Scaling infrastructure and digital inclusion represent the next frontier for India, as is apparent by the government’s continued efforts to run programs like Smart Cities and ‘Make in India.’ Despite urbanization, however, rural markets still account for half of India’s gross domestic product (GDP). This market activity and affluence make it necessary for marketers to continue focusing on them. In fact, some industries, such as two-wheelers and telecom, derive almost half their earnings from the hinterland.

Dissecting the rurban market

A large part of this burgeoning opportunity lies in the ‘rurban’ part of India—the urban part of rural areas. This includes markets that are quintessentially rural, yet have the influences of a more affluent urban lifestyle. But while rurban India has existed for a while, there is an increased need for companies to distribute to this market more optimally. With increased availability of macroeconomic data, geospatial data and custom data assets like Nielsen’s retail census, and the ability to combine them using advanced analytical methods, this optimization is now more possible than before.

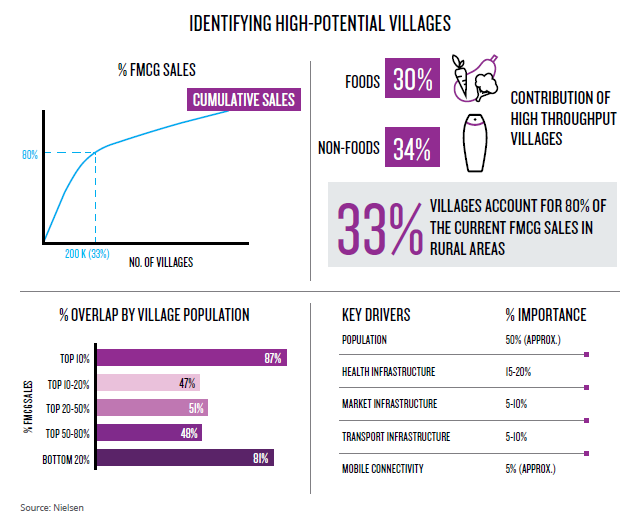

The real challenge is being able to identify the affluent clusters. The holy grail would be a precise identification of the Rurban clusters (including villages) that account for a bulk of the affluence. For instance, NielsenIQ’s advanced analytics and macroeconomic data reveal that just 33% of villages, numbering about 200,000, account for 80% of all rural fast moving consumer goods (FMCG) sales. This high concentration exists across various markets and levels of consumer affluence, making it vital for manufacturers and retailers to cater to people in those villages and clusters. Further, these high potential rurban clusters and villages act as feeder points for the rest of the proximate markets.

When picking the most attractive markets, high-potential villages should not be confused with those that have a high density of population. This is a prevalent practice and is inefficient. Again, our analytics clearly establish that there is only a 50% overlap between villages with high population, and those that contribute high sales, indicating that population is not the sole driver of sales. This is why transportation infrastructure—ease of reaching these markets—is one of the most important considerations in selecting high-potential clusters. Health infrastructure, market infrastructure and mobile connectivity are some of the other important considerations. They indicate prosperity.

For more details, download the full report (top right).