The news cycle is no longer driving consumer response to COVID-19

In addition to keeping us informed, the news media can often inspire quick, sometimes targeted, behavior shifts, especially in times of crisis. But in today’s prolonged timeline of crisis, there are other factors driving consumer behavior transformation.

While much broader and wide-sweeping in nature, the news cycle about the novel coronavirus (COVID-19) in the first quarter of this year sparked global purchase shifts that were clearly tied to what was being reported in the news. Sales of hand sanitizers, food staples, and cleaning products skyrocketed in step with news conferences and reports related to the spreading virus. But over time, the correlation has faded, and consumers have, in many cases, stopped responding to the news cycle with their wallets.

That hasn’t meant, however, that consumers have pulled back on purchasing fast-moving consumer goods (FMCG). Their purchasing just no longer mirrors media reports about increasing rates of virus transmission. Even in countries that have experienced fresh or ever-growing outbreaks of the virus, such as the U.S., Brazil and Russia, FMCG purchases remain relatively steady. And in some instances, increased FMCG purchasing has correlated with momentary factors beyond the virus itself, such as local business re-openings and changes in restricted living conditions.

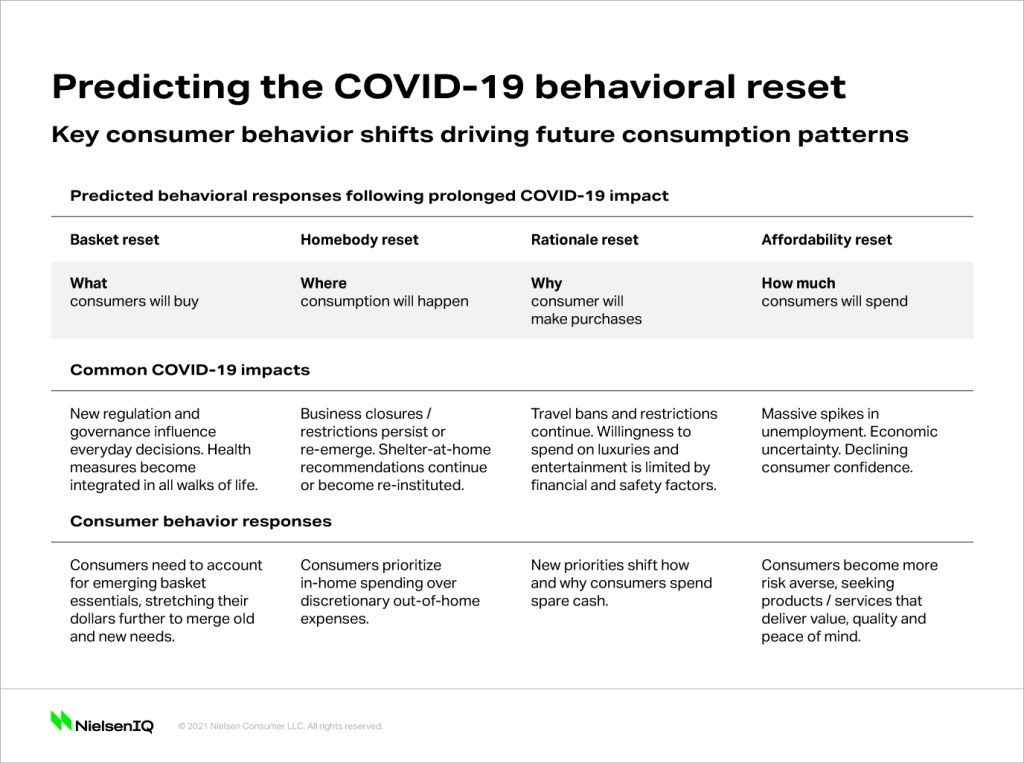

In studying this shift in behaviour, the NielsenIQ Intelligence Unit has identified four emerging patterns that can help predict the drivers of pandemic purchase decisions moving forward: a basket reset, a homebody reset, a rationale reset and an affordability reset. All four are underpinned by rising unemployment levels and concerns about the future of the economy.

Each behavioral switch includes a set of indicators that point to how purchase patterns are likely to pivot as markets experience rising or ongoing rates of COVID-19 transmission.

Key Consumer Behavior Shifts Driving Future Consumption Patterns

NielsenIQ Intelligence Unit leader Scott McKenzie highlights why it’s important to get ahead of these expected consumer responses. “Consumer behavior is spinning in fundamental ways right now,” he says. “The unique macro conditions of a pandemic driving economic recession are forcing consumers to rethink how they shop and what they buy.” And NielsenIQ data shows that changes are already unfolding in households across the world. McKenzie adds, “Habits are changing in days and weeks. Typically, we, as humans, have months or years to adjust to new conditions. But that’s no longer the world we live in. The implication for brands trying to meet the new needs of consumers is that they must be very focused and very fast in their response.”

