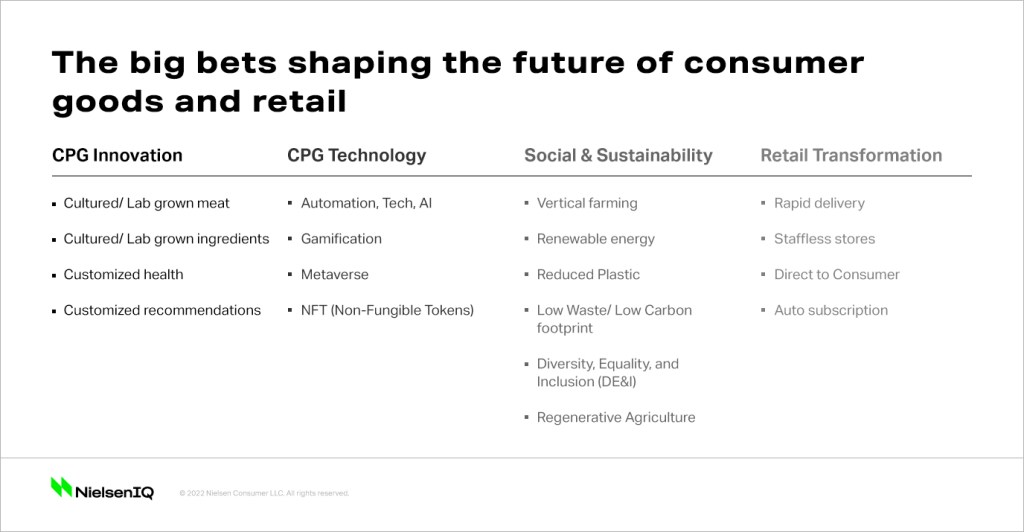

The Leading Edge: The big bets shaping the future of consumer goods

The leading edge is where first movers are investing, testing, and betting on the next big thing. Understand the top investments that will impact CPG in the next 3 years.

Introduction

As an authoritative voice in CPG and retail, NielsenIQ is fostering forward-focused conversation around what’s ahead. Our newest analysis of the leading edge explains and explores 18 popular transformative ideas where the industry is investing in, today. These ideas are slated to fuel the next phase of exponential growth within the retail and global consumer goods sector.

In this report, we assess the trajectory of many common “big bets” being made in CPG, including lab-grown meats, customized health products, NFTs, the Metaverse, vertical farming, regenerative agriculture, rapid delivery, staffless stores, and more.

Understand how to assess the big bets that will shape retail

Across the 18 ideas included in our analysis, these big bets sit at varying stages of maturity. Some are close to becoming mainstream game changers, others are a bit farther from claiming success. All are leading indicators that consumer needs are shifting and change is in the air.

Our thought leadership framework considers investments being made by industry players and analyzes consumer sentiment, emerging enablers, social impact, sustainability, retail transformation, and potential barriers impacting CPG innovation and technology.

It is important to note that this research is filled with directional foresight. While we are not predicting or claiming certainty of what the future holds, through our framework we are shining a light on potential future scenarios to facilitate informed conversations.

What investments are piquing global companies’ interest? How ready are consumers to adopt these ideas? What are the factors of success?

For companies looking to get ahead, they must first understand the betting landscape of the leading edge.

The Leading Edge of: CPG Innovation

Tech and health-minded products are becoming personalized and connected. Under this umbrella theme, science and innovation are blurring the traditional lines of what we eat and how we treat our core needs.

The Leading Edge of: CPG Technology

The leading edge of CPG technology is where tech is becoming interconnected with the human experience. Under this umbrella theme, companies are investing in a future tied to digital identity, communities, convenience, and ownership of digital goods, experiences and proof of provenance.

The Leading Edge of: Social + Sustainability

The leading edge of social and sustainability initiatives is where regenerative programs are becoming the norm. Moving beyond the vision of just maintenance and survival, under this umbrella theme, there is movement toward regeneration focused on authentic efforts of restoration and thriving growth.

