Spotlight on LGBTQ+ consumer insights

Australian LGBTQ+ households have unique needs from their repertoire of consumer goods products compared to the total Australian population. According to this report, 6% of Australian households identified themselves as LGBTQ+ in 2022 and spent a massive AUS $4.5 billion dollars* on grocery shopping last year. These are compelling data points for consumer goods companies to pursue an in-depth examination of this group’s shopping and brand preferences.

Affluence with sense of purpose

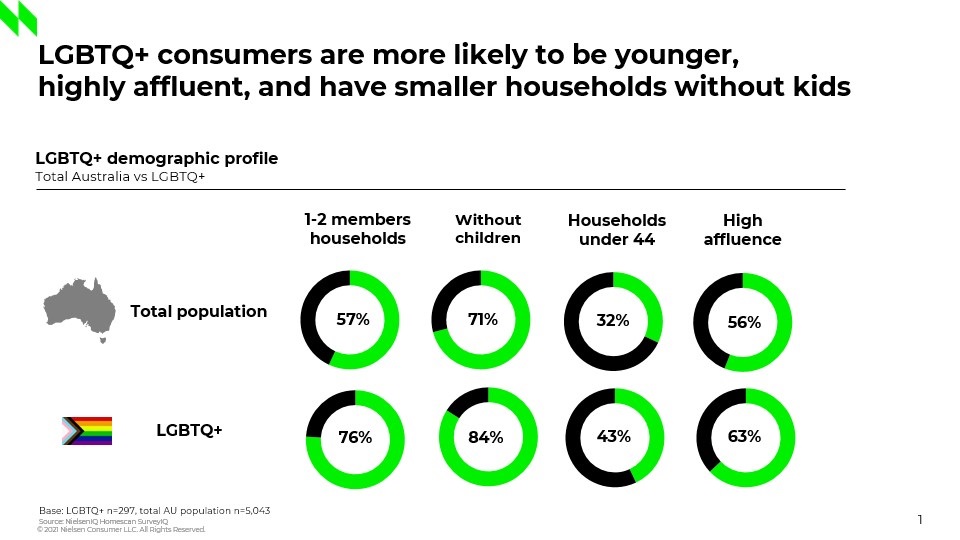

Of that 6%, gay males make up for a massive percentage (44%) of LGBTQ+ households in Australia, closely followed by bi-sexual (26%) and lesbian (15%) identity households. Additionally, LGBTQ+ individuals are more likely to reside in two-member households without kids, are relatively younger than other households, and are more affluent than the total population.

This affluence characterizes their ability to consider spending on premium products designed to make a positive impact in their community while supporting brands that demonstrate a strong purpose toward inclusivity in society. The price point mantra is less likely to appeal to this group, given that 18% of LGBTQ+ consumers confirmed this stating they are less likely to buy products that are on offer.

The three things that are important to LGBTQ+ households when purchasing a product are:

- Sustainable products

- Socially responsible

- Brand is supportive LGBTQ+

Additionally, 77% of LGBTQ+ consumers are more likely to purchase products from companies that promote Diversity & Inclusion (D&I) in their workplace. They are willing to consider brands that contribute toward integrating people with disabilities in mainstream, and stand-up for racial/ethnic minorities.

Conscious of lifestyle and community

The Australian LGBTQ+ community is very health conscious compared to the rest of the population. They demonstrate a strong commitment to following diets and are more likely to practice a vegan and vegetarian lifestyle. Almost 40% of LGBTQ+ households responded positively to buying products that claimed health benefits followed by weight loss and animal welfare. This community actively looks for information and labels such as low-sugar, sugar-free, cruelty-free, plant-based, and organic products while making purchasing decisions. Food brands cannot afford to ignore this health driven and immensely selective group when it comes to designing products for them.

There is an intense sense of solidarity within LGBTQ+ households, along with a willingness to increase their visibility and participate in a pride parade locally or overseas to celebrate their identity. The LGBTQ+ community wants to see their reality reflected off-screen and on-screen, more openness in society, and companies to rally behind a greater inclusive workplace.

In the past, there has been limited availability of published census data about the LGBTQ+ community in Australia. Through this report, NielsenIQ aims to amplify the voice of LGBTQ+ community and provide better understanding to businesses about the needs of LGBTQ+ consumers.

About NielsenIQ Homescan SurveyIQ

The NielsenIQ Homescan SurveyIQ for LGBTQ+ households was conducted between January 27th to February 9th, 2022, comprising 10,400 households (HH) representative of the total population of Australia (10 million HH) demographically and geographically according to the latest Australian Bureau of Statistics census. The survey presents data about LGBTQ+ consumers’ attitudes, lifestyle, brand preferences, overall selection criteria of retail outlets and FMCG products.

Sources: Homescan SurveyIQ: Understanding the LGBTQ+ consumer, February 2022, Anna Cobb and Jose Rodriguez at NielsenIQ, Australia