What are the long term effects of inflated grocery prices on retail shoppers?

The short-term result? FMCG sales shot up $77.9 billion across all U.S. channels for the 52 weeks ending Sept. 12, 2020, translating to year-over-year growth of 9.3%. While this lift was astounding for the retail industry, it’s time for stakeholders to stop celebrating and examine the long-term implications of inflated grocery store prices on retail shoppers as financial stability remains a looming question for 46% of Americans, according to NielsenIQ’s COVID-19 Shopper Survey.

A much more discerning grocery shopper is emerging in the wake of initial widespread panic-buying sparked by COVID-19 this past spring that led consumers on a consumer journey to disregard prices and stock up on products and ingredients required to prepare the entirety of their family meals at home. Retailers and their trading partners responded as rapidly as possible to the sudden spikes in demand by pulling back on promotional efforts and focusing on their supply chains to keep up, which led to higher prices on 64% of more than 500 grocery store categories.

Shoppers have been primarily driven to make purchases based on health and safety concerns throughout the pandemic. However, a second layer of consumption behavior has been emerging from those experiencing (and anticipating) financial restraint. U.S. unemployment has fallen from its peak of 14.7% in April, but consumers are still feeling weary and, as a result, the U.S. Consumer Confidence Index plummeted by 21 points from Q1 to Q2 of 2020. The impact of underlying financial risks is not equal among consumer groups, and it’s important for retailers and brands to understand where consumers are headed in terms of how they will make purchases and the strategy behind them.

