Online shifting into high gear

Shoppers now enjoy the new freedom to choose between in-store shopping, grocery delivery, or curbside pickup—and these new behaviors are mostly here to stay. Due to this, understanding the facts behind “the great shopper shift” has become a major concern of retailers and manufacturers alike.

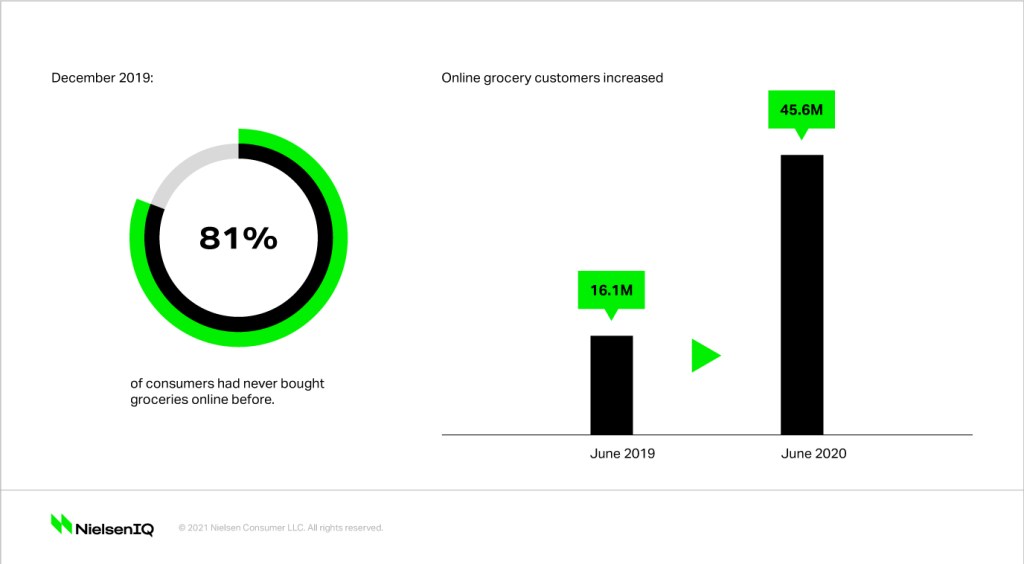

For context, it is important to understand that U.S. grocery sales had stayed consistent over the past decade, growing an average of 1.31% per year between 2010 and 2019 and hitting $653 billion in 2019. Prior to 2020, 81% of consumers had never tried ordering groceries online.

While the trend toward omni-channel shopping had accelerated in other sectors over that time, the shift in grocery was largely precipitated by the pandemic—and the shift was huge.

By May 2020 in the U.S., 79% of all grocery shoppers had made at least one online grocery purchase. About 75% of the top 50 store-based retailers in the U.S. now offer curbside pickup.

Retail rises to meet new challenges

Now, more than a year into the pandemic, customers are more comfortable with the new reality of grocery shopping. They mostly have the freedom to choose between in-store shopping, grocery delivery, or curbside pickup. Amid these drastic changes, manufacturers and retailers have faced challenges that required quick solutions:

- CPG manufacturers decreased production during the pandemic to save money, and they still aren’t introducing new products on a wide scale

- Outdated, traditional tools and data for measuring product performance needed an upgrade to properly track sales and behavior of today’s omni shopper

- Online grocery shopping can mean fewer impulse buys and less time that the shopper spends with the retailer

The industry has largely risen to meet these challenges, backed by the increase in omni data available to retailers and manufacturers today. Shoppers aren’t returning to their pre-COVID behaviors, likely because now that they have seen multiple purchasing options, there is considerable demand for each retailer to meet those high expectations. Consumers will want to retain this flexibility of omnichannel shopping beyond the pandemic.

Omni data tracks behavior across channels

Omnichannel shopping provides consumers with more ways to shop than ever before—more buying opportunities, payment types, rewards programs, and points of interaction with the customer. Keeping track of shopping behaviors and patterns across channels is now crucial for retailers and manufacturers.

The new multi-channel reality has forced the CPG industry to reassess how it measures product performance. Traditional data strategies that were used to track sales and shopper behavior in the past limited manufacturers’ understanding of how their overall sales stack up in the category.

A renewed focus on omnichannel data has helped retailers and manufacturers determine their placement in the market, along with their strengths and weaknesses:

- Omnisales data measures and benchmarks sales insights across channels

- Omnishopper data reveals the context driving sales, and why sales occur in which channel

- Omnishopper data can also help retailers identify converted shoppers and missed shoppers across channels

Drill down on what drives growth

Backed by omnichannel data, retailers in particular have upped their investments in loyalty programs and e-commerce platforms, which allow them to make better recommendations to shoppers. Grocery shopping now has a firm hold on the digital space, so both CPG brand managers and retailers can more efficiently track consumer behavior and influence their purchases.

Getting to know the omnishopper of today on a deeper level requires a comprehensive tracking of omnichannel performance, through following the shopper and their habits in-store, online, and in between.

With this approach, brands and retailers can continually assess their strategies and tweak them if necessary, figuring out which work and which fail to drive growth over time.