New consumer groups identified for 2021

A rapidly growing group of newly constrained consumers have been identified in a NielsenIQ study. And despite the positive news of vaccination deployments, this emerging customer segmentation points to a year that will require historic readjustments for the consumer goods industry.

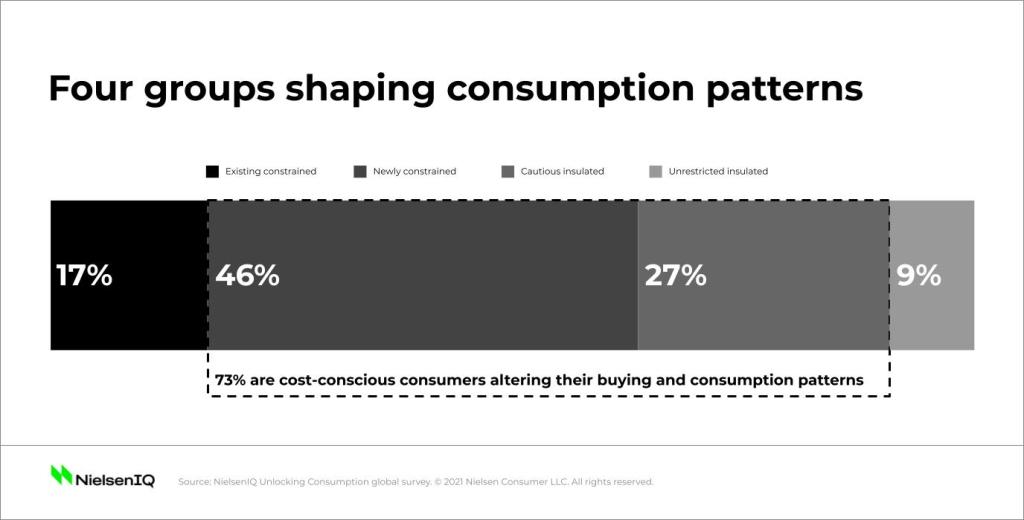

The number of consumers identified as “newly constrained” has doubled from 23% to 46% in the four months between September and December. By definition, these newly constrained consumers have experienced a decline in household income or their financial situation has worsened, leading them to consciously watch what they spend. And as economic stimulus packages and furlough schemes come to an end in some countries, those numbers are at risk of rising.

The study, conducted across 16 countries by NielsenIQ’s Customized Intelligence team, also revealed concerns for the future; 33% of global consumers said they felt less secure about their income prospects in the first half of this year.

In 2020, NielsenIQ identified a clear, polarizing impact from COVID-19; two distinct consumer groups emerged as unemployment numbers soared, and the disease took hold worldwide. The two groups were defined as “constrained” — those who faced job losses — and “insulated” — those who held their jobs and felt generally secure. But the study conducted in December found that consumers’ circumstances and intentions relative to spending had changed significantly and required further segmentation. Four cohorts were identified, and their new habits are expected to be very different compared to what was experienced in 2020.

Four consumer groups driving spending shifts

The NielsenIQ study breaks down the four groups in the following way:

