Sustainability is a corporate issue

Consumers are aware a vast majority of their product and packaging waste comes from their local supermarket; most agree that product manufacturers bear the responsibility of addressing the issue. According to our 2020 sustainability survey, 82% of Canadian households agree sustainability is an important issue for them.

In today’s retail environment, consumers want to feel empowered by their ability to shop sustainably. It’s no longer enough for companies to say they hope to make responsible environmental choices in the future—consumers are demanding change now.

Consumers purchase products with a clear commitment to a broader definition of a sustainable future; corporations, retailers, and manufacturers that support social responsibility and planet sustainability will hold a competitive advantage long term. In other words: neglecting sustainability means leaving money on the table.

Pandemic shifts sustainable efforts into focus

During the pandemic, there was a marked increase in consumer concern for local communities, particularly the wellbeing of supermarkets and food supply chain employees. These frontline workers became heroes of the collective: many consumers recognize the contributions and risks that supply chain workers face in their line of work and hope to protect the human rights they deserve.

In the Beer, FMB, Cider category, products featuring the Fair Trade attribute had a 74% increase in sales versus two years ago. There was also a $279.5M increase in Personal Care products with the Fair Trade attribute, and a $125.9M increase for the Grocery Food and Beverage category featuring the attribute during the same period. Clearly, consumers are placing greater emphasis on the human rights of supply chain workers.

With combined sales amounting to $1.6B this year, growth for fair trade items increased compared to last year:

- Beer/FMB/Cider +11.5%

- Personal Care +8.6%

- Grocery Food & Beverage +3.8%

Animal rights is another social movement gaining recognition, consideration, and protection in the sustainability realm. In the past 5 years, 7 states passed legislation prohibiting animal testing in cosmetics with 4 more states following suit. Now, the cruelty-free category represents a growing trend in total beauty and personal care, with 27% dollar growth.

Cruelty-free state-by-state beauty legislation ushered in accountability for mainstream categories. As NielsenIQ’s Beauty Vertical Client Director Anna Mayo states, “beauty is a trendsetting category, paving the way for innovative, sustainable products.”

The California Right to Know Act requires manufacturers to update cleaning product labels to disclose the presence of intentionally added ingredients, encouraging sustainable product development and reformulations of products that do not meet current criteria. NielsenIQ data found 153% growth in cruelty-free household products from two years prior. Like cruelty-free legislation, other states are expected to follow suit until it becomes an industry standard.

Consumers demand greater transparency

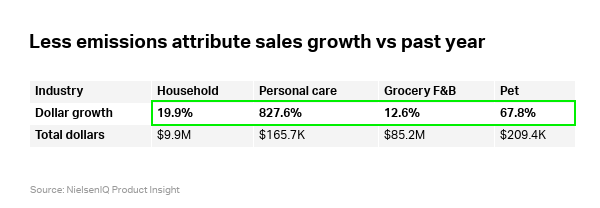

During the 2020 lockdown measures, carbon emissions decreased by an estimated 2.4 billion tons1, resulting in cleaner air in major cities. As of September 2021, data from NielsenIQ Product Insight shows a 12% increase in the past year in Grocery, Food, and Beverage for products sold with fewer emissions. For the Household category, data showed a 19% growth for lower emissions compared to last year, and a 34% increase for the same period 2 years prior.

Increasingly, consumers feel challenged by the lack of options offered and expect greater transparency from both brands and retailers. As environmental concerns grow, it is lucrative for brands and retailers to adhere to environmental practices and clearly label the impact of products to remain competitive. Target does this well by providing online consumers with the option to filter based on sustainable concerns, like biodegradable formulations2. Retailers outline their dedication to clear labeling and quality through sustainable sourcing. Transparency on meat, poultry, and fish vendor sourcing signifies intent to protect delicate ecosystems.

Whole Foods collaborates with the Monterey Bay Aquarium Seafood Watch program, a nonprofit, to provide color-coded sustainability ratings in store, demonstrating transparency in wild-caught sourcing.3 The Sustainable Seafood Qualified attribute in Food and Beverage grew 20% compared to last year and 49% from two years prior.

Locally made and grown items do not considerably strain supply chain systems and help stimulate the local economy. There has been a marked growth of both retailers and manufacturers becoming more engaged with local farms. Nestlé works with 600,000 local farmers for a safe, high-quality, nutritious milk supply, which in turn helps stimulate the economy.4

- Household items certified Made in the USA is a $3.7B business, with a 24.9% growth versus 2 years ago.

