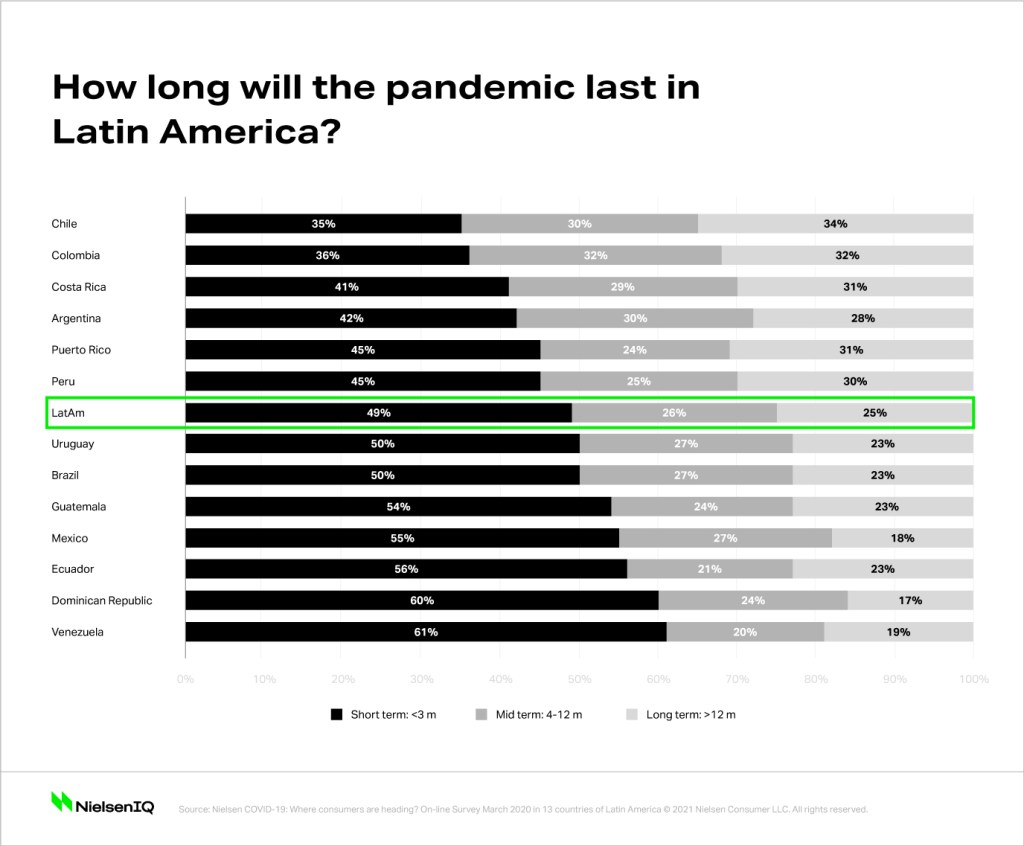

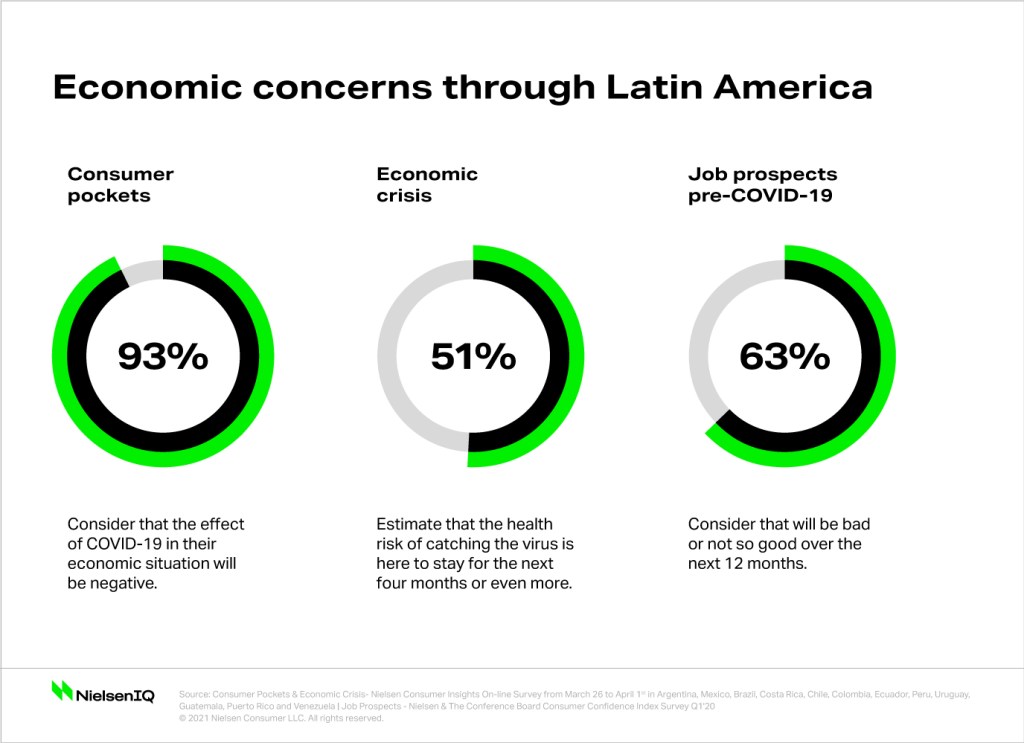

At the beginning of March, consumers in Latin America hoped they could avoid the worst of the impact caused by the novel coronavirus (COVID-19) outbreak. In three short weeks, however, the number of known infections increased exponentially, spreading to all countries in the region. That, along with the fact that pandemic has essentially shut down most of the world, has consumers in Latin America expecting the impact to be lengthy. In fact, a NielsenIQ study of 13 Latin American markets found that 76% of Latinos are now concerned about COVID-19, and 51% estimate that it’s here to stay for the next four months or even more.

The social challenges for Latin American consumers

Since the start of the pandemic, consumers around the world have been advised about how to manage the spread of the virus: wash your hands, practice social distancing and “#stayathome.” But staying at home is not an option for over half of working consumers (53%) across Latin America. These consumers belong to the informal sector and earn money on a daily or weekly basis in positions that often don’t include social security or benefits.

While many Latin American governments are seeking policies to subsidize low-income consumers and the most vulnerable populations, the policies don’t remove the risk of exposure to the virus. For many, staying at home is an impossible reality, as staying at home would mean these