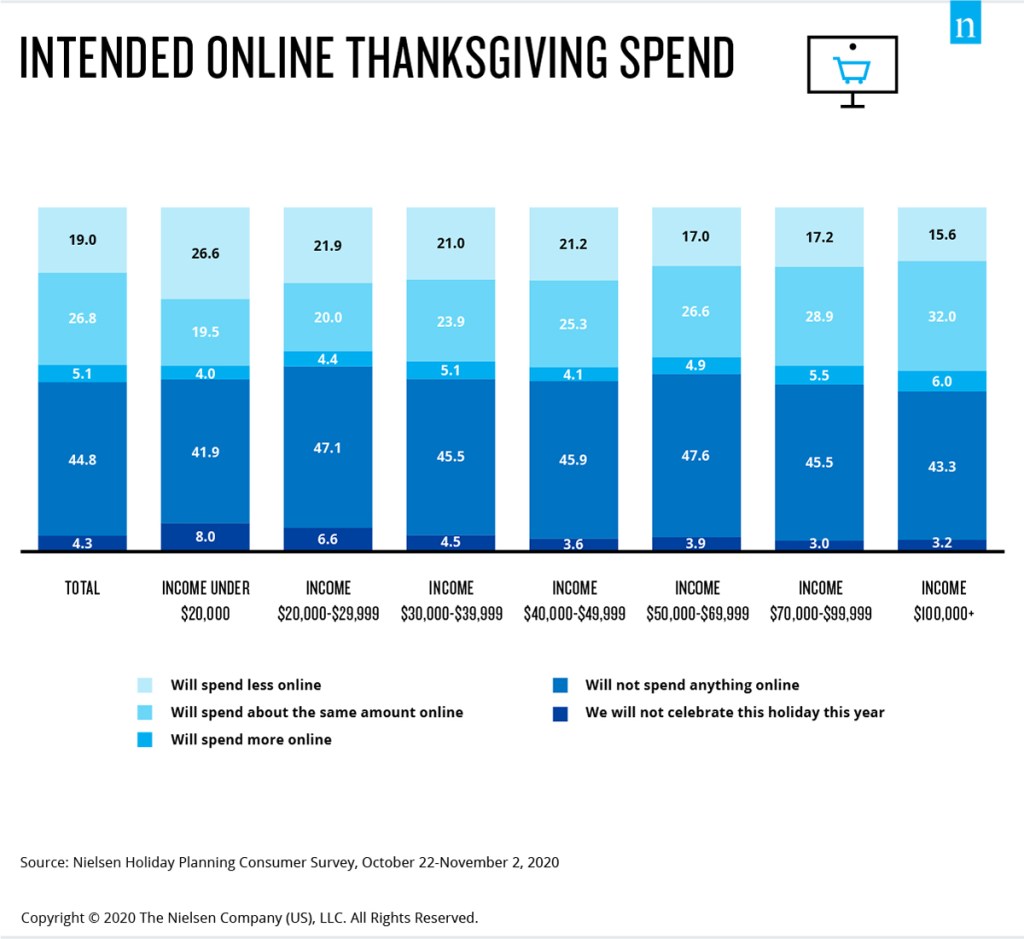

Findings reveal that middle-class consumers with income levels over $50,000 are more likely to celebrate similarly to years past and remain committed to holiday purchasing. Although constrained consumers have taken to the reduced delivery costs of e-commerce, online shopping will serve as an essential avenue for insulated consumers in particular, as consumers who earn more than $70,000 in annual income plan to spend more online this Thanksgiving than lower income households. Exciting insulated consumers through exclusive online savings and opportunities for impulse purchases will capture new and existing shoppers. As retailers enact last-minute strategies, doubling down on online offerings and curbside pick-up at physical stores should be in the mix.

During the season of deals, it’s critical that retailers and brands give shoppers enough leeway to plan their purchases by extending the length of sales and continuously reminding consumers of when and where they can anticipate a big promotional event. Given the chaotic crowds that are commonly associated with Thanksgiving, retailers can delight consumers with promotional periods and sales through multiple channels, including in-store, home delivery, and curbside pickup.

Even during a pandemic, Thanksgiving remains core to the fabric of the U.S. Retailers and brands that throw out last year’s playbook and adapt to an altered holiday landscape will reap the benefits.