- Family Farmed segment is worth $1.8B for Grocery F&B, with a 0.8% growth increase this past year and a 13.4% increase in two years.

With concerns over quality of raw materials for product, companies are committing to better vertical integration, like Above Foods, a plant-based company dedicated to a “seed-to-fork approach,” as stated by company chairman Douglas Hines when speaking to Forbes.5 Consequently, with pandemic supply chain constraints and sustainability concerns, verticalization may become more popular. Companies are recognizing the need for connection to the land for sustainable management practices.

Consumers are more astute than years prior to greenwashing practices by industry lobbyists against social good. NPR reports most consumers are aware that less than 10% of plastics are recyclable and that not only does plastic take a century to degrade in landfills, it may also harm wildlife.6

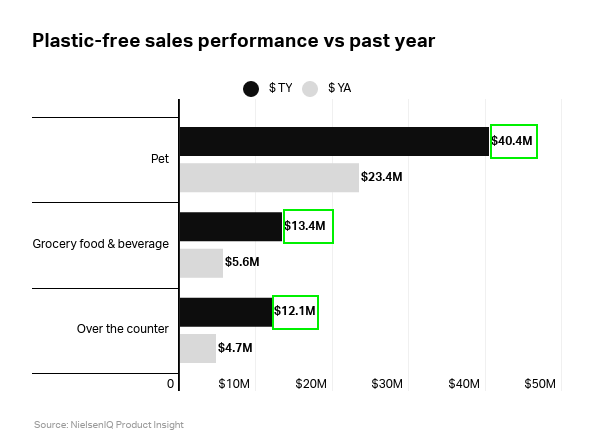

The plastic-free segment is experiencing triple digit sales growth year-over-year in Grocery, Food, & Beverage and Over-the-Counter Medication. In Pet, the $40.4M segment grew 507% in the past two years alone. Consumers are also spending on household products comprised of renewable resources, which show a 67% sales increase versus the prior year, and the Sustainable Packaging Qualified attribute alone shows $2.0B growth from two years prior.

Retailers can deliver on sustainability promises by stocking products with labels that speak to environmental impact to maximize profits.

Better for we: Opportunities for brands and retailers

As human, non-human, and environmental health become more important issues for shoppers, companies need to move along the continuum of sustainability to regeneration. Addressing sustainable transparency is key to gaining consumer trust, especially from the most environmentally conscious generation, Gen Z, who will soon become supermarket shoppers.

Building a better world will require more sophisticated metrics and tools for measuring, tracking, and contextualizing ethical actions and usher in a new era where ethical evaluations are integrated into products and services.

Driving Sustainability in CPG: Win for your business, win for the planet

As technology enables greater sustainability metrics tracking, we guide our clients along the path. Access the recording and deck from our sustainability in FMCG webinar.

Sources:

1 “Covid Lockdown Causes Record Drop in Carbon Emissions for 2020.” Stanford Earth Magazine, Stanford University, 10 Dec. 2021, https://earth.stanford.edu/news/covid-lockdown-causes-record-drop-carbon-emissions-2020#gs.g8c39r.

2 “A Bullseye View. behind the Scenes at Target.” Target Corporate, https://corporate.target.com/corporate-responsibility/responsible-sourcing.

3 “Seafood Standards like Nowhere Else.” Whole Foods Market, https://www.wholefoodsmarket.com/quality-standards/seafood-standards.

4 “Working with Dairy Farmers.” Nestle Global, https://www.nestle.com/brands/dairy/dairycsv.

5 Ewing-Chow, Daphne. “The Food Industry’s Latest Plant-Based Deal Is a Regenerative Mic Drop in the Face of Big Food.” Forbes, Forbes Magazine, 25 Oct. 2021, https://www.forbes.com/sites/daphneewingchow/2021/10/25/the-food-industrys-latest-plant-based-deal-is-a-regenerative-mic-drop-in-the-face-of-big-food/?sh=58bdebd3e8b8.

6 Sullivan, Laura. “How Big Oil Misled the Public into Believing Plastic Would Be Recycled.” NPR, NPR, 11 Sept. 2020, https://www.npr.org/2020/09/11/897692090/how-big-oil-misled-the-public-into-believing-plastic-would-be-recycled.