The Leading Edge of: Retail Transformation

The leading edge of retail transformation is where retail is becoming digital, physical, and experiential—all at once. Under this umbrella theme, companies are hyper focused on curated journeys and looking to invest in areas that intentionally expand the potential and possibilities of cross-reality, multi-sensory retail far beyond what we know today.

Follow the money

To understand where the industry is headed, follow the money. The last 24 months have forced accelerated investment in areas like e-commerce, delivery, and digital tech adoption. The consumer goods industry is ripe for continued investment with trillions of dollars earmarked toward accelerating change over the next 5 years.

Where are companies investing money, time, and attention?

While recognizing that there are hundreds of different areas of investment and innovation taking shape, NielsenIQ selected 18 popular areas of investment, reflecting a curated selection of global big bets shaping the future of consumer goods and retail.

Reduced plastics

Within the Australian retail landscape, Aldi, Woolworths & Coles committed to have 100% of plastic packaging be reusable, recyclable or compostable by 2025, The supermarkets join a cohort of 60 businesses including The Arnott’s Group, Coca-Cola South Pacific, Nestle Australia, PepsiCo and Colgate Palmolive. (Source)

Direct To Consumer

Nestle expects to nearly double its global e-commerce sales to 25% of its group total by 2025 by stepping up marketing and technological investments in the direct-to-consumer space. (Source)

Automation

The World Economic Forum’s report on “The Future of Jobs,” indicates 43% of businesses surveyed plan a move to reduce their workforce due to technology integration and automation. (Source)

Vertical farming

In early 2022, Walmart became the first large U.S. retailer to significantly invest in vertical farming in collaboration with Plenty (Source).

Cultured / Lab grown meat

Brazilian company JBS S.A.—the largest meat-processing company by sales in the world—acquired BioTech Foods, a Spanish developer of cultivated protein, in 2021. JBS also announced plans to build a research and development center for cultivated protein in Brazil, investing U.S. $100M into the two projects. (Source)

Metaverse

Microsoft makes a strategic bet on the Metaverse with the $68.7B acquisition of Activision Blizzard. (Source)

Staffless stores

FamilyMart Japan is looking to open about 1,000 staff-less shops by the end of fiscal 2024. (Source)

Customized health

Nordstrom has paired with startup Viome Life Sciences to sell kits online and in select stores that analyze the microbiome. It’s AI-driven algorithms are able to yield personalized recommendations for diet and supplements. (Source)

“What companies are investing and focusing on now is a precursor to what we will see in the years ahead in terms of products, business models, or even what businesses stand for as they represent themselves in the marketplace. How successful these big bets are, will be dependent on several factors—not least of all is how they resonate with consumers and their changing values and needs.”

Regan Leggett – Foresight leader at NielsenIQ

Learn about the leading edge

Select each leading edge category below to learn more about these big bets.

Which leading edge technologies are most likely to influence the next 3-5 years of Global CPG?

Download NielsenIQ’s industry scorecard assessing the trajectory of all 18 big bets.

