Living cautiously

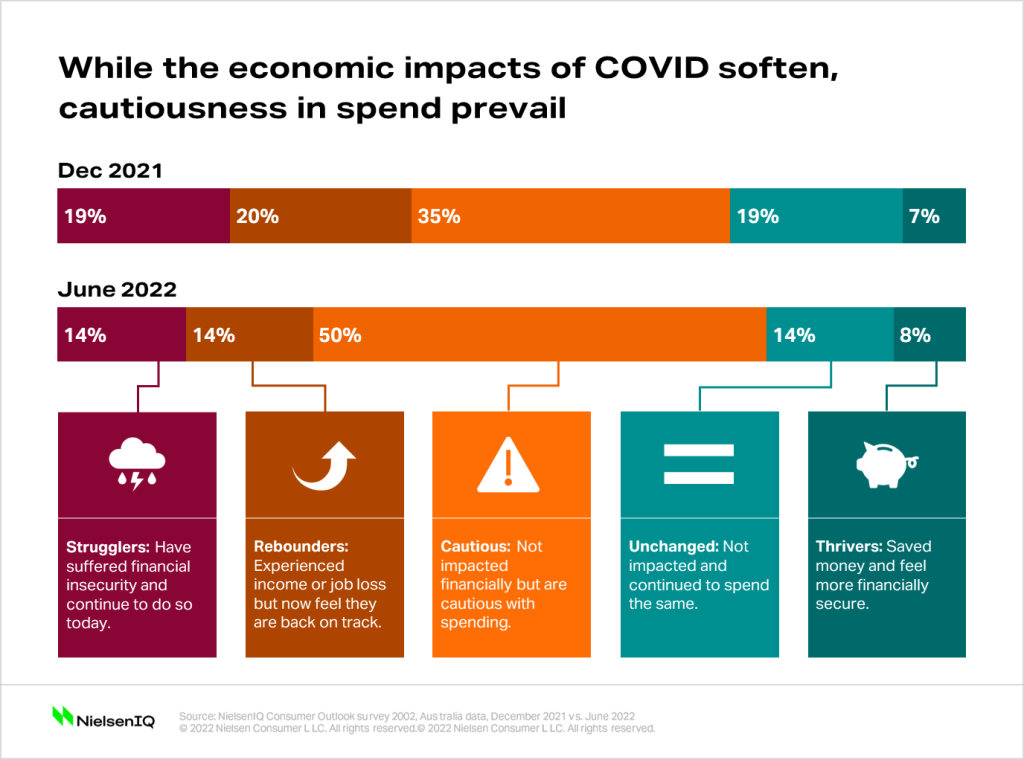

After transitioning from hard lockdowns and strict social distancing protocols meant to curb COVID-19 infections, Australian consumers emerged from the lockdown-era with caution. A mid-year check into how they are feeling about the economy reveals that this cautious sentiment not only persists but has intensified. The mid-year update of the NielsenIQ Consumer Outlook global survey, conducted in June 2022, showed that while the economic impact of COVID-19 has softened, many are still not fully confident in their spending. In fact, 50% of surveyed consumers in Australia described themselves as cautious when asked how COVID has impacted their overall financial household situation—compared to 35% of surveyed consumers in December 2021.

The movement across the consumer groups that NielsenIQ has been tracking globally, since the onset of the pandemic, now indicates a decrease in percentage of Australian consumers who look at themselves as strugglers (14% in June 2022 vs. 19% in December 2021). However, those who described themselves as unchanged have lessened from 19% in December 2021 to 14% six months after .

Further, while Australian consumers are feeling slightly better financially than during the two years of the pandemic, 32% of Aussie consumers are keeping a tighter watch on their spend compared to six months ago as a result of inflation and high interest rates in housing mortgages.

The cautionary approach to spending has been triggered by the general increase in the cost-of-living expenses and the uncertainty around how long Australians will need to endure these inflated prices.

Today, almost seven in 10 Aussie consumers (68%) are saying that their normal weekly grocery expenses are costing more compared to six months ago—an increase from 44% when consumers were surveyed in December 2021.

Consumers are scaling back to save

A review of the changes in the average price per unit of goods using NielsenIQ Homescan Panel shows a 2.3% increase in prices in the 52 weeks ending June 2022.

