Back-to-school beauty revelations

NielsenIQ’s Connected Partner PCSSO—a visual search engine that monitors growing and declining beauty and fashion trends on social media—has studied the Back-to-School trend via images posted by beauty consumers, brands, and retailers across Instagram. PCSSO’s AI technology uncovers some huge shifts for the Color Cosmetics and Skincare categories:

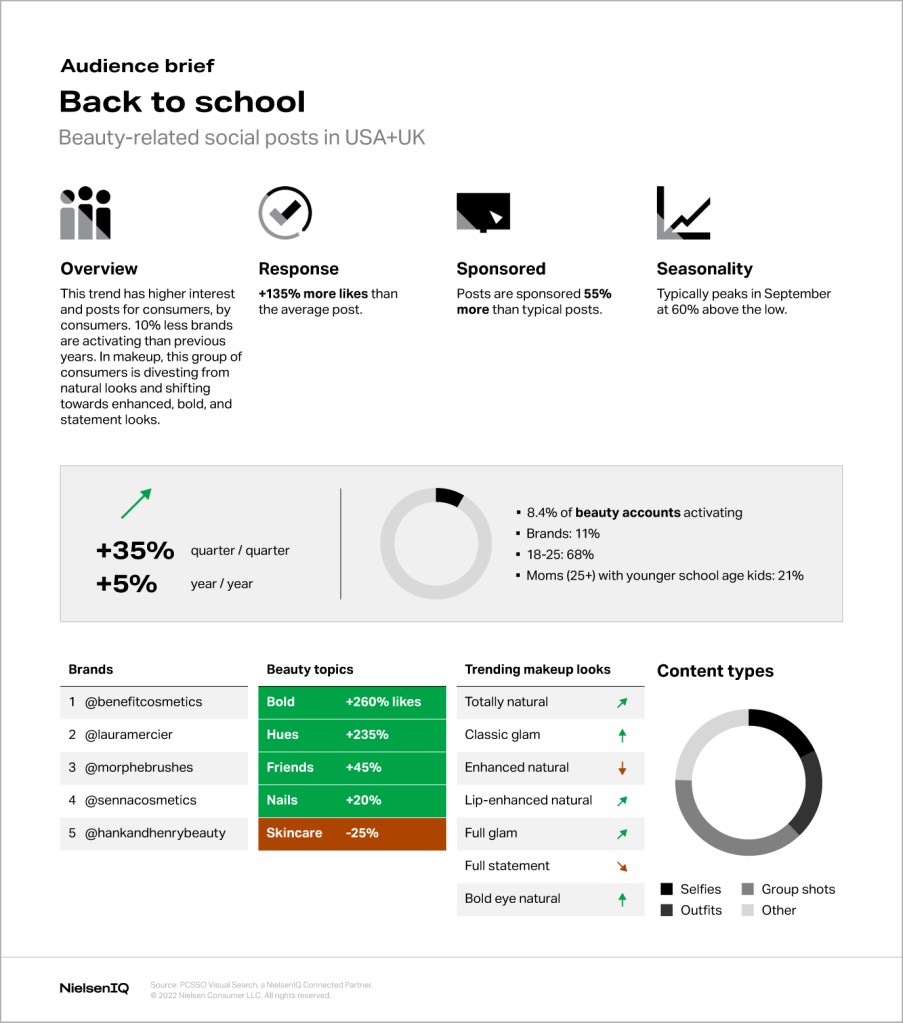

- Posts about the back-to-school beauty trend have jumped up by 35% quarter/quarter and by 5% year on year (YoY).

- These posts have 135% more likes than the average post.

- They are also sponsored 55% more than typical posts.

- Consumer posts are of more interest than posts from brands and 10% fewer beauty brands are activating in comparison to previous years.

- 8.4% of beauty accounts are activating on this trend: 11% brands; 68% aged 18-25; 21% are moms aged 25+ with younger school kids.

- This group of consumers are starting to reject the long-admired natural makeup look and shifting toward more enhanced, bold and statement looks.

The brands that are bringing their A-game and posting the most frequently about the back-to-school trend are:

- @benefitcosmetics

- @lauramercier

- @morphebrushes

- @sennacosmetics

- @hankandhenrybeauty

The most popular beauty topics are “bold” (+260% in likes), “hues” (+235% in likes), “friends” (+45% in likes), “nails” (+20% in likes).

Meanwhile, the ever-popular topic of “skincare” has plummeted by 25% in likes.

Finally, “group shots” are the most popular type of image being posted to represent the back-to-school beauty trend.

