What is the global state of e-commerce?

This is an unsettling time for many consumers. NIQ’s 2023 Consumer Outlook research confirms that consumers intend to change their spending habits to combat growing economic insecurity. But, unless you have the fullest view of shopping and buying behavior, it’s hard to truly grasp how changing spending intentions will manifest across retail channels in this environment. In 2023, the digital and physical worlds of retail will merge in ways we’ve yet to see before. Let’s dissect the key questions and answers surrounding why this is important and what’s at risk without an omni retail perspective.

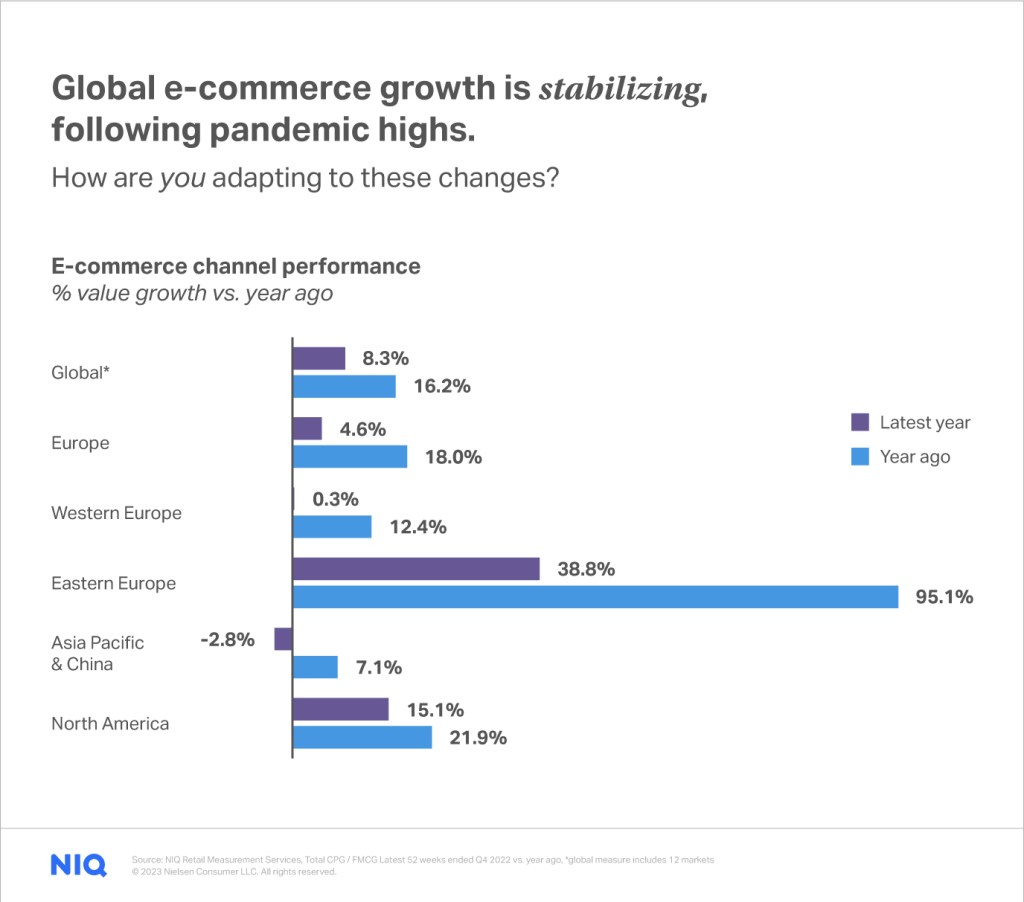

Global NIQ measures confirm that e-commerce growth is stabilizing in many markets. Following the frenzied e-commerce adoption at the height of the COVID-19 pandemic, companies need to think holistically about where their products are being sought by consumers.

Compared to measures in 2021, global online sales growth has slowed from 16% to just 8% year-over-year. E-commerce sales growth in analyzed markets in Asia has declined by nearly 3%, while in Western Europe, sales have remained flat (up by just 0.3%). That’s not to say that e-commerce is a declining opportunity — it’s a warning signal that consumers are allocating post-pandemic needs differently across channels.

