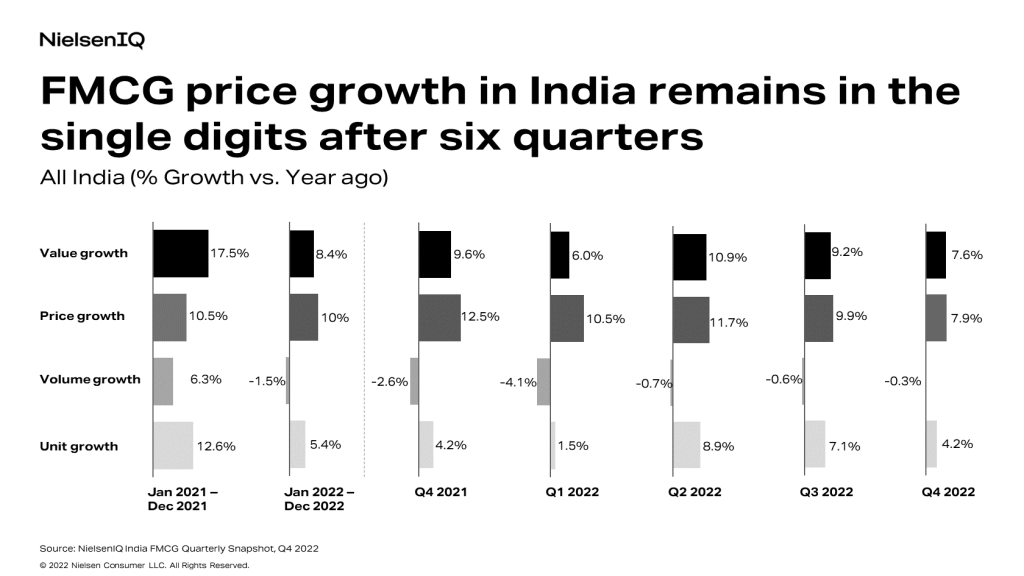

FMCG slowdown driven by lower price growth

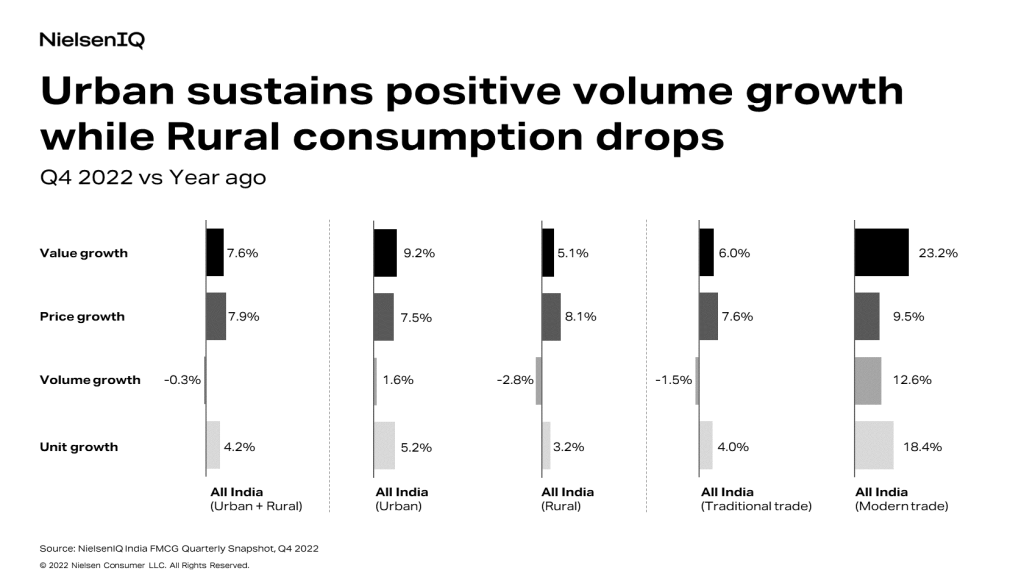

The slowdown in India’s FMCG industry was driven by a drop in price growth to 7.9%, as well as a flat consumption growth at -0.3% in Q4 2022. According to the latest findings from NIQ’s FMCG Snapshot for Q4 2022, the drop in price growth happened in both urban and rural markets. However, in terms of volume, urban markets maintained positive momentum with a stable growth of 1.6%, while rural continued to decline at -2.8%. When we look at consumption drivers, we see that food drove consumption, while non-food categories were deprioritized.

In the retail space, modern trade maintained a double-digit value growth of 23.3% in Q4 2022 compared to a year ago, as well as a volume growth of 12.6%. Traditional trade however continued to see a negative consumption growth of -1.5% for the fifth consecutive quarter.

As their spending continues to be impacted by inflation, consumers continue to favor smaller product sizes across both traditional and modern trade, combined with manufacturers reducing grammage. Consumers in rural areas have felt this pressure the most, and rural markets are seeing continuous negative consumption growth. However, there is also positive sales movement: modern trade grew double digits in the last two quarters, and absolute consumption levels continue to surpass those of pre-Covid-19 years.