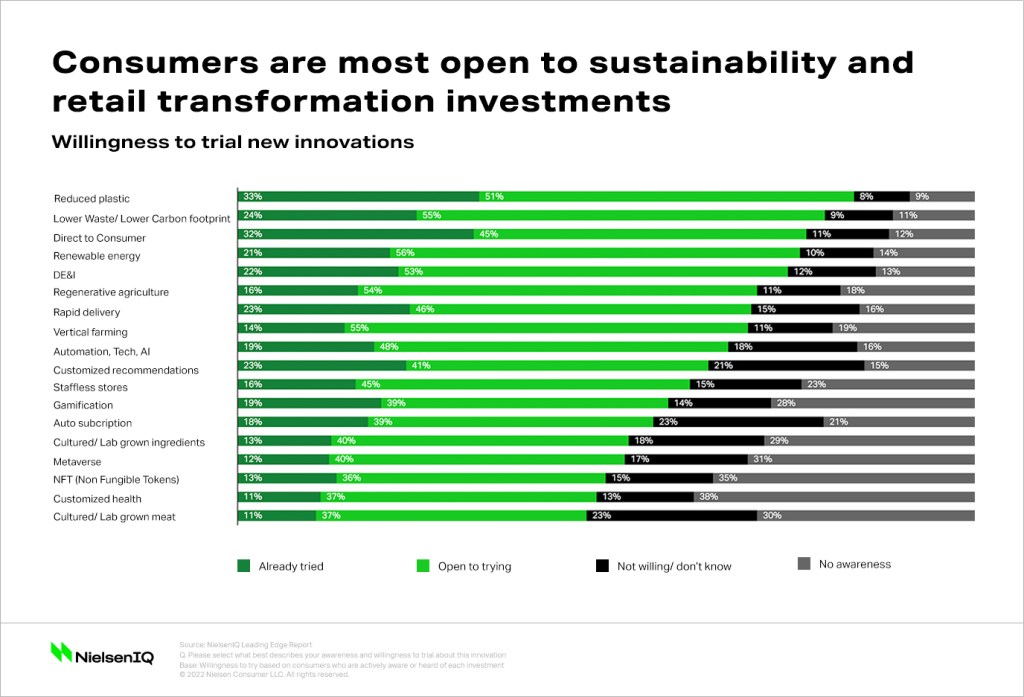

Consumers favor big bets with a sustainable focus

Recent research shows that consumer preferences and priorities are more dynamic than ever. According to NielsenIQ‘s 2022 Consumer Outlook online survey, 74% of global respondents believe that their priorities and resulting shopping habits have been impacted by the pandemic.

Matching investments to sentiment, NielsenIQ conducted a directional survey of consumers in 17 global markets to gauge the general levels of willingness and “openness” toward adopting the big bets that are examined in our leading edge report.

NielsenIQ’s global consumer survey revealed that the investments that aligned with sustainability, inclusive of reduced or recycled plastic, lower waste/footprint, and renewable energy consistently ranked the highest around the world. What does this mean? Global consumers are serious about sustainability and have noted a strong willingness and acceptance toward sustainability-focused programs.

It is interesting to note that direct-to-consumer (DTC) models also have widespread positive consumer acceptance around the world. DTC models have sprung to prominence in the past two years as pandemic-induced behaviors and homebody lifestyles have provided trial and adoption.