Understanding newly constrained consumers

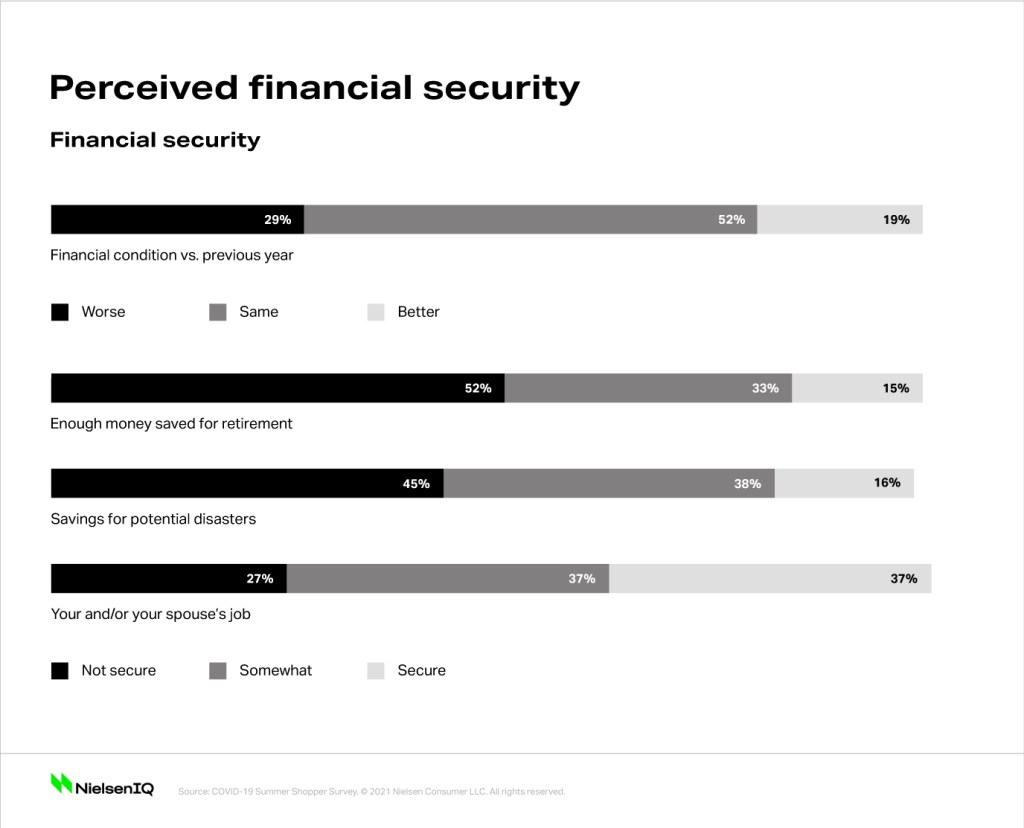

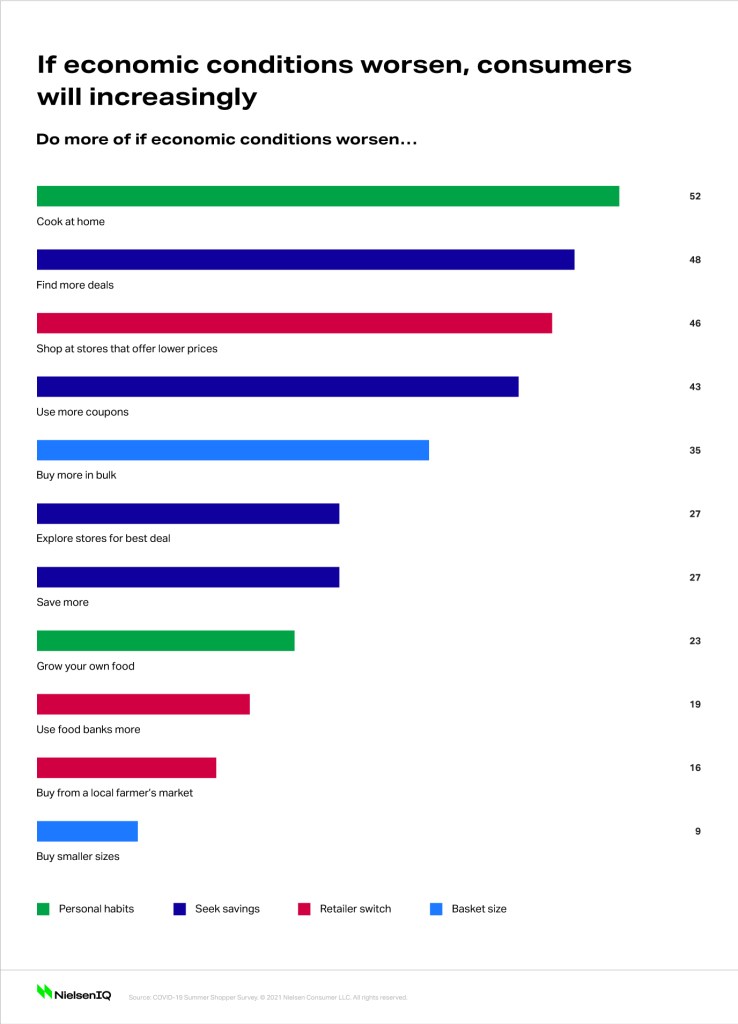

Of those who participated in NielsenIQ’s COVID-19 Shopper Survey in the first week of July 2020 in the U.S., 29% of respondents said their household’s financial condition had worsened from the previous year, forcing many into a segment of newly constrained consumers with adapted habits that align to lost income. Joining them in switching gears are the cautious middle consumers who are planning for an uncertain future that may include an impact to their income, though it hasn’t happened yet. These segments are developing new shopping strategies to protect their health and make each dollar stretch further by seeking out discounts and promotions, shopping at stores with lower price points, cutting back on luxury items, increasing their reliance on e-commerce, opting for nonperishable and frozen foods over fresh foods, and substantially reducing their overall spending.

Brands and retailers need to pay the closest attention to the newly constrained and cautious middle consumer groups. As the U.S. continues to face a recession, more Americans will join these groups and will look to recalibrate their shopping habits. Brands, retailers, and manufacturers need to determine how to maintain their sales as the majority of consumers substantially cut back on spending and seek deals through various channels. This is particularly important in an environment where prices are inflated.

Retailers and brands should cater to the growing segment of financially limited consumers

These consumer segments are less familiar with stretching their dollars to make ends meet. Therefore, retailers, brands, and manufacturers need to make it easier to find information on deals and lower prices, and assist consumers in making their purchases last longer. Retailers and brands can properly cater to the growing segment of financially limited consumers by reassessing their assortments for constrained wallets, offering a price match guarantee and freezing prices on essential and nonperishable items, such as paper goods, sanitizing products, and shelf-stable foods. Retailers would be wise to tout their price matching and price freezes, including the duration and related policies, via digital campaigns, social media, and impactful on-shelf and in-store signage. In addition, stakeholders can provide customers with information on how to preserve food longer, keep their homes clean with budget-friendly products, and provide value comparisons for low-cost products vs. their high-cost counterparts.

Retailers and manufacturers who have limited ability to lower costs will find success in directing consumers to more shelf-stable products, balancing ingredient quality vs. costs for essential items to expand more choices across price tiers and reducing packaging materials to lower production and shipping costs (e.g., expand self-serve product dispensers and packaging options). As more shoppers shift to online shopping, retailers could even reduce costs by reevaluating costs per square foot to spend less on keeping shelves visually appealing and focus more on expanding selection and reducing out-of-stocks.

Further, as raw material costs rise, consumers will respond well to new, smaller pack sizes at lower price points as well as economy sizes that provide lower cost per serving. While more make the leap to online grocery shopping, given its convenience and product comparison capabilities, newly constrained and cautious middle consumers will expect easier online solutions to price compare and order from stores with the best price more often. Retailers need to make pricing and deal information easy to find online, for even the most basic items.

In-store promotions and sales on essential items will increasingly entice consumers to shop brick-and-mortar given their locality and wide array of options. Consumers who need to do more with less will search for the best value. That means brands must communicate the added benefits of their products in terms of cost, quality, and features, with a special focus on in-home spend. In addition, newly constrained and cautious consumers will respond especially well to loyalty programs that reward repeat purchases and make it easier to save money. Newly constrained and cautious middle groups will become loyal to retailers who have helped them learn a new shopping strategy that saves them money and keeps them healthy.

Communication is key

Although the U.S. is bracing for a long-term recession, this scenario is drastically different from the financial crisis in 2008. It’s not enough for retailers and brands to simply reassess their package sizing, quality, and promotional strategies. In order to make consumers feel comfortable shopping in stores, retailers need to clearly communicate the measures they are taking to keep their employees and customers safe from viral exposure and focus on online information and shopping options. Financial concerns are not the only factors influencing purchase decisions; 60% of households expect their routines to remain altered for at least the next four months, meaning consumers from all income levels will continue to limit risk of exposure to the virus and purchase products that reinforce health and sanitization.

In order to quell pandemic-related concerns and allow shoppers to remain confident while shopping in-store, it’s crucial that retailers communicate and enforce safety protocols and precautions, such as limiting the number of shoppers, disinfecting carts, baskets, shelves and checkout areas, providing visible social distancing markers, and implementing contactless payment and pick-up methods.

Brands and retailers looking to capture consumers with less financial flexibility have little choice but to assess shoppers’ altered perceptions of value and react accordingly. The demand for promotions, sales, and high-value products that fit current needs will continue to rise as more consumers become constrained.