Make sure your business is adapting to this moderated pace of growth, leveraging the broadest picture of omni-retail performance to offset any slow or leveling e-commerce sales. E-commerce can’t remain the sole focus of retail’s long-term growth strategy.

What’s at risk without the full view?

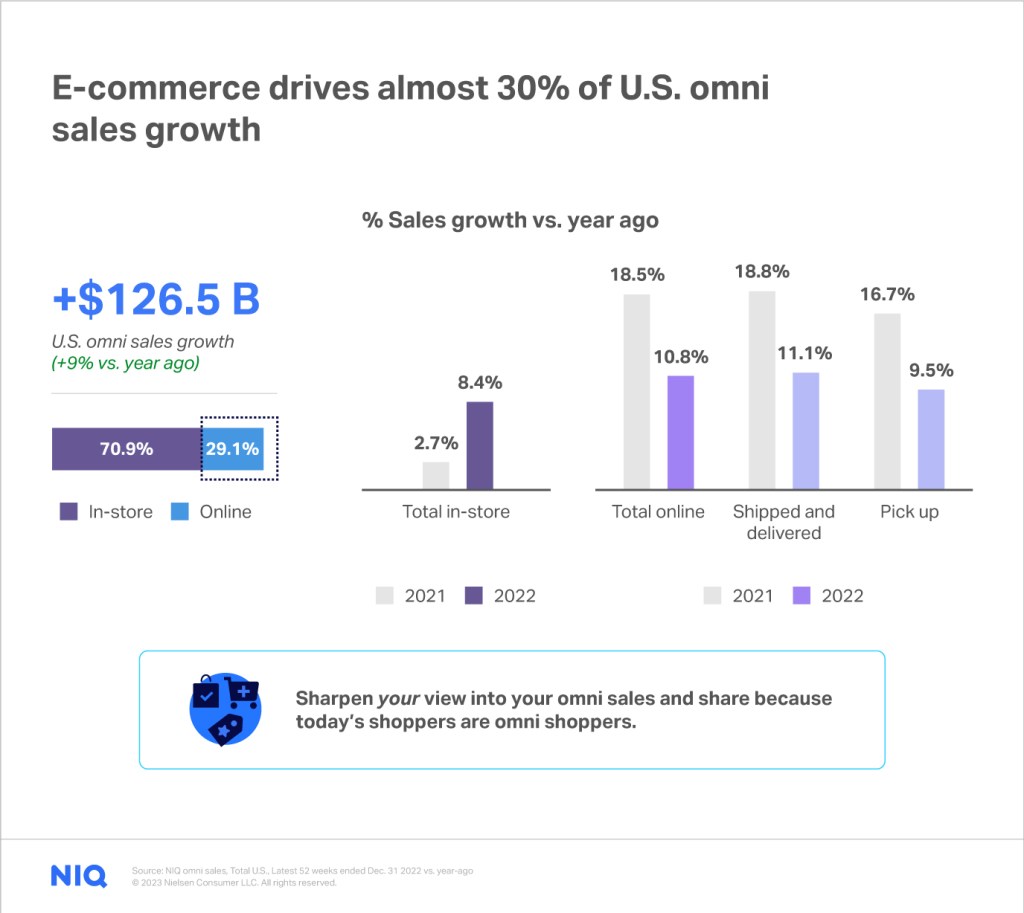

Omni sales measurement incorporates the full view of online and offline channels. In the case of the US market, this omni perspective highlights two factors of growing importance.

- In-store sales continue to outpace the slowed performance of the 2020-2021 period.

- Nearly 30% of CPG growth was driven by e-commerce.