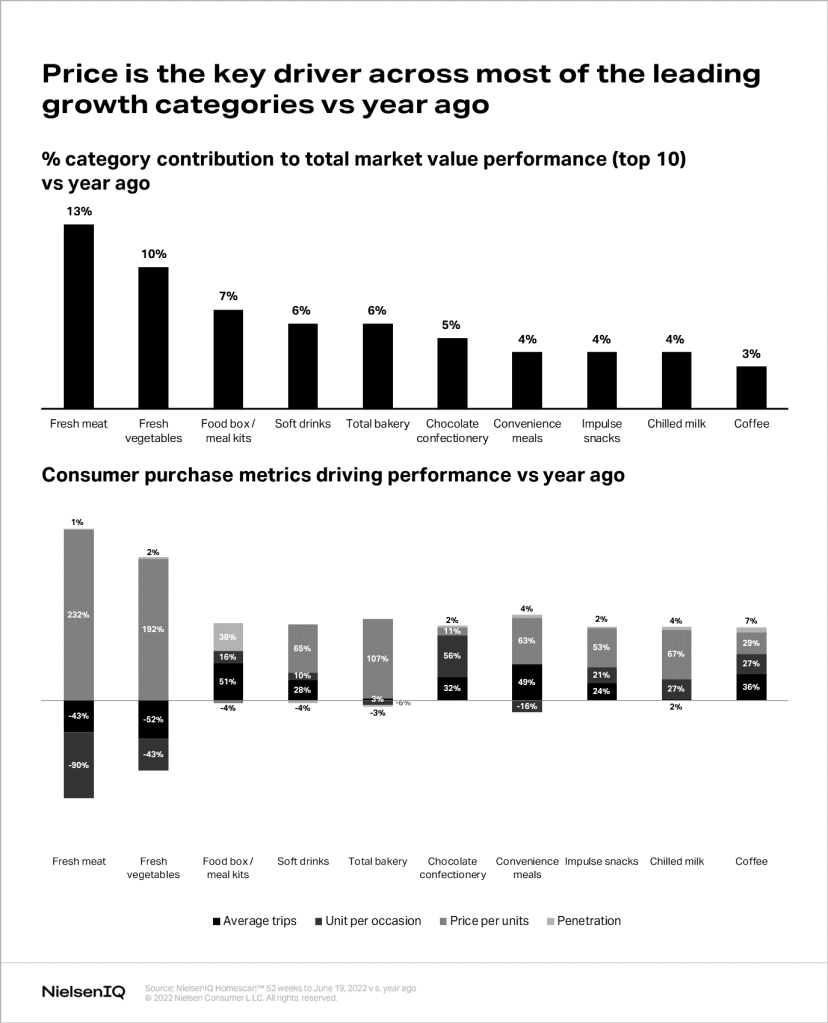

The price surge in grocery products drove the 3.2% growth in FMCG in the 52 weeks ending June 2022. An examination of categories shows that price is the key driver across most of the leading categories in June report. Fresh meat, fresh vegetables, convenience, and impulse categories are the largest contributors to the overall growth of Australian grocery.

In the example of fresh meat and fresh vegetables, the increase in prices was the key driver of growth—a reflection of the impact of inflation.

A further examination of the data reveals that consumers were spending 5% more per shopping trip in 52 weeks ending June 2022 compared to the same period last year. The trend toward fewer but bigger baskets continued with Homescan Panel showing diminishing shopping trips by 2.2%.

