Got milk? As children we were told that if we wanted to grow up big and strong, we should drink our milk. It’s full of protein for our muscles and calcium for our bones, and it’s just the right consistency to stick to our upper lips for the perfect milk mustache. But in the U.S., traditional milk is moo-ving over as almond milk is taking center stage.

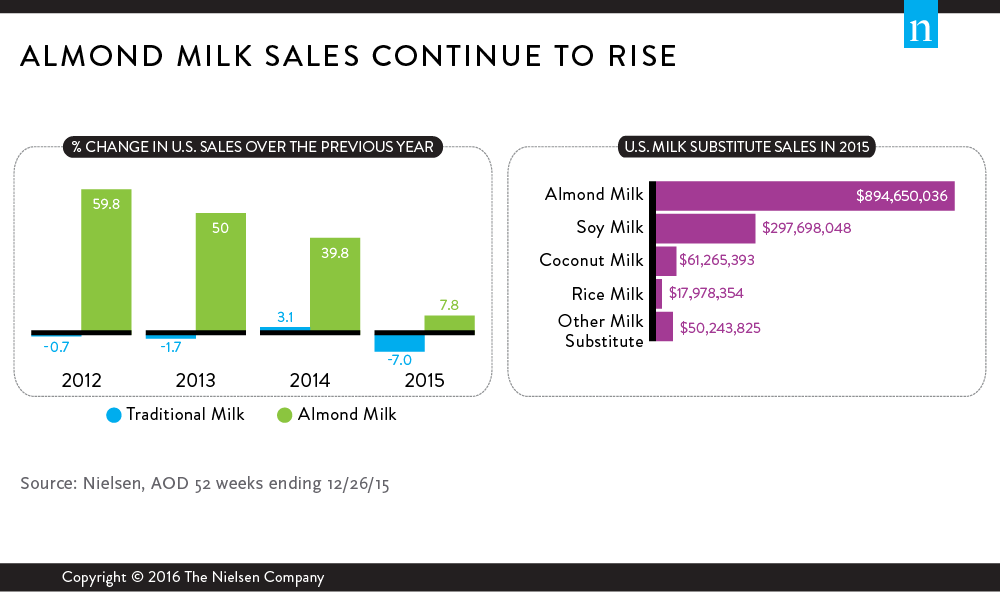

In fact, almond milk is now America’s favorite milk substitute, boasting sales growth of 250% over the past five years. During that same period, however, the total milk market shrunk by more than $1 billion. And while almond milk still accounts for just a fraction of the total milk market (about 5%), it brings in more than twice the revenue of the other substitutes combined – holy cow!

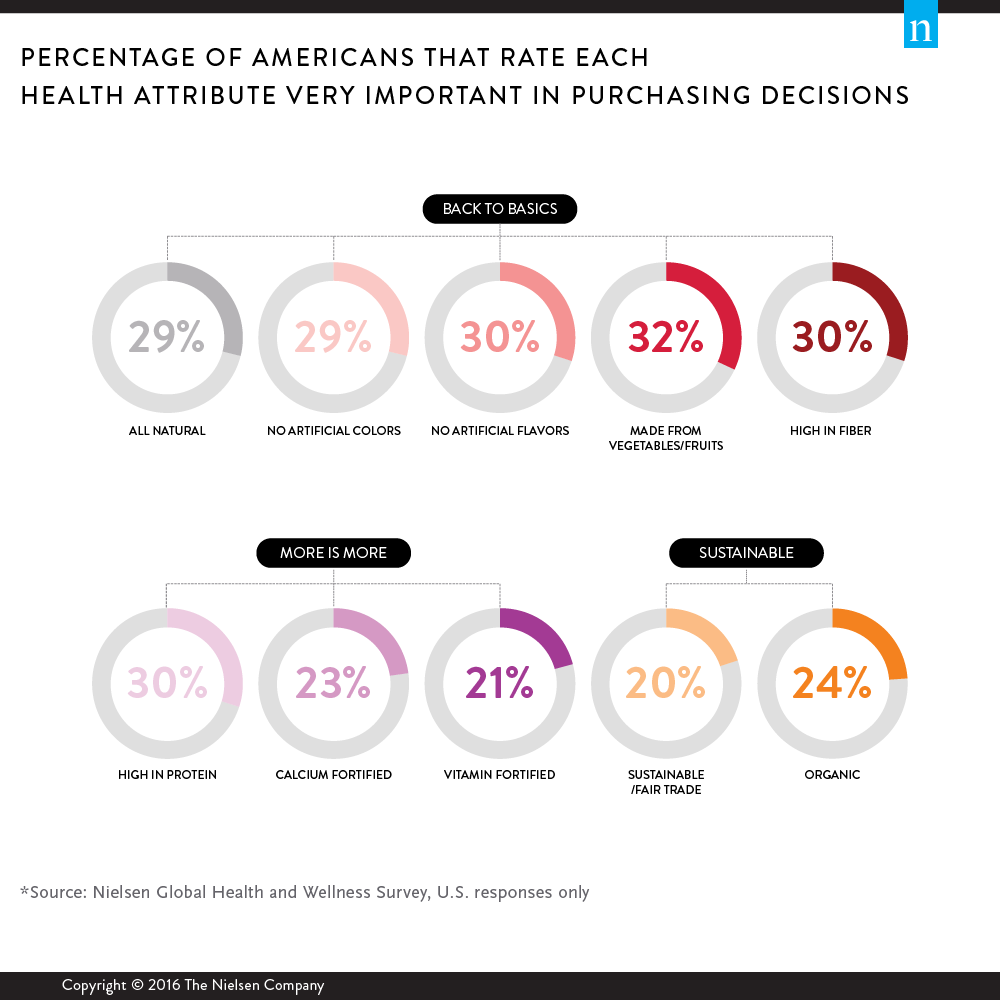

So why is almond milk growth going nuts? While this beverage could have a dairy godmother watching out for it, the uptrend in sales is more likely the result of current health and wellness trends. According to NielsenIQ’s 2015 Global Health and Wellness survey, consumers rated back-to-basics food attributes like “all natural,” “no artificial colors or flavors” and “made from vegetables or fruits” the most important.

While health attributes are important factors in purchase decisions for all age groups, certain attributes are more important to younger generations. Forty percent of Generation Z respondents in the global health and wellness survey said ingredients sourced sustainably are very important in their purchase decisions, followed by Millennial (38%) and Generation X (34%) respondents, compared with only 21% of Silent Generation respondents.

Dietary restrictions may also be playing a part in the rise of almond milk, as it lacks the lactose of traditional milk and the hormones found in soy. In fact, products labeled hormone or antibiotic free have posted double-digit growth over the past four years. They also generated $11.4 billion in sales last year. And products labeled as lactose free saw sales of $8.7 billion and grew 8.6% in the last four years.

Despite the huge growth in almond milk sales between 2011 and 2014, the pace did slow a bit in 2015, suggesting a potential plateau on the horizon. Regardless of the slowdown, it’s clear that when it comes to milk, health benefits play a major role in purchasing decisions. So whether you’re filling your glass with traditional, soy, or almond milk, go ahead, have an udder one.