The overflow

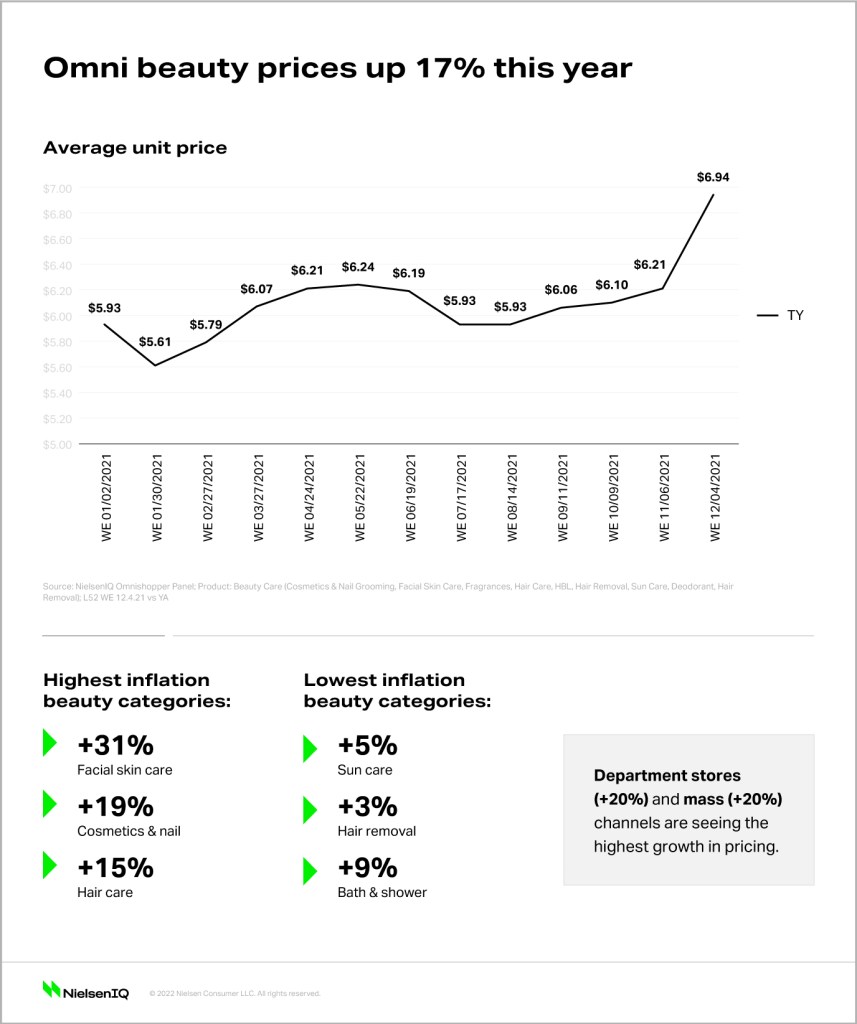

Across in-store and online, beauty price per unit changes shot up 17% this past year, according to NielsenIQ Omnishopper Panel. This impacted many categories but it’s important to note was driven by many factors, not necessarily price inflation. In terms of unit price, the categories that were most affected were:

- Facial skin care (+31%) and cosmetics & nail (+19%).

- Fragrance (+11%) and haircare (+15%) were below the industry average

- Hair removal (+3%), suncare (+5%), and bath & shower (+9%) were far more insulated by the changes.

The influential factors driving the average unit price increase appear to be premiumization, innovation, retail mix, price pack architecture, and product accessibility. The increase in product accessibility is attributed to the consumer migration to online during the pandemic.

Across retailers, department stores and mass had the highest growth in pricing at 20% while Ulta, Sephora, and Amazon had less than 5% decline year-over-year. The brisk rise in mass may not come as a surprise, inflation by default affects household goods and services; the pandemic also diverted spending to the grocery category. However, grocery unit increase grew shy of 5% and channel spend has declined year-over-year (-7%). On the other hand, mass merchandising and department stores have shown double-digit growth, which confirms price increases.

What concealer cannot cover up

The toll inflation evidently has on the consumer conscious is and will continue to be substantial. While most adults are familiar with economic strife and recession, many are experiencing high inflation for the first time due to inflation remaining relatively stable for the past forty years.i. Businesses need to take stock and assess the data. Most importantly, brands need to understand what answers we can glean from omnichannel data particularly, how shopping patterns shifted, and how it is affecting consumers across demographics.

Source:

i Bartash, Jeffry. “High U.S. Inflation Hearkens Back to the 1980s.” MarketWatch, MarketWatch, 28 Dec. 2021, https://www.marketwatch.com/story/high-inflation-harkens-back-to-the-1980s-here-is-whats-similar-and-different-11640722274.