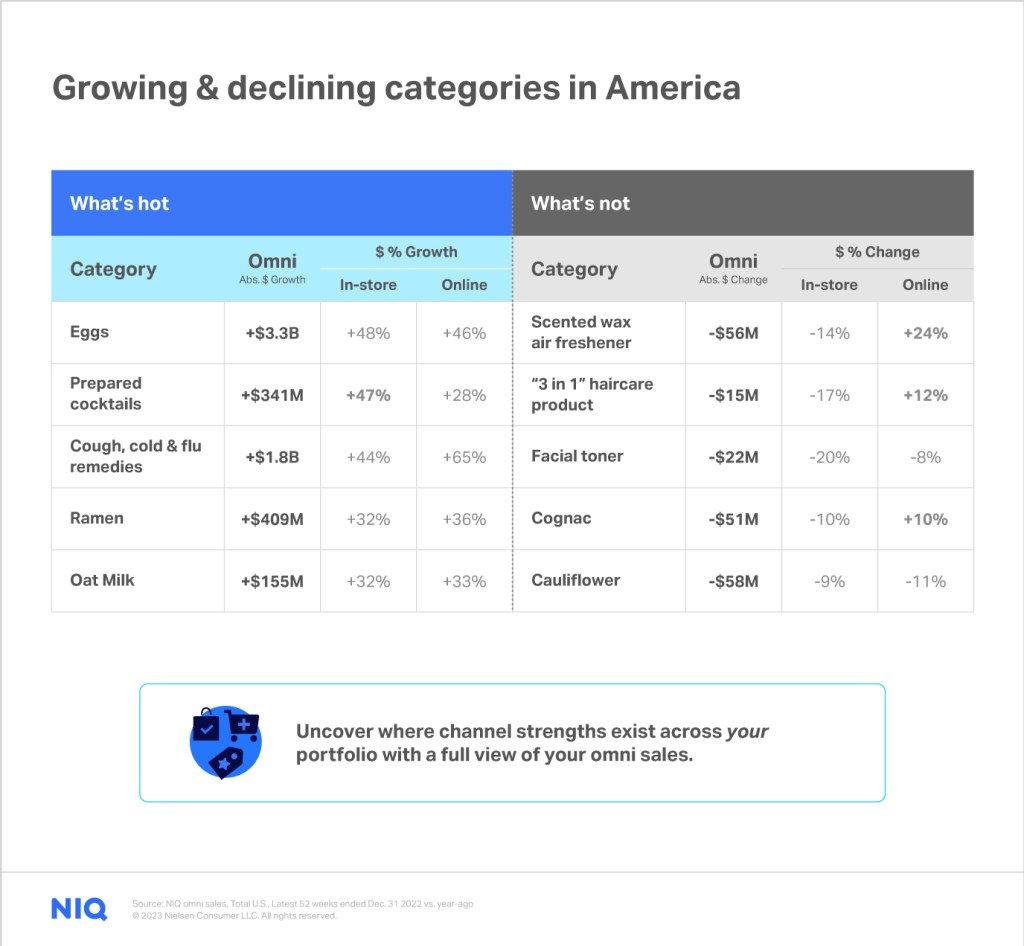

This highlights the true omni nature of consumer demand today and the need to uncover where channel strengths exist across the CPG landscape. In the future of retail, consumers will continue to develop deeper preferences for where particular needs are fulfilled across the omni channel.

If we dive down to category-level sales performance, we can see many categories have unique strengths in one channel or another. Essential remedies like cough, cold, and flu products have seen incredible growth across the spectrum of omni sales. Whereas, a category like 3-in-1 haircare has seen more polarized channel performance, where consumers have spent more on these products via e-commerce channels in the last year. Eggs are another instance where purchases have been spread across both online and in-store channels in the US, growing at 46% and 48% respectively, year-over-year. For a category that has been heavily impacted by price increases across the nation, it’s interesting to see buyers leveraging every shopping channel at their disposal to secure their supply in a way that suits them.

How are consumers “shopping” vs. “buying”?

