E-commerce: A mosaic of platforms and opportunities

The COVID-19 pandemic has disrupted Europe’s physical and digital balance within the consumer goods industry, accelerating the growth of e-commerce market share against brick and mortar.

In the U.K., online shopping has nearly doubled its market share in 2 years, from 7.4% in 2019 to 13.8% in 20211. The online revolution within the consumer goods industry, once hovering at a 1-2% share in many European markets, is becoming increasingly more important across categories such as food and beverage, homecare, and beauty products. The e-commerce landscape is transforming at unprecedented speeds, and is more fragmented than ever, featuring an ever-widening range of digital shopping options.

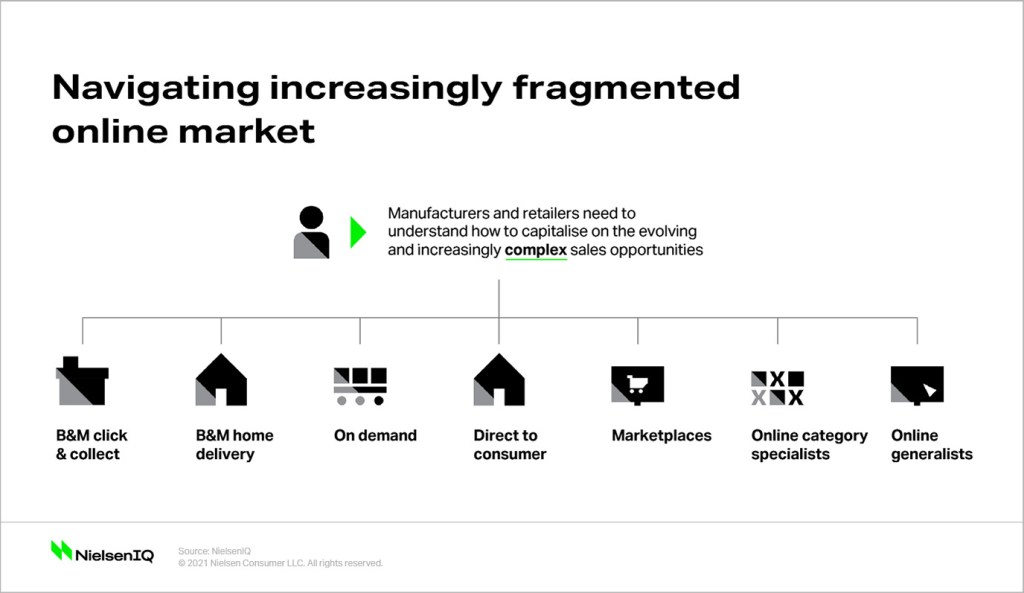

To answer their shoppers’ needs, brick-and-mortar retailers have expanded their e-commerce footprint, offering various options to customers: click-and-collect (where the U.K. leads the market), drive-thru pickup (mainly developed in France), or home delivery (favored by many throughout Europe). The competition is booming: generalists like Amazon or Ocado as well as category specialists like Zooplus act as pure players, while brands often work on their own through on-demand, direct-to-consumer, online marketplaces, social platforms, and more.

With this fragmentation of the e-commerce marketplace, players need a breadth of coverage of this landscape, including the different forms of e-commerce, from A (Aldi) to Z (Zooplus).

Be confident in your next e-commerce move

Are you looking for holistic e-commerce insights to enable better data-driven decisions? Look no further. Discover how you can get granular e-commerce insights to help you make the right decisions today—and tomorrow.

Discovering the opportunities of tomorrow, today

Pre-Covid, NielsenIQ measured e-commerce growth at 9% in the U.K. In the first half of 2021, that figure stood at 37%2.

Online sales are rapidly outpacing offline sales by double digits in countries like the U.K., Italy, Spain, and the Netherlands, leaving consumer goods players no option but to keep a keen eye on emerging trends, new ways of shopping, and new competitors. Every manufacturer, retailer, and brand needs to understand how to capitalize on those evolving and increasingly complex sales opportunities.

Smaller and more mature players need to do the following if they want to survive and thrive in a fragmented and highly competitive market:

- Use the most robust, integrated, and accurate data available to measure and predict future opportunities. Seeing the full picture will help spot the best opportunities online, identify emerging competitors and potential acquisitions, and have confidence in your next strategic move.

- Understand which channel provides the best potential for your current—and future—products. While there isn’t a one-size-fits-all approach within the e-commerce marketplace, manufacturers should understand which platforms will provide the highest chance of success for their category or size. Small brands, for instance, might opt for Amazon or Ocado due to their lower thresholds to entry, but they definitely need to take the whole retail landscape into account so as not to miss other opportunities.

- Optimize online marketing between platforms. Once on digital shelves, brands will have to prioritize and activate promotions in a smart way to make a difference as a brand.

As the e-commerce landscape continues to evolve at speeds the industry hasn’t seen before, one thing is for certain: the channel provides huge growth potential for retailers and manufacturers who understand the developments of the market, are able to spot tomorrow’s opportunities, and who can get their formulas right.

NielsenIQ acquires Foxintelligence

By adding billions of new consumer data points to our gold-standard retail measurement core services, our clients will get a unique omni-sales view across all major categories in Europe – all in one place.

Methodology

1Source: NielsenIQ Homescan, year to date ending July 17th, 2021.

2Source: NielsenIQ Total Store Read, year-to-date ending June 19th, 2021