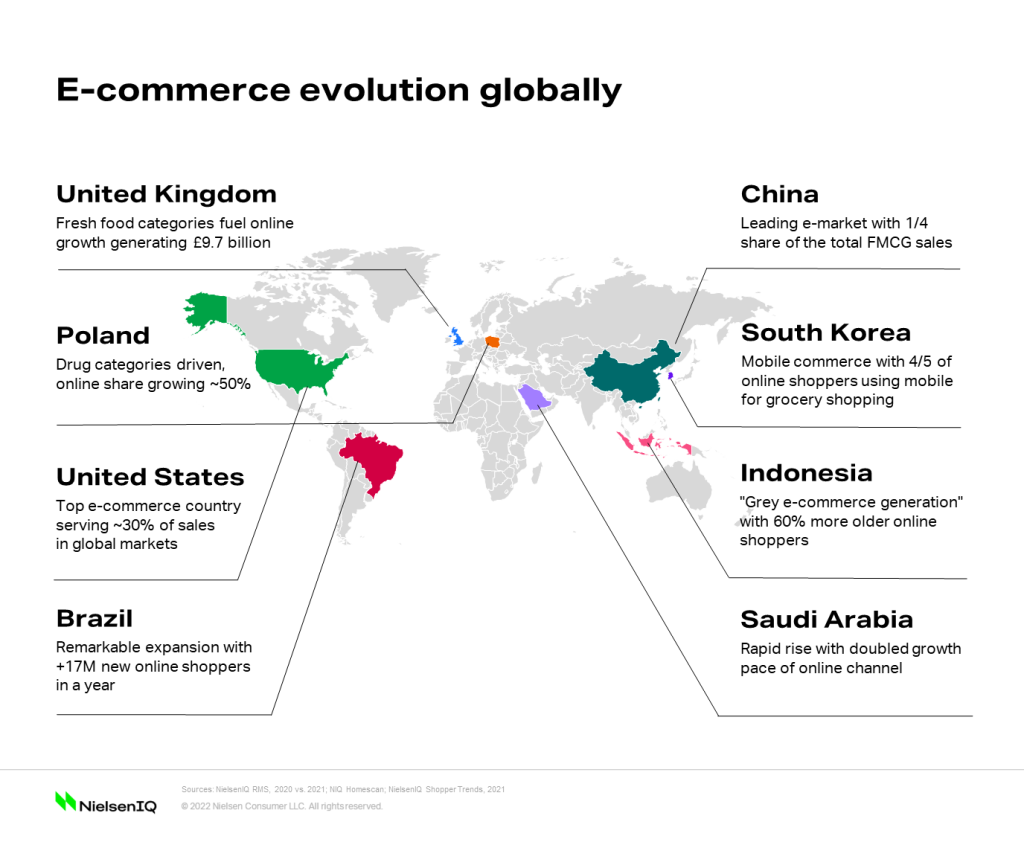

Multi-speed vertical evolution and fragmentation

Asia produces over 50% of all global e-commerce sales with developed markets like China, South Korea, and Japan. As a pioneer e-market, China accounted for almost a quarter of the total retail sales of consumer goods in 2021 with the country’s younger generation driving involvement. Yet there is a “grey e-commerce generation” emerging across Asia who have a high rate of online adoption, with 60% more older online shoppers in Indonesia and 64% in Thailand in 2021 than at the end of 2019.

In the Middle East, e-commerce is driven by a digital-first approach. In Saudi Arabia, online penetration has significantly increased over the last year. 58% of the population said they used the internet for grocery shopping in March 2021, while in the previous year, 49% stated the same. This trend is more outstanding in the United Arab Emirates with 61% in 2021 versus 38% in 2020. These changes of behavior are reflected in the pace of online channel growth which almost doubled in both countries in 2021 compared to 2020.

On the other side of the hemisphere, markets in Europe and America have gone through a quick commerce revolution and now face extreme fragmentation. The U.S. is among the top five e-commerce countries serving 12% of total consumer goods sales for the market and up to 30% of sales in global markets as Data Impact by NielsenIQ points out.

In parallel, Latin America is on a steep growth curve with online consumer goods sales increasing by 35.4% in 2021. In Europe, the growth rate of online FMCG versus offline is remarkable—in Italy, it is 16.2 times higher and more than 10 times higher in the United Kingdom, Spain, and the Netherlands. The U.K is the most mature European e-market, where fresh food categories have a significant role in online platforms, generating 9.7 billion pounds for digital commerce. Meanwhile, in the dynamically emerging Eastern European countries, the “less risky” drug categories which offers more durable products dominate the e-basket repertoire.

Online, the channel of convenience

Transcending boundaries and distance, e-commerce has digitalized the world into a single platform that boasts a broad selection and extreme convenience to customers.

Online shoppers have easy, fast, and equal access to all goods, and they have the freedom to browse seamlessly between wide ranges of platforms, products, prices, payments, and delivery options. Even the significant barriers of online shopping — delivery time and cost —are eliminated with click and collect and improved, fast delivery options.

In developed countries, same-day delivery has become a realistic expectation of consumers. Click and collect options are highly popular in France and the U.S., with a 147% increase in these types of orders registered in the U.S. alone.

In EE countries, the delivery-to-home is the ultimate convenience for consumers. In Romania, 2/3 of shoppers mention convenient delivery as a reason for online shopping and prompt delivery of online orders is also a significant driver in Poland and Turkey. On the other hand, extra charges still do not favor online shopping. As a response, retailers in Poland made actions to intensify online sales via click and collect services. Meanwhile, as another form of response, free shipping deals substantially power online purchases in Brazil.

Quick collect options also propel the online sales of a wider range of categories. Therefore, investment in enhanced delivery appears to yield a smart return.

In light of these current trends, it is critical for manufacturers to avoid blind spots. Understanding the trends and consumer needs currently shaping the e-commerce landscape is a must to secure today’s business. Be sure to take the necessary steps to ensure you are keeping up with the e-commerce revolution.

Power your e-commerce strategy

Get in touch with us for accurate data and actionable insights.