vulnerable consumers would not have enough money to eat or purchase everyday essentials. That means they continue to work, which heightens the risk of infection. It is an increasingly complex situation that is adding to social unrest and a latent increase of delinquency in the short term.

As COVID-19’s footprint spread across Latin America, many became profoundly concerned about the increasing humanitarian, economic, and political consequences. COVID-19 will have the biggest impact on consumers who are least equipped to handle it: those living in extreme poverty and inequality*. Poverty and inequality were already an issue in the region, but COVID-19 will exacerbate them, putting increased pressure on consumers’ financial outlook and lifestyles.

Latin American consumers’ optimism toward job prospects, even prior to COVID-19, was already the lowest in the world. And with unemployment rates climbing, government stimulus or assistance will be critical to keep the country’s financial stability afloat.

Changing consumption behavior and retailer challenges

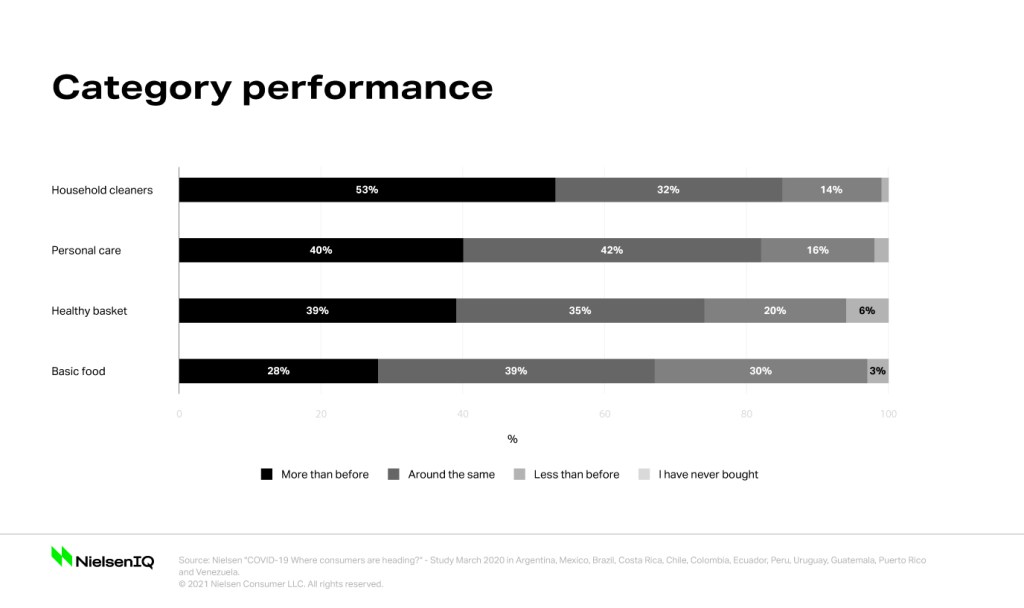

As we’ve seen globally, Latin American consumers have dramatically shifted their purchasing habits amid the pandemic, with large upticks in pantry and cleaning category purchases. According to data from NielsenIQ’s HomeScan panel, 50% of Brazilian, Mexican and Colombian households say they have ample pantry stocking on particular categories for at least three weeks.