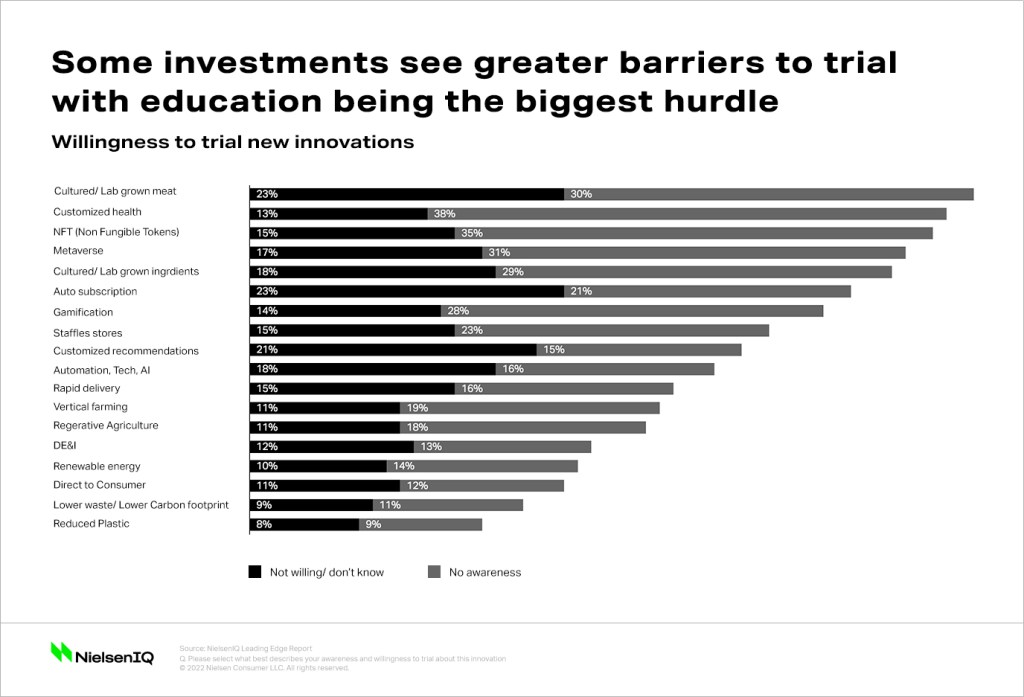

At the other end of the consumer responses are the negative sentiment or resistance to trial. For some, the road to future adoption may be long. The five investments that have the biggest lack of awareness or resistance to trial are lab-grown meat, customized health, NFT’s (Non-Fungible Tokens), the metaverse, and lab-grown ingredients.

“A lack of awareness or even resistance to trial is certainly not an indication that these investments will fail. Factors like governance, social good, scalability, weight of investment, readiness, and competitive advantage all play a substantial role in the adaptiveness of big bets. Each has the potential to influence the success of these investments negatively or positively in the future and it highlights how dynamic and interconnected the consumer goods eco-system is right now.”

Regan Leggett – Foresight leader at NielsenIQ

Leading edge objections can be overcome

Within our analysis of these big bets, several figures demonstrate just how far some of these 18 concepts are from mainstream adoption. Take, for example, the popular concept of automatic subscriptions. Currently, 39% of global respondents have shown openness to this idea. However, a proportionately high percentage of global consumers (23%) are not willing to try a subscription or are unsure.

In the age of social media, discourse over unwieldy subscription delivery cadences and unbreakable subscription service agreements have tarnished the overall industry. While not a reflection of the majority, deceptive practices in this space have caught the attention of governmental regulatory organizations that are looking to protect consumers. For the overall automatic subscription service industry, this is a public relations and marketing challenge to overcome and represents a major roadblock to mainstream adoption.

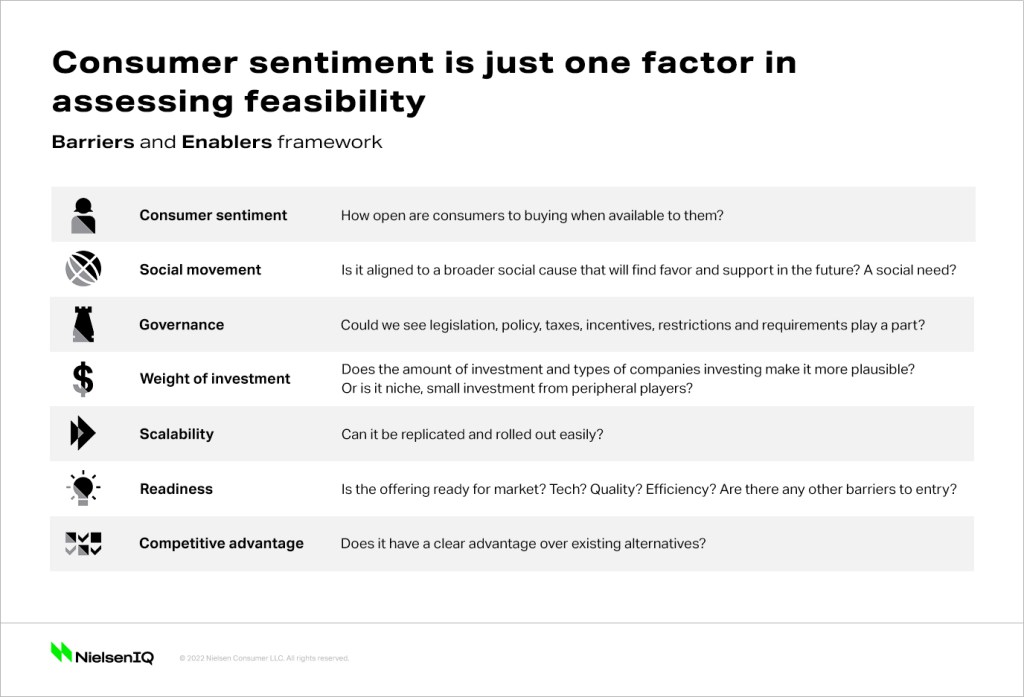

Factors of success: what will flourish & what will fail?