In the U.S. for example, the links between virus transmission and purchase behavior are beginning to fade at the local level. Topline sales growth trends in various U.S. locations show similar peaks and valleys throughout recent weeks, despite each area having drastically different local instances of COVID-19 cases. In fact, weekly FMCG sales growth rates throughout June in the Miami and West Palm Beach areas of Florida were very similar to the growth rates witnessed in the relatively steady Hartford and New Haven areas of Connecticut, averaging just over 10% sales growth, respectively, over the six weeks through to July 18. Meanwhile, the two U.S. states couldn’t look more different in terms of local COVID-19 impact, as reported by each state’s Department of Health: The state of Florida had exceeded 430,000 in total confirmed COVID-19 cases as of July, whereas the state of Connecticut had fewer than 50,000 total confirmed cases.

There is some correlation between actions at the local level and purchase behavior, but the impact of the actions is typically short lived. For example, we saw a 20% increase in FMCG sales in the Los Angeles area in the four weeks that followed the start of business openings in early May. The extent of upticks sparked by business openings or re-instituted living restrictions, however, has not typically lingered beyond a few weeks, and in the case of Los Angeles, the rate of increase remained just a fraction of what was witnessed at the onset of pandemic lockdowns, when sales growth peaked at 79% in late March.

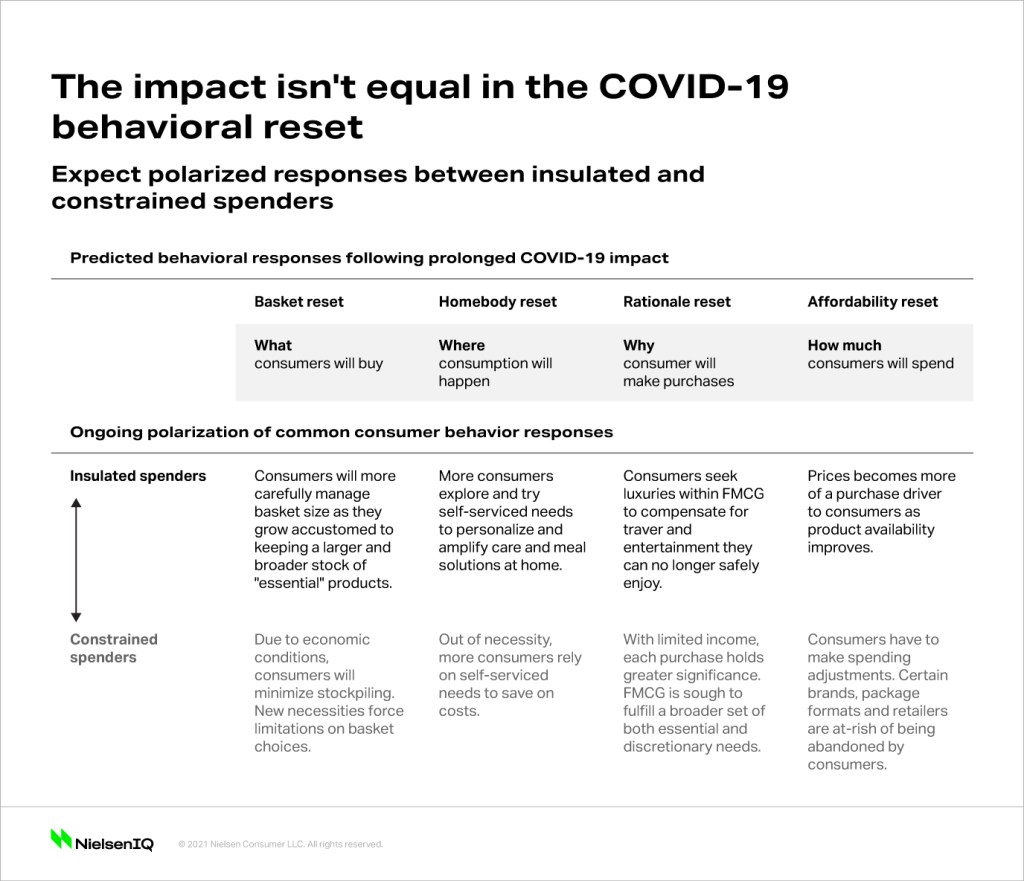

On top of changing habits, future socio-economic consequences are weighing much heavier on spending decisions, and the impact across consumer groups isn’t equal. Constrained spenders, or those whose incomes have been negatively impacted by COVID-19, will spend to survive, compared with insulated spenders, who may adjust situationally even though their incomes remain unchanged by the pandemic.