Additionally, NielsenIQ’s “COVID-19 – Where are consumers heading now” study highlights how consumers are purchasing more across most categories as a result of the pandemic. For example, more than 50% of consumers state they have increased purchasing in categories such as antiseptics or masks, while consumers are also stocking up on some food categories as well, such as sauces and condiments (45%), ready to eat food (42%) and products with a long expiration date (e.g., canned food {33%}) as consumers embrace the homebody economy.

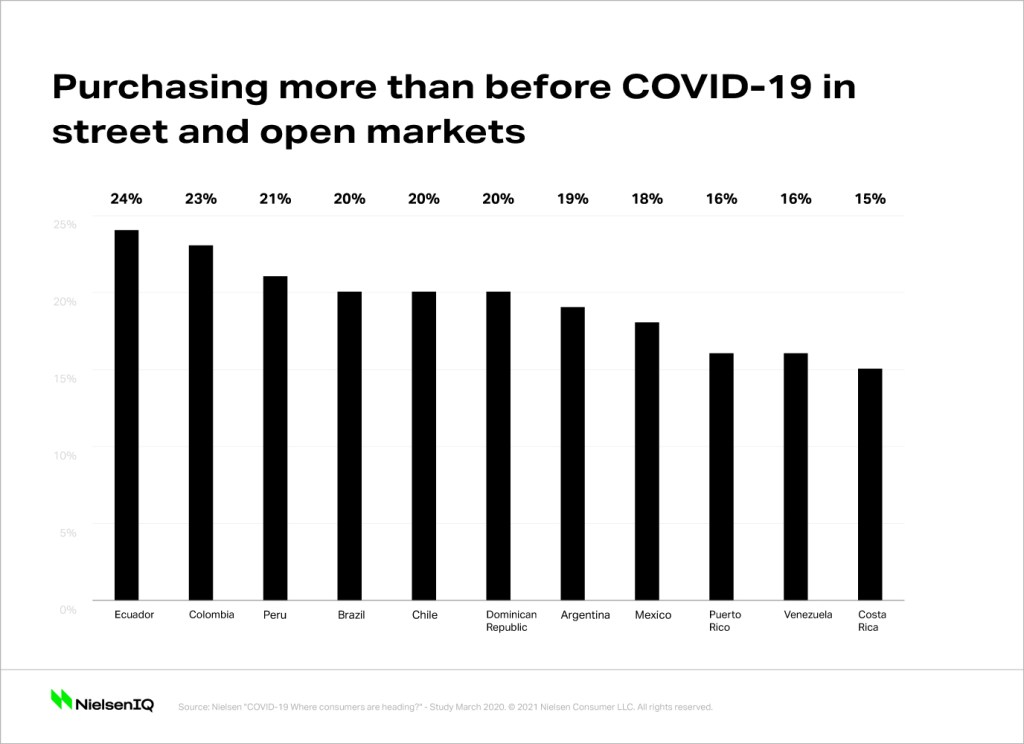

The majority of consumers in Latin America have less money in their pockets and are becoming increasingly cautious when it comes to future spending. They are living day by day and don’t have additional funds to stock up their pantries. As mobility restrictions continue and businesses remain closed, consumers will grow increasingly desperate to guarantee their health and food supply. These constrained consumers will likely turn to small and informal purchase places that predominantly offer low prices and smaller out-of-pockets (e.g., street markets, traditional trade, discounters, cash and carry, and wholesalers) to meet their everyday needs. For example, in Mexico, 66% of low-income households say they stock-up from traditional trade outlets and 30% from street markets. Comparatively, 80% of higher socio-economic levels make their purchases from supermarkets.