Consumer sentiment alone will not be the single factor that decides the success or failure of these big bets. When assessing the viability of these leading edge investments, companies will also have to consider a number of additional factors to determine where to place their big bets. To help advance the industry discussion about change, NielsenIQ has created a framework to assess the most influential barriers and enablers to success. While not intended to act as a set of predictions, this 7-point framework enabled the creation of industry scorecards across all 18-leading edge, big bets. The resulting rankings reveal a deep insight into which leading edge investments we believe are the most likely to fuel the future of growth in CPG and retail. Gaining this in-depth understanding of the trends and hurdles at play will allow companies to intelligently plan and make the right investments to future-proof their business.

This 7-point framework enabled the creation of industry score cards across all 18-leading edge, big bets.

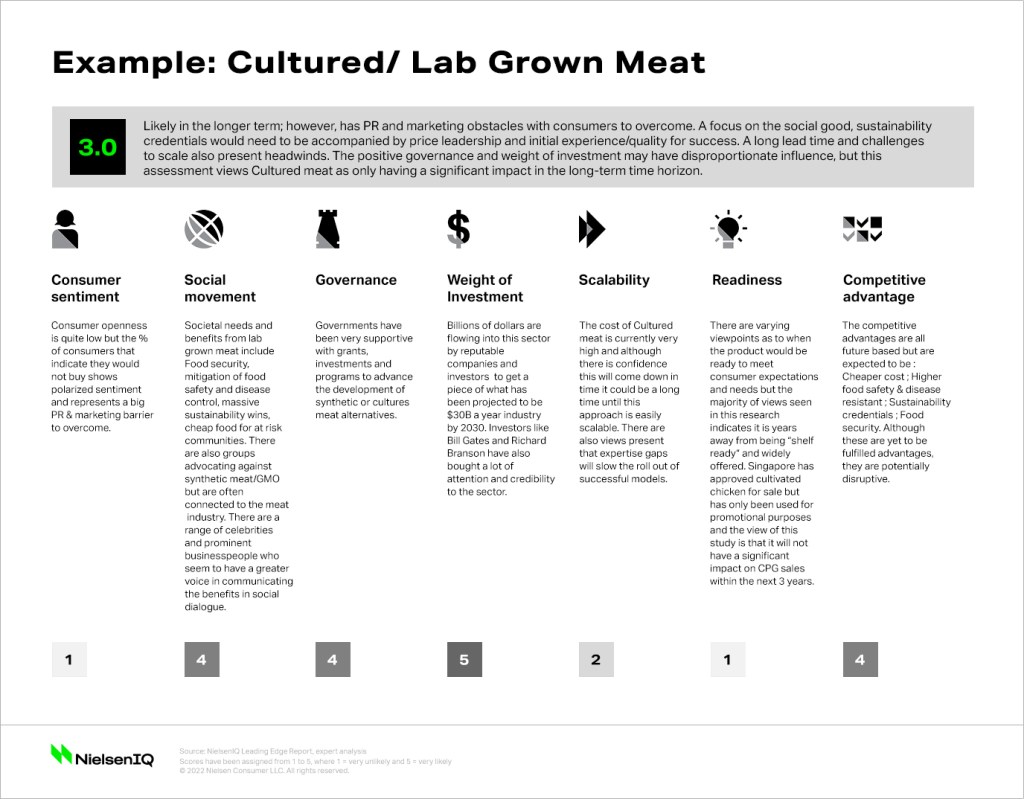

As an example, the NielsenIQ score card for lab-grown meats shown below, reports an overall score of 3.0—noting that mainstream adoption is likely, within a long-term time horizon.