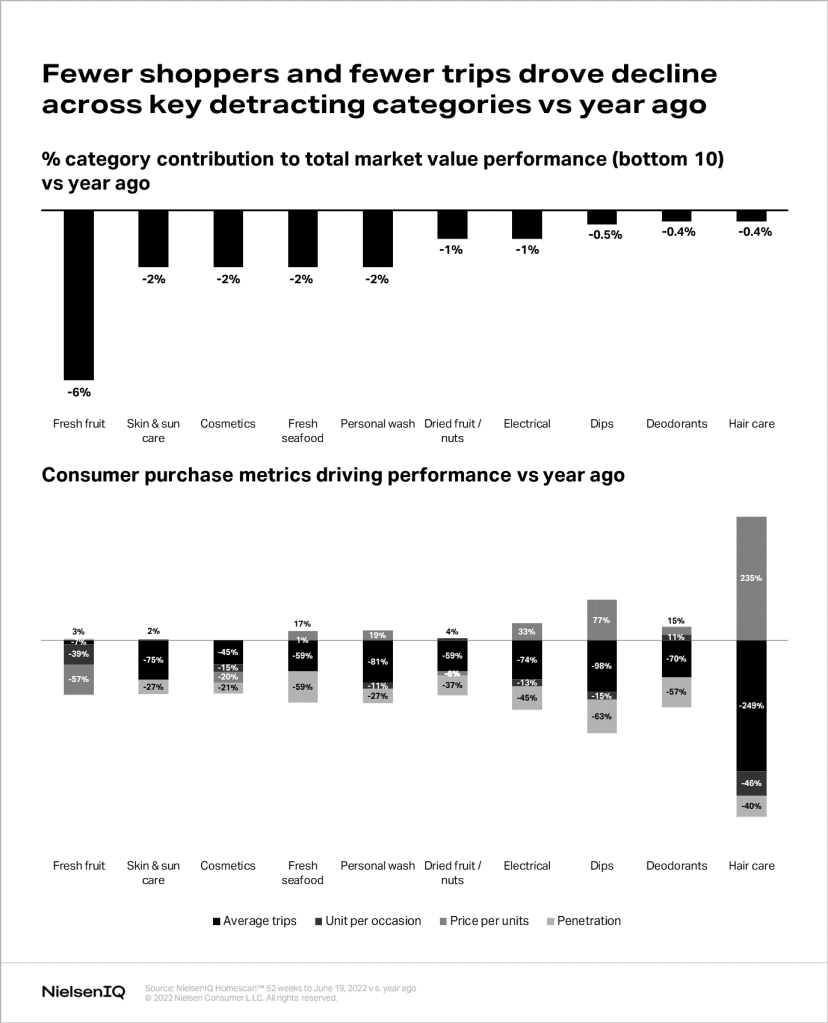

Fewer shopping trips contributed to the declines in some categories such as fresh fruit and personal care categories.

As consumers feel the pinch of higher prices, changes in consumer behavior are afoot. Our panel data aligns with the results of the mid-year Consumer Outlook report which shows that a substantial proportion of consumers claim to be cooking more at home (50%), reducing waste (42%), and making choices between various discretionary spending such as clothing and grooming (43%).

Among the saving tactics that consumers employ at the grocery checkout include looking for the best promotions, trading down in certain categories and products, and opting to buy more private label.

While future wallets will continue to be reshuffled with more cutbacks than anticipated at the start of the year, a decrease in spend on other discretionary items such as out-of-home dining, entertainment, and holidays could be beneficial to grocery as consumers return to at-home consumption and entertaining.

As new concerns emerge, consumers are ranking priorities differently

The December 2021 consumer survey shows that consumer priorities have shifted due to social disruption brought by COVID in the last two years. Six months later, the priorities remain the same but are now ranking differently among consumers.

When asked last year, Aussie consumers indicated their highest priorities were mental wellness and physical wellness. While consumers still give their number one importance to mental wellness, in the mid-year check-in, planning and saving for unforeseen circumstances ranks higher than physical wellness. Access to basics such as food, shelter, and healthcare is a key priority for Aussie consumers.

Three key attributes that shoppers consider when they buy

While consumer priorities remain the same, despite a shuffle in the ranks, we do see changes in consumers’ purchase behaviors.

The Consumer Outlook shows that the bigger shift is in what shoppers are more likely to buy. When asked about their purchasing preferences, shoppers are placing increased importance on the following attributes compared to six months ago:

- Affordability / lower prices: 41% vs. 27%

- Provenance: Country origin (23% vs. 19%); local product or business (22% vs. 17%)