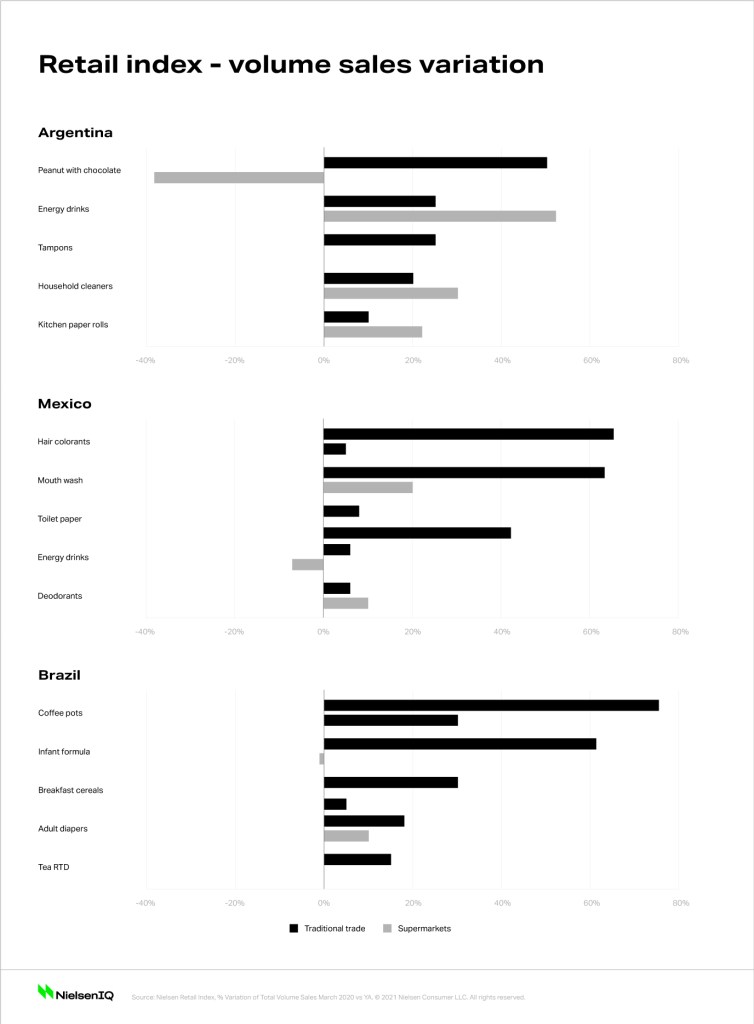

We also see Latin American consumers’ increasing reliance on traditional trade through their increased purchases at traditional trade outlets (the traditional trade channel represents more than 50% of total sales in Latin America). Traditional trade offers the convenience of proximity as well as cheaper prices and lower out-of-pockets for low-income consumers.

Given the recent increases in shopping for everyday needs, the traditional trade channel is facing significant challenges in maintaining adequate supplies. The majority of traditional trade retailers have informal sourcing and supply chain arrangements, and very few companies deliver directly to traditional trade stores. Additionally, their own limited cash flow resources do not allow them to add additional stock to meet increased demand, which is leading to store closures for many in the channel.

Given the pressure to stay stocked, traditional trade retailers have an opportunity to adapt and survive the pandemic; doing so provides them the chance to embrace the strengths that the channel offers: proximity to shoppers’ homes; an assortment of products that meets constrained consumers’ needs in smaller packs and lower out-of-pockets. But they must address their traditional assortment mix of on-the-go convenience products by expanding into more essential and staple categories (e.g., packaged food, personal care, and cleaning products). Those traditional trade retailers that can survive and prosper during COVID-19 will be able to strengthen relationships with wholesalers and manufacturers with or without direct distribution.

This scenario presents an opportunity for wholesalers, manufacturers and even retailers; to improve their relationships with traditional trade owners by providing additional credit lines or ease of payments, distribution services, exclusive packages for this format and also partnerships with distributors from FMCG or even online platforms. Traditional stores offer a lifeline for millions of low-income families in the region; hence, supporting them during this period could be a great opportunity to demonstrate that companies are committed to the recovery of local economies in the era of COVID-19.

As Oscar Cabrera head of NielsenIQ Analytics in Latin America says: “This represents a key opportunity for manufacturers, retailers, and delivery apps such as Rappi or Cornershop, to expand their delivery options and capture this huge market; rethinking their supply chain’s strategy to include the coverage of traditional trade stores via segmentation tools to push the efforts in the right stores.”

Note

*GINI Index (eight countries in the Top 20: Brazil 53.30, Colombia 49.70 and Mexico 48.30 vs. top 1: South Africa 63 or Italia 35.40 or Sweden 19.20).