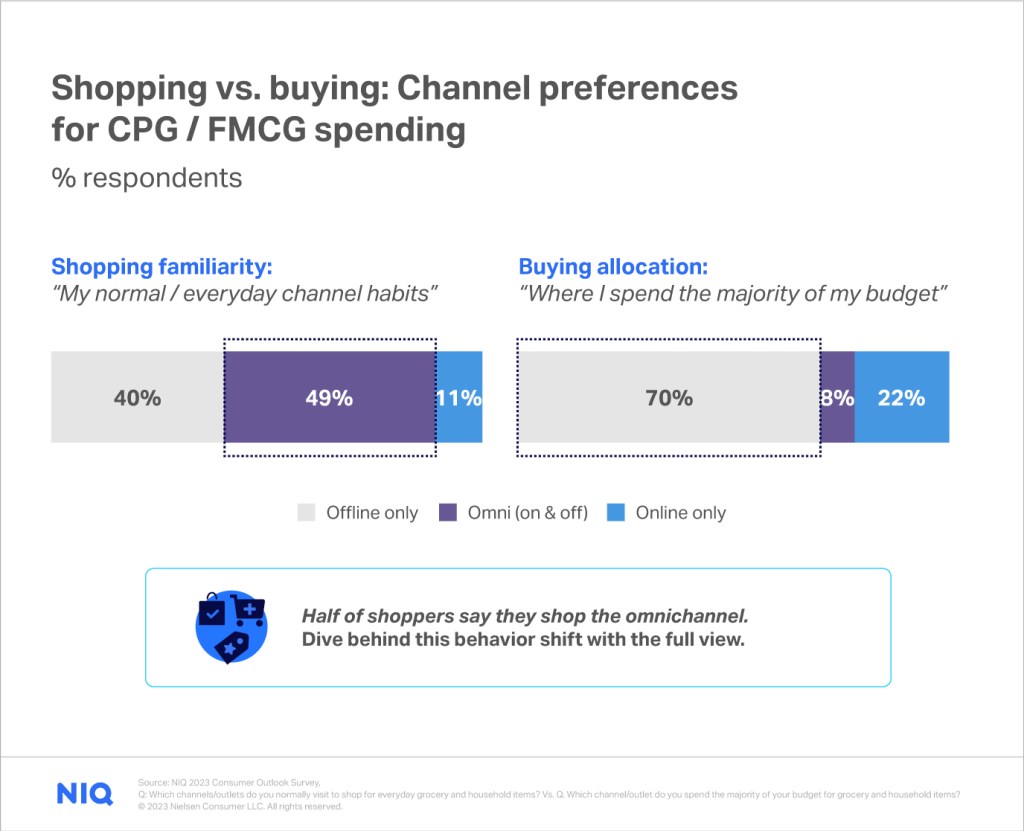

Speaking of how consumers are integrating omni habits into their everyday lives, we arrive at an interesting delineation in behavior: shopping vs. buying. Research from NIQ’s 2023 Consumer Outlook study confirms that offline channels are essential to consumer “buying” habits, but there is also strong omnichannel “shopping” familiarity across the globe.

In other words, nearly half of global respondents say they frequent a combination of online and offline channels for their everyday CPG shopping. Even though 70% of those surveyed say they spend the most offline in physical stores, shopping habits are evolving and will continue to infiltrate how spending budgets are allocated in the omni world of retail.

This reinforces how important it is to understand the channel strengths and incrementality of your product or category. Your brand presence and impact during the formative process of omni “shopping” across channels has a direct impact on what they may choose to eventually buy (whether in a physical store or online).

Outlook on the future of retail

When navigating the retail road ahead, keep two things in mind: symbiosis and balance.

Symbiosis:

the omni future of retail

The digital and physical worlds of retail will merge in ways we’ve yet to see before.

E-commerce growth is stabilizing from the frenzy of pandemic needs. Because of this, the road ahead relies more heavily on symbiotic balancing of both online and offline sales.Consumers are fluidly fulfilling their needs across channels, and this heightened omni familiarity is what makes the full omni view of retail an absolute necessity for measurement today.

Lauren Fernandes

Global Director, NIQ Thought Leadership

Consumers move fluidly across channels to fulfill their needs, meaning growth will come from a balance of both online and offline sales strategies. Consumers have a heightened omni familiarity thanks to the conditions of pandemic lockdowns and limited store access. As they build on that familiarity, while re-introducing physical store interaction, we will see a blurring of “shopping” habits across channels and a renewed interest in shopping e-commerce, particularly as a strategy to save money.

Seizing the omni future of retail requires the fullest view of omni measurement today.

About the author

Lauren Fernandes is a seasoned thought leader and content strategist, serving as Global Director of NIQ Thought Leadership. Based out of Toronto, Canada, she has a passion for exploring emerging trends and shifting consumer behaviors. Her work has scaled many of our global audiences and clientele, helping manufacturers and retailers make more informed business decisions. For the past decade, Lauren has enjoyed sharing her perspectives and analytic pursuits via thought leadership content, industry publications and to diverse audiences within the NIQ network.