Old-school glamour is back

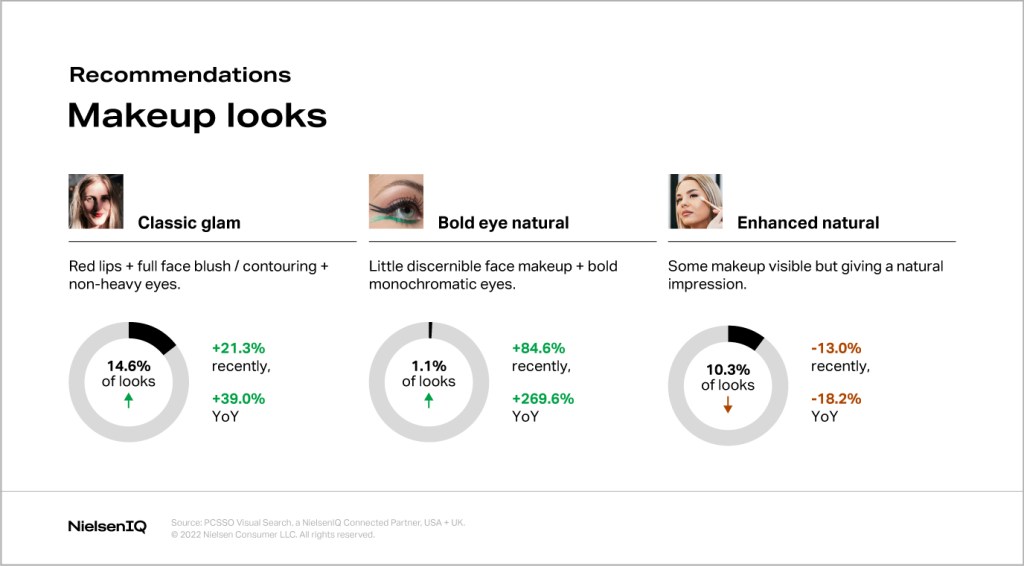

Among Gen Z consumers posting about the back-to-school trend, PCSSO has observed a marked shift away from the ever-popular “enhanced natural” look toward a “classic glam” look or “bold eye natural” look. Both draw attention to just one facial feature: either lips or eyes. It’s about wearing visible “Euphoria-inspired” makeup that stands out but still falls within the “school rules” these young consumers might have to follow.

The looks they’re loving and the looks they’re losing

Here’s what we know about the most popular back-to-school makeup looks:

- Classic glam (red lips, full face blush/contouring, light eyes)

This movie star staple look has suddenly switched from being the third most common makeup choice among Gen Zs to being the second most popular. - Bold eye natural (minimal face makeup, bold monochrome eyes)

Although small in share, this look has had consistent growth over the past year. It’s on the way up, along with the keyword “bold” which can apply to eyes, lips and more.

The ever-popular “enhanced natural” look (which has reigned supreme in recent years among this generation) is starting to lose style points. Considering that Gen Z has one of the highest levels of adoptions of the No Makeup/Natural look overall, this means that these consumers want to be noticed when they decide to wear makeup.

For them, back to school is a special occasion that’s deemed worthy of buying new makeup and wearing it to stand out in a crowd.