Within the scorecard, there are both negative and positive elements for industry players to consider. At one end, consumer resistance will be challenging to overcome. However, governance in policy, legislation, and grants may eventually facilitate growth in markets. The societal benefits and potential that lab-grown meats may bring (namely: sustainability, food security, enhanced safety, and hygiene) are promising. Scalability will require additional expertise and innovation. This category will remain niche until long-term conditions are more favorable.

Which leading edge technologies are most likely to influence the next 3-5 years of Global CPG?

Download NielsenIQ’s industry scorecard assessing the trajectory of all 18 big bets.

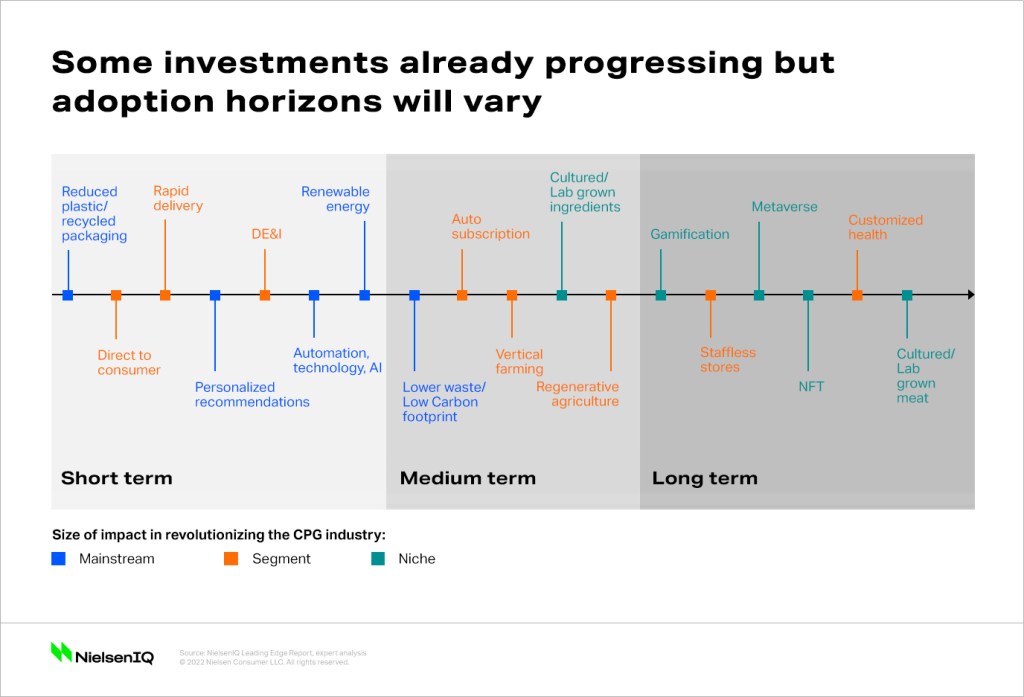

What will create meaningful change in the global CPG landscape over the next 3 years?

Across the consumer landscape, examples of progress and adoption are already in full motion—however, the scale and readiness will vary considerably.

The money and focus flowing into reduced and recycled plastic, for example, is happening right now and is expected to accelerate in line with commitments. However, as mentioned above, lab-grown meats have a slew of factors to work out before it can be considered ripe for mainstream, global adoption.

Top investments that will impact CPG in the next 3 years

According to NielsenIQ analysis, of the 18 big bets that we considered, the top five areas of investment that will most likely have an immediate and widespread influence on the global CPG industry in the next three years are reduced/recycled plastic, DTC, rapid delivery, renewable energy, and automation technologies.

The time is now to focus on leading edge investments

“Without question, the transformation imperative is now clearer than ever,” concludes Leggett. “The CPG environment is ripe for transformative change. Not only have consumers gone through disruptions that have markedly altered behaviors and priorities for the long-term, but the industry players are making big bets on which business models will be successful in a post COVID world.”

A significant amount of investment, focus, and innovation is happening right now at the leading edge. Transformative leaders need to build a culture that is committed to monitoring and learning about new innovations, technologies, and approaches to maintain an agile, forward-looking company.

Stay one step ahead by staying up to date.

Don’t miss out on latest insights, offers and opportunities by NielsenIQ.