The decision process

We make thousands of decisions each day, most of them rather small with limited impact—do I want sugar in my coffee today, for example. But some are quite big and a wrong turn can have serious repercussions for small and medium FMCG manufacturers.

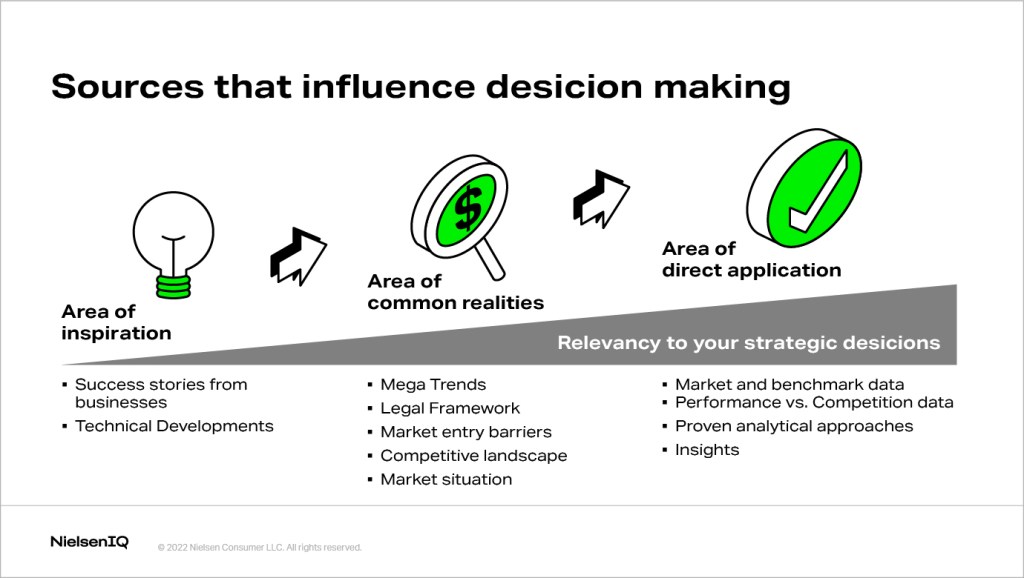

Our decisions are influenced by several factors. When it comes to strategic business decisions, we can far too often get stuck in a decision dilemma. Finding and deciding on growth opportunities can be one of them.

Let’s take a look at three large buckets that growth opportunities can “hide” in.

1) Area of inspiration

No question, inspiration is important. Inspiration is a seed for potential future success, the fuel that drives our “out-of-the-box” thinking. Beyond these aspects, inspiration also has an impact on our well-being.

However, we don’t know when and where inspiration will strike, and we cannot force inspiration. But we can try to help create an environment conducive to inspiration.

Exposing ourselves to new “input”, reading, listening, watching how others achieved things—or just much how they failed! Topics close to our reality seem to be the fastest way for inspiration to strike, however, inspiration has the power to “cross-pollinate”. For example, did you know that bubble wrap was initially invented as a 3D plastic wallpaper?

So, can you count on inspiration? Hardly. But you should make room for it so it has a chance to strike.

2) Area of common realities

This section refers to a shared setting or reality that an individual has little direct influence on. It includes aspects like mega trends or legal frameworks and even political and economic developments.

We all operate under this shared or common reality. Rules and regulations level the playing field. They need to be adhered to and certainly have an influence on strategies and approaches. Market situations and competitive landscape develop in this environment.

However, one strong commonality of these realities is they rarely change quickly and bigger shifts usually spend quite some time on the horizon.

There are opportunities that arise from these situations, but timing can be unpredictable. For example, veganism and vegetarianism can be traced back to earlier than 1000 BCE, but only started to become a mainstream topic and one of the fastest growing categories in FMCG since the mid 2010’s.

Can you count on the common realities for growth? Due to the slow pace of change, new opportunities don’t arise frequently. Your timing needs to be right and investments ought to be balanced.

3) Area of direct application

Deciding to bring an idea to life (or consciously not to bring it to life) always comes with a price tag. What you must balance is the up-front cost versus the opportunity cost when deciding to invest in an idea. If you decide against a potentially great idea only to see a competitor bring it to life instead… that would be hard to swallow.

To make the right decision, ensure your review process is data-based and follows the sequence of data, analysis, and insight. This logical flow will help you make a decision directly and with confidence—the key term being confidence.

So, can you count on direct applications? Well, it depends on the level of confidence that you have in them. If your data and analysis are solid, they can provide you with solid insights. But if you question either the data or methodology, you might continue to feel doubt about your decision, which could lead to longer decision times or increased use of “gut-feeling” decisions. A dilemma that Arthur C. Nielsen once phrased as, “The price of light is less than the cost of darkness”.

While ideas for growth can come from all three buckets, the crucial aspect at the end is always to make a confident decision on whether to pursue it or not. The underlying information informing your decision should be a true representation of what is happening in the market, which means you need to have confidence in the data used. But data alone is never the answer.

The analysis done based on the data needs to be correct as well, which means you need to have confidence in the methodology used in the analysis. Only then can you derive true insights. In the past getting reliable data, analytical concepts, and expert interpretation was so expensive that it was almost exclusively used by larger companies. or trade-offs were necessary. You might have received lower quality data or less expert resources for interpretation.

This is no longer necessary—we can help you with an easy-to-use and affordable solution exclusively for small and medium businesses.