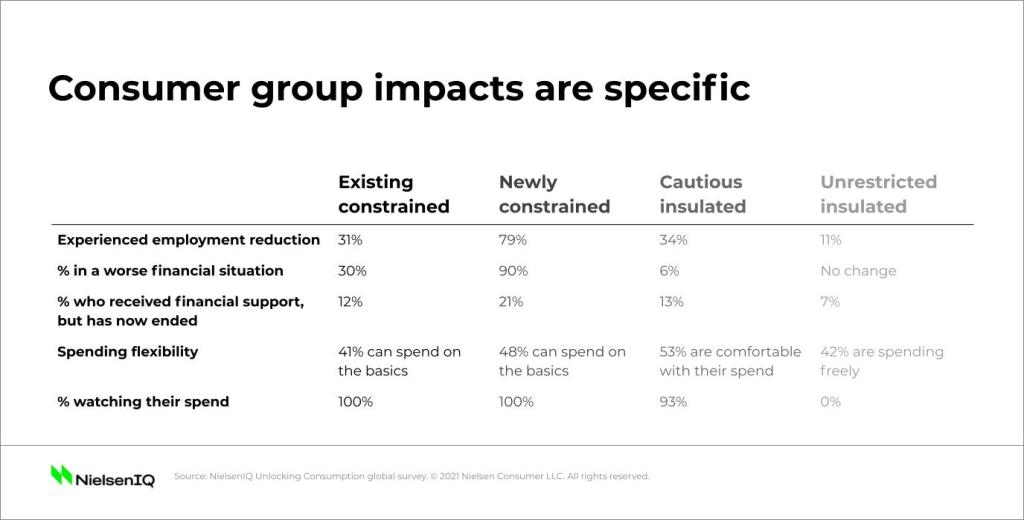

- Existing Constrained – were already watching what they spent prior to COVID-19, and this has not changed

- Newly Constrained – experienced worsening household income/ financial situations and are consciously watching what they now spend

- Cautious Insulated – limited impact to income/ financial situation, but are watching what they spend a lot or much more than before

- Unrestricted Insulated – similar or improved income/ financial situation and do not feel the need to watch what they spend

Variances by country

The size of these consumer groups varies significantly by country. For example, many developing and emerging markets have higher numbers of newly constrained consumers whose employment, income or finances have been negatively impacted by the pandemic. This can sometimes be linked to areas with relatively limited financial support programs and large informal employment sectors that have struggled in the face of lockdowns and COVID-19 restrictions. Out of the countries surveyed, Thailand (73%), South Africa (66%), Turkey (65%), the United Arab Emirates (64%) and India (63%) had the highest numbers of newly constrained consumers.

Developed markets had a correspondingly higher proportion of consumers who indicated they have had little to no impact on their income or finances as a result of COVID-19. Consumers in these countries have benefited from strong governmental support programs and higher levels of consumer confidence. The United Kingdom (49%), Australia (45%), Canada (44%), Germany (44%), and the United States (39%) have the highest proportion of total insulated consumers, though only a small proportion of these consumers say they can spend freely.

How shoppers are coping

While the Fast Moving Consumer Goods (FMCG) industry was one of the few industries to grow in most markets last year, such extreme growth is unlikely to continue at the same rate.

“The duress of COVID-19 drove spending on consumer goods to new levels in 2020. Extended lockdowns meant in-home consumption was over-indexing against pre-COVID conditions. The natural expectation as the world unravels from the disease is for a return to something resembling pre-COVID times; however, that is unlikely to be the case in the coming months,” said Scott McKenzie, Global Head of the NielsenIQ Intelligence Unit.

“The four new cohorts we’ve identified point to a huge part of the population, over 70% of those we survey demonstrating real constraint in their ability and/or desire to spend freely. This cautionary spending environment means brands will need to be laser-focused on this group’s newly emerging need states. Assortment, pricing, innovation, and distribution of products will need to be recalibrated; and quickly,” McKenzie said.

Globally, 66% of consumers say they have changed how they buy categories and brands, which has major implications for manufacturers and retailers.

Large numbers of consumers are employing new coping mechanisms to manage household budgets: 46% say they buy products based solely on promotions, irrespective of brand, 42% say they’re driven by lowest price and 45% always seek private label/store brands to save money. But 55% of consumers say they are brand loyal, and will only change brands if the regular price increases (53%).

The majority of consumers are scrutinizing their purchases, weighing up what matters to them and whether it’s worth the cost. And with 81% of global consumers saying that they will continue to restructure their spending in 2021, we are likely to see even more change.

“The consumers that brands and retailers knew last year are not the same today. Brands and retailers need to understand how their consumers’ situations have changed so they can meet their new needs.”

While there is no one-size-fits-all approach, there is some common ground across these new consumer groups: 85% want a better variety of quality value offers; 80% are willing to buy direct from manufacturers and; 71% are still willing to pay more for higher quality.