E-commerce expansion

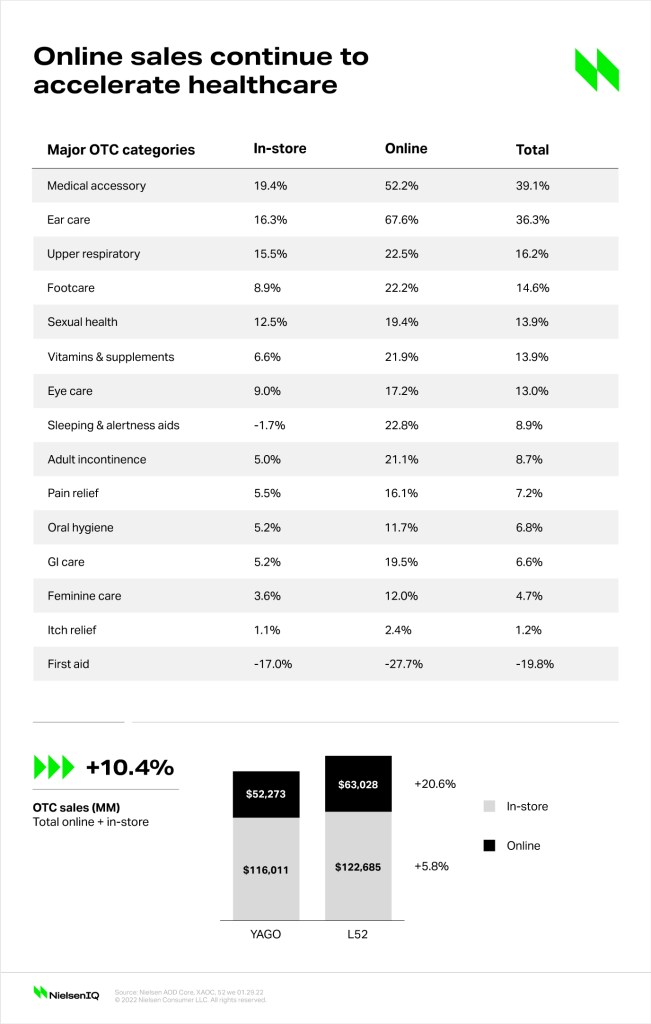

Despite an increase in online shopping, NielsenIQ RMS sales data revealed shoppers did not suspend brick-and-mortar shopping, as very few shoppers are exclusive to e-commerce (9%). When Nielsen IQ looks across all major categories in OTC, there is evidence of strong, double-digit growth among all healthcare categories online. For example, our data shows growth in:

- Ear Care +67.6%

- Upper Respiratory +22.5%

- Footcare +22.2%

- GI Care +19.5%

- Sexual Health +19.4%

Of note, subscription purchases drive 9% of online OTC sales. For these companies landing subscriptions is key as they are able to lock in a steady revenue stream while only offering small cost savings on products. The vitamins and supplements category has 33% of its online purchases from subscriptions.

Brick-and-mortar continues to evolve

When compared with in-store purchases, the story is much more varied. Growth in brick and mortar is increasing slightly, at 5.8% for OTC sales, but the total market is double the worth of online. We observed growth in select categories that correspond with online, with a few exceptions:

- Ear Care +16.3%

- Upper Respiratory +15.5%

- Sexual Health +12.5%

- Eye Care +9.0%

- Footcare +8.9%

NielsenIQ’s analysis uncovered an interesting trend in how consumers are shopping for sleeping and alertness aids. Most shoppers prefer to shop the e-shelf, with +22.8% growth, and the data shows a -1.7% in-store decline versus last year.

The proven strategy of choice for brick-and-mortar retailers is click and collect: it combines the ease of online shopping with the convenience of immediate pickup. Popularity for this shopping method surged during the pandemic (43%) because it helps reduce in-person contact. The challenge for brands is double counting click and collect purchases from brick-and-mortar or online sales, which NielsenIQ Omnichannel solutions can distinguish with ease.

The future is omnichannel

The majority of shoppers purchase both online and in-store, with a healthy 10% increase across omnichannel sales. Brands and retailers must underscore marketing efforts for both online and in-store. Omnichannel marketing efforts deserve equal prominence, so consumers can shop wherever best meets their needs at the time.