NielsenIQ research highlights key evidence and examples supporting the predictions made about each of the four consumer behavior responses.

Basket Reset

Overall, we anticipate that many consumers will carefully evaluate the products that make up their “usual” shopping basket. Particularly as more and more consumers become unable to maintain their peak COVID-19 spending levels, the consideration set for what is “essential” will shrink. Even insulated spenders are likely to scrutinize the contents of their above-norm purchase habits formed at the onset of the pandemic.

While still at least 11% above the average weekly basket size from 2019 by the end of June, we can already see that in the U.S., the average size of the American shopping basket has continued to come down from peak COVID-19 levels. Simply put, we anticipate that all consumers will start to re-prioritize what goes into their baskets, and that broad-based adjustment reflects a fundamental consumption reset.

And while consumers carefully evaluate the products that they purchase, they are also assessing the mix of retail and e-tail outlets they use to fulfill each need. The nature of channel shifting will vary by country and by category, but in the U.K. for example, overall FMCG purchasing has steadily climbed via online channels in recent weeks. In fact, the weekly ecommerce basket size in June and July among British consumers was consistently between 130%-160% higher than measures from those weeks in 2019.

For companies, this means there’s a critical window of opportunity to translate pandemic-minded consumption into continued, essential routine. As emerging essentials like face masks become mainstays that weren’t historically a part of budgets, and new preferences emerge among retail channels, consumers, especially constrained consumers, will seek justification for every purchase moving forward.

“As consumer response deviates from the news cycle, the building blocks of the everyday shopping basket have bent in the face of economic downturn and transformation of the workforce,” says McKenzie. Consumers, whether employed or not, are less optimistic about what the future holds. This cautiousness will alter where and how households continue to pad their pantries and shelves amid COVID-19. According to McKenzie, “decisions will need to be made to reconcile purchase habits people have had in place for years alongside today’s new reality where health and value priorities compete side by side.”

Homebody reset

Over the course of months spent at home hoping to reduce levels of virus transmission, consumers have embraced a “do-it-yourself” (DIY) mentality with respect to consumer goods. But even as many shelter-at-home restrictions have lifted around the globe, some aspects of self-care and self-service have lingered on.

Global measures confirm that many homebound routines are here to stay, and this facet of consumer reset is transforming behaviors in a big way. For constrained consumers, self-fulfillment of needs using key consumer goods provides the benefits of limiting virus exposure and essential cost-savings. For insulated consumers, staying at home has prompted creative exploration and trial of products.