- Environmental/sustainable/socially responsible: 22% vs. 19%

Navigating inflation and future uncertainties

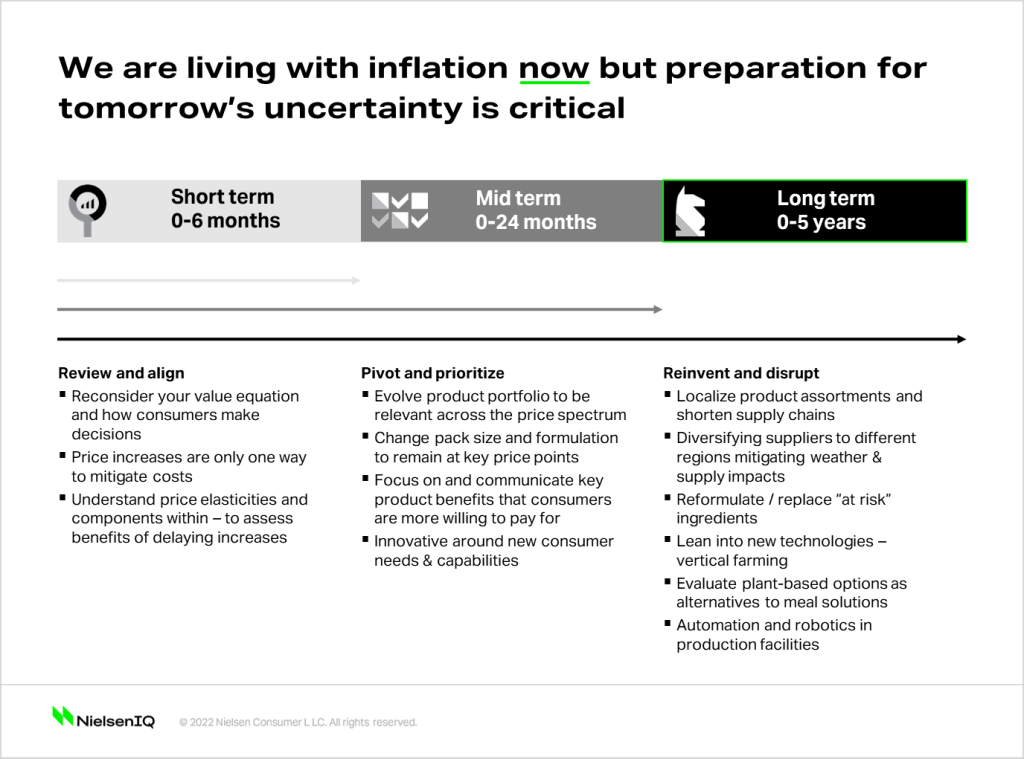

Just as consumers are adapting to the inflationary environment, consumer goods manufacturers and retailers must prepare for the uncertainties of tomorrow. In mitigating the effects of inflation and adapting to increasingly cautious consumer environment, a short-, mid-, and long-term strategy must start now.

A short-term plan covering the next six months may seem limiting. However, acting swiftly by reviewing and aligning price and promotion strategies is critical.

Across the next 24 months or mid-term, organizations have more ability to make bigger adjustments and initiate new elements to better navigate inflationary pressures and polarized consumption. The mid-term plan involves being relevant across the price spectrum through product innovation, line extensions, reformulations, and new pack developments. Product innovation should also address new consumer needs, while it is crucial organizations build a communication approach that focuses on highlighting key product benefits that appeals to consumers’ wallets.

The long-term horizon over the next five years gives time to make major changes that could include the localization of your product assortment, the shortening of supply chains, diversification of suppliers to different regions to reduce weather and supply impacts, reformulation or replacement of “at risk” ingredients, leaning into innovative technologies such as vertical farming, evaluation of plant-based options as alternatives to meal solutions, and automation and robotics in production facilities.

Across the next 24 months or mid-term, organizations have more ability to make bigger adjustments and initiate new elements to better navigate inflationary pressures and polarized consumption. The mid-term plan involves being relevant across the price spectrum through product innovation, line extensions, reformulations, and new pack developments. Product innovation should also address new consumer needs, while it is crucial for organizations build a communication approach that focuses on highlighting key product benefits that appeals to consumers’ wallets.

The long-term horizon over the next five years gives time to make major changes that could include the localization of your product assortment, the shortening of supply chains, diversification of suppliers to different regions to reduce weather and supply impacts, reformulation or replacement of “at risk” ingredients, leaning into innovative technologies such as vertical farming, evaluation of plant-based options as alternatives to meal solutions, and automation and robotics in production facilities.