Consumption growth driven by North and East zones

After five consecutive quarters, the North zone in Q4 2022 saw an uptick in positive volume growth (0.1%). The East zone meanwhile remained stable at 0.6%. Although the West and South zones continued to show negative consumption growth, there were marginal improvements against the same period last year. The consumption decline in the Western zone deepened from -0.1% to -0.9%, driven by a slowdown in urban areas and a continued decline in rural areas. The South zone continued to see a decline of -0.9% from -1.2% through both urban and rural markets.

The slowdown in the South and West zones was driven by the food category, which consists of staples, impulse, and habit-forming categories (beverages, biscuits, packaged tea, coffee, etc.). Unlike in the other zones, the decline for staples and impulse occurred because of high positive growth during the previous year. Although overall FMCG volume growth was negative, the absolute values as well as volumes in Q4 2022 continue to be above pre-Covid levels across markets.

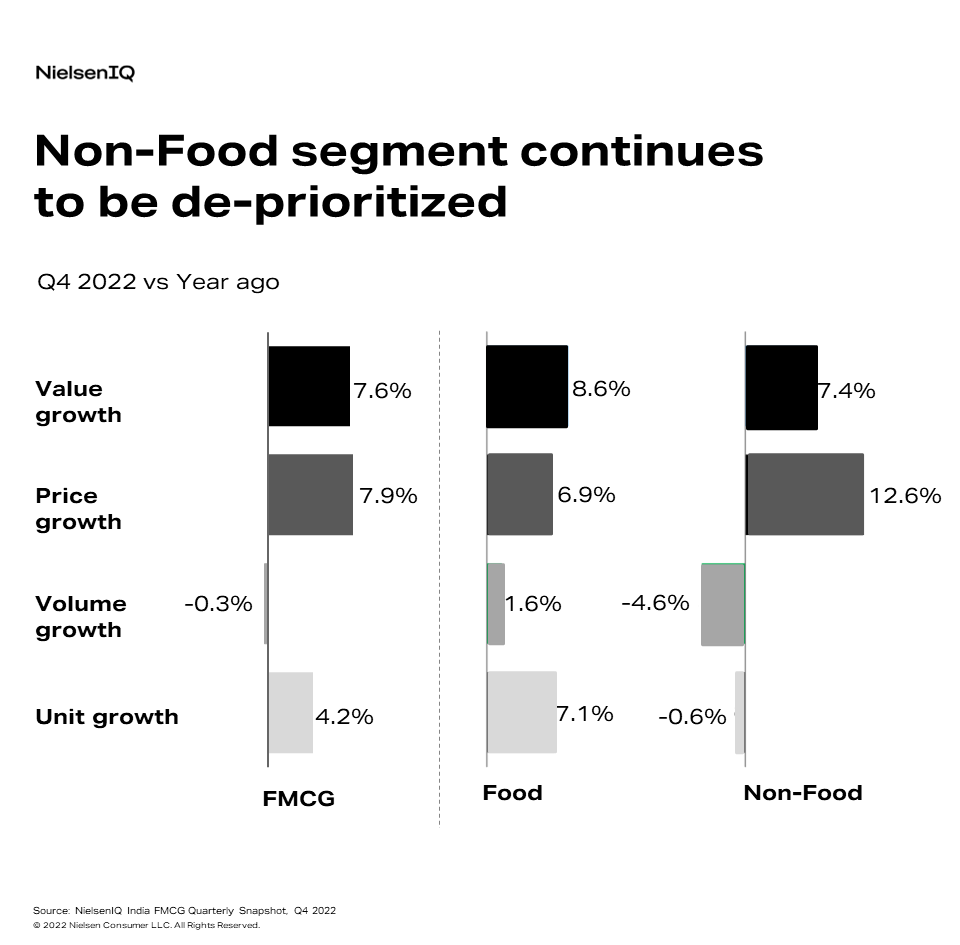

Non-Food continues to be de-prioritized

The food segment sustained positive volume growth as the staples and impulse categories within this segment remained positive. Non-food consumption on the other hand continued to decline across categories and had lower volume sales than pre-Covid levels in the past few quarters. This decline can also be observed in the leaner assortments and downward trend for stock levels in retail spaces, as well as manufacturers cutting down on promotions for categories such as washing powder, detergent bars, toilet soaps, shampoos, etc.

Even within small manufacturers, the Food segment continued to drive consumption growth, while small manufacturers in the non-food segment were impacted negatively due to higher price growth.

Both consumers and manufacturers are feeling the impact of inflationary pressures, and manufacturers are moving away from promotions to maintain margins. However, manufacturers should also continue to support small pack sizes in their portfolio to drive consumption, particularly in non-food categories. Re-evaluation of the portfolio strategy is also critical as the retail environment becomes more challenging.