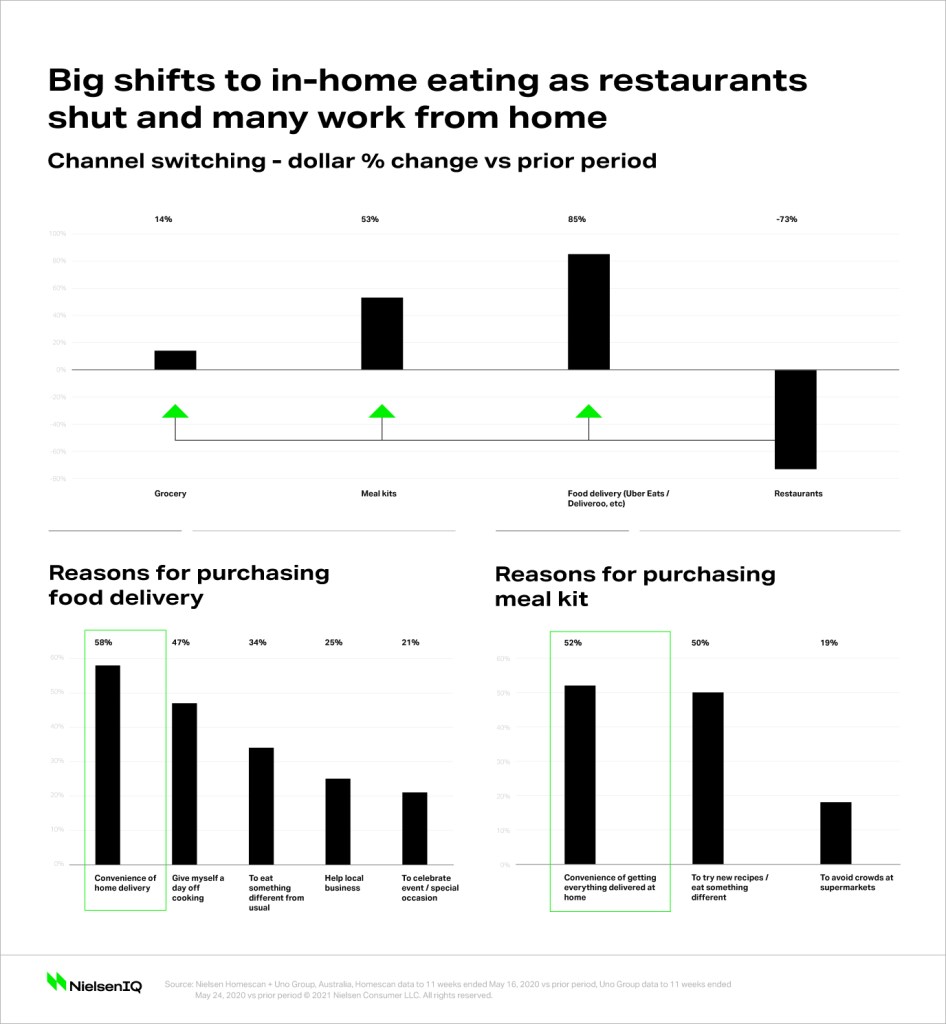

DIY has become quite an umbrella term due to unprecedented and continued demand for a variety of self-serviced consumer needs. From the strong 39% value growth of flour in last week of June, driven by “Bake-it-Yourself” enthusiasts in Poland, to the strong U.S. sales performance of electric razors (up 19%), costume hair coloring (up 35%), pet grooming (up 14%) and food preparation products like canning supplies and seaweed/sushi wrap (up 53%, each) in the month of June, consumers are more willing to try and rely on self-managed routines. And across the world, NielsenIQ has observed big in-home eating shifts. In fact, grocery stores, meal kit providers and food delivery services are the three major benefactors of restaurant closures in Australia.

This homebody reset of consumer behavior aligns perfectly with the transformation that’s required of businesses today. Companies that can intelligently drive the discovery and learning of DIY behaviors, will succeed in empathizing with current consumer interest in creative, cost-conscious and safe consumption. Consumers are already willing to do the legwork to bring a product experience into the safety of their homes. Therefore, companies have the opportunity to seize that interest and respond with affordable, accessible and branded take-home experiences.