Trending topics

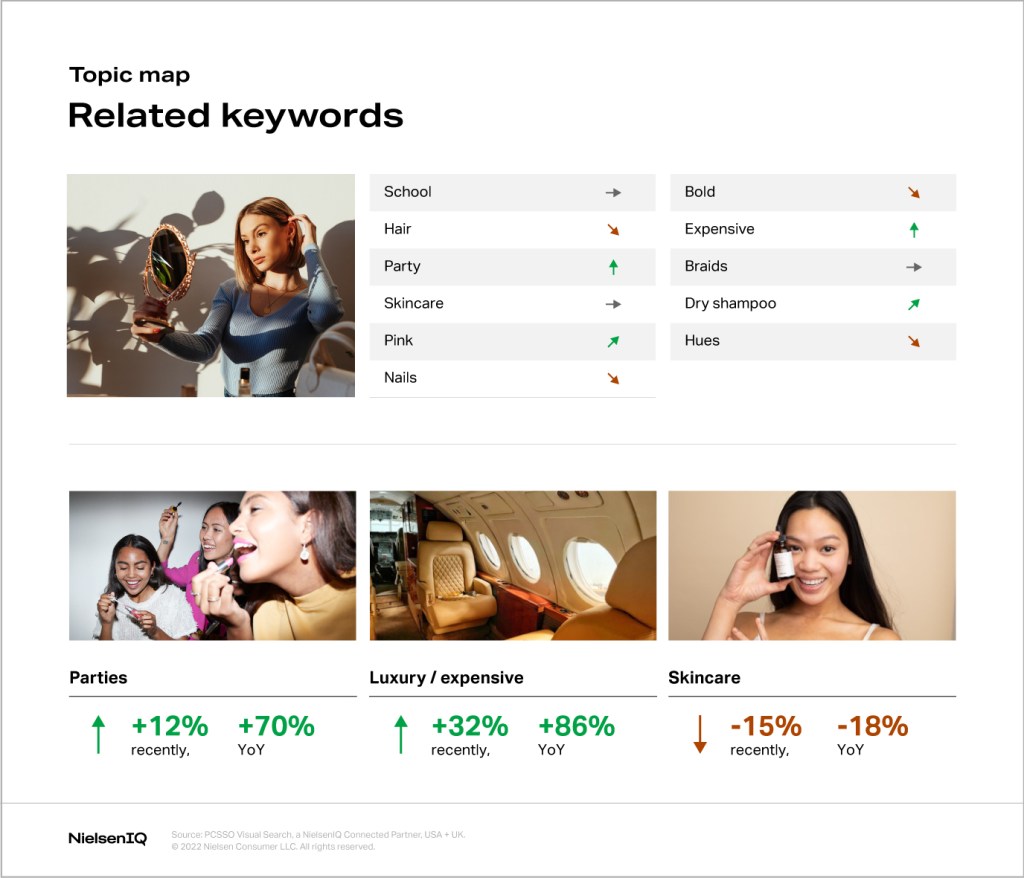

This trend map shows the topics that are growing and declining within the back-to-school trend:

Let’s take a closer look at the most popular themes:

- Parties: Party season is in full swing; going back to school and seeing their friends is a chance for back-to-schoolers to celebrate. This theme is up by 12% recently (+70% YoY), so fit it into campaigns and editorial and be certain to emphasize friends, fun, boldness, and adventure.

- Luxury/Expensive: Young consumers want nice things and are willing to spend money for them, but inflation is a growing concern. However, “luxe” posts have recently been up by 32% (86% YoY) and it appears that Gen Z consumers are attracted to a good deal on a luxury item—especially if it’s nicer than what everyone else at school owns.

NielsenIQ’s data supports this too: over the past 12 weeks, omnishopping (both online and in-store) sales of luxury beauty products in the U.S. have increased by 33% among this group.This makes Gen Z the fastest-growing market for luxury beauty products.

Is Skincare losing its sparkle?

We’ve discussed what’s hot and now it’s time to move on to what’s not. It may be a surprise to discover that Skincare is no longer on the priority list for these consumers. While Skincare still owns the majority market share across categories at $4.4B in-store, social posts about Skincare within the back-to-school trend have recently dropped 15% (-18% YoY).

Previously, this group has had the largest share of Totally Natural/No Makeup for some time and a huge interest in the Skincare category. They focused on achieving beautiful skin rather than covering up with makeup. But now they’re shifting away from this approach and becoming bolder with statement makeup.

NielsenIQ’s data shows that unit sales of Facial Skincare products in the USA* decreased by 1.9% in the latest 52 weeks; 5.5% in the past 12 weeks and 5.9% in the past 4 weeks. Whereas in the past 2 weeks, unit sales of Lip Cosmetics increased by 11.2% and Eye Cosmetics by 2.8%.

Meanwhile, data on product searches from top beauty retailer Ulta also supports this trend. In July 2022, the volume of searches for Serums was down by 22%, Gels by 28% and Creams by 41%. But interestingly, searches for Balms increased by 221% and Tinted by 98%. Similarly, at Sephora searches for Cream were down by 22% in the same month.

As a result, we expect that interest in Skincare will continue to decline yet remain at higher levels than other groups for some time.

About PCSSO

PCSSO‘s AI technology precisely measures and forecasts beauty and fashion trends by watching the products that consumers are wearing and sharing, to help you better understand your consumers and competitors. Identify catalog gaps and explore popularity for looks, styles, packaging, brand rankings events, ingredients, product types, and more for the USA, European, Korean, and Japanese markets.

Learn more about how it works here.

Sources

- PCSSO Visual Search, a NielsenIQ Connected Partner USA+UK data

- Nielsen IQ AOC data Source: 1. NielsenIQ Omnishopper panel latest period ending 07/16/2022. 2. NielsenIQ Retail Measurement Services xAOC latest period ending 08/06/2022

- Ulta search volume data

- Sephora search volume data as of 08/06/2022