Rationale reset

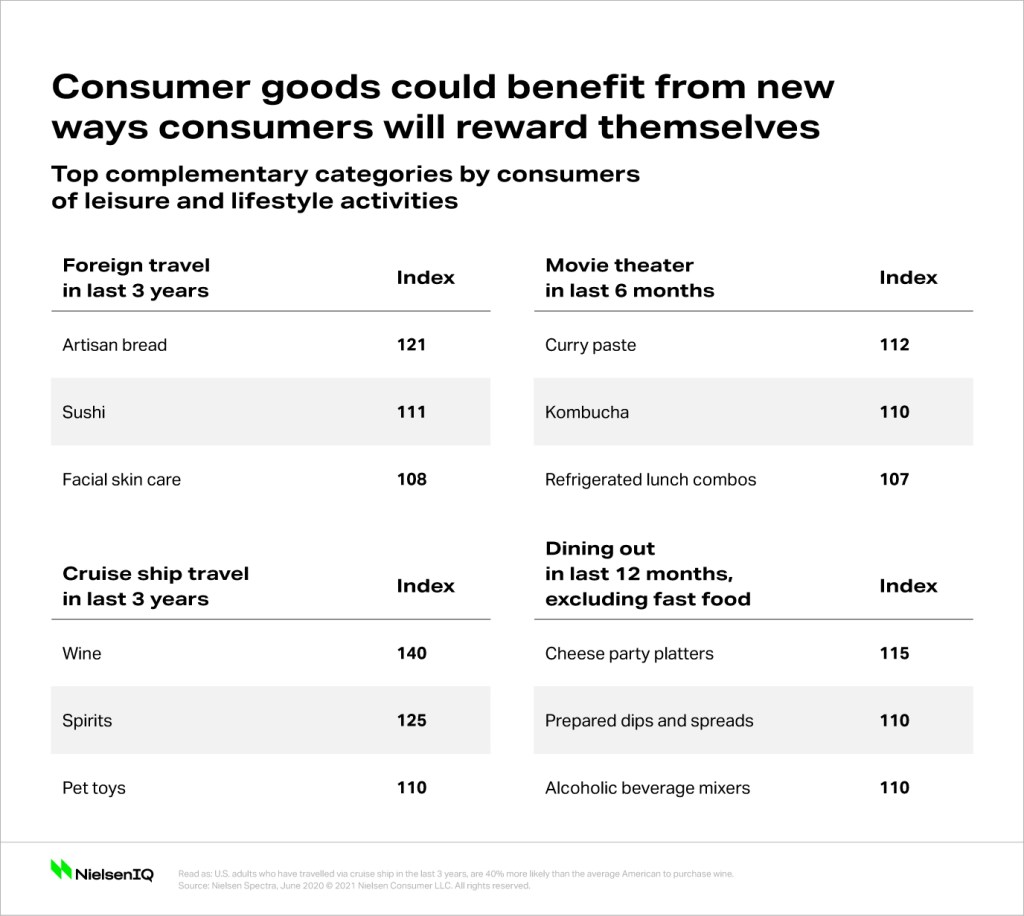

With today’s economic climate and rising unemployment rates, consumers may have less discretionary income to work with. As a result, 78% of consumers surveyed around the globe indicate they are cutting back to save on household expenses, as measured via The Conference Board conducted in collaboration with NielsenIQ. This means that consumers may soon redefine the significance and meaning of the smaller FMCG goods they buy in a retail store. With a third or more of surveyed consumers spending less on take-away meals, travel, entertainment and clothing, we predict consumers will turn to consumer goods as a means to fulfill some of these gaps in smaller ways.

For a family of constrained consumers, the purchase of refrigerated meal combos could replace what used to be higher priced food they had bought at an event’s concession stands. Meanwhile, insulated spenders may indulge in a premium bottle of alcohol at home or expand their skin care product repertoire as an equivalent to the larger dining or vacation experience they can no longer safely access.

Companies seeking to reposition their products in a COVID-19-adjusted world need to consider the rationale reset manifesting among consumers. They need to show empathy and recognize the trading down or trading in of luxuries that will be taking place for both constrained and insulated consumers. Brands that can realize the full extent of their new use cases will be most likely to benefit from the incoming wave of consumers finding comfort and reward in small purchases within FMCG.

Affordability reset

You’re not alone if you feel that you’ve been without a good deal on your FMCG purchases in recent weeks. Nearly one-third (32%) of surveyed consumers in multiple markets around the globe have felt a noticeable decline in promotions in stores they’ve shopped at. And Retail Measurement Services (RMS) data confirms it. NielsenIQ has observed a historically low level of trade promotion activity across various countries. In fact, promoted sales reached a four-year low across the U.S., Spain, Italy, France, Germany and Poland in the second quarter.

From this global viewpoint, McKenzie believes brands and retailers will be forced to examine how and where they return to promotional activity, particularly as more shoppers have expanded to online channels in recent months. “We see the early indication that the promotional baseline has been reset, prompting a huge opportunity to transform consumer behavior around affordability, too. The recent lack of ‘normal’ promotional activity leads to an important and perhaps historic moment where companies can reset their approach to affordability in ways that offer greater efficiency than before.”

In the U.S. market, where promotions have increased slightly in recent weeks, only 21% of products were sold on promotion in the month ended June 13, which is far below the 30% sold on promotion measured back in June of 2019. This makes sense given the demand for products among pantry-stocking consumers and the relatively low need to promote most goods in order to sell them. But times are changing, rapidly.

When executed successfully, brands and retailers can achieve greater promotional efficiency while opening the door to consumers who have less flexibility in their adjusted wallets to work with. Constrained consumers will grow to make up a larger percentage of the global population, and all consumers are feeling less confident in their financial futures as the pandemic and its effects remain at the forefront.

“It’s up to companies to continually assess consumers’ perception of value,” says McKenzie. The economic climate is driving major changes to consumers’ wealth and financial outlooks. In the near future, we expect fewer consumers to be able to realize economies of scale when it comes to pack sizes, while many may place greater priority on the need to access certain brands at certain price points in value-oriented retail formats. McKenzie concluded, “companies that are unable to provide products that can fit the adjusted wallet and price sensitivities of constrained and insulated consumers may ultimately lose long-term traction with core users.”

As markets continue to contend with this global health crisis, NielsenIQ will provide ongoing updates on the active behavioral reset driven by prolonged impacts of COVID-19 to society. Visit our content hub for the latest global consumer insights about how behavior is evolving throughout the coronavirus outbreak.