Consumers willing to pay more for safety and effectiveness

Type the phrase “Can I get Coronavirus from… ” into a search engine and the window will auto-complete your question with an array of options ranging from the straightforward to the seemingly ridiculous. In the current environment, where facts can be fluid and there is an expanding list of information sources that consumers turn to, there’s bound to be uncertainty and uncertain behavior associated with this global health emergency.

With all the learnings, opinions, and behavior evolving before our eyes, one factor can be safely assumed: Over the coming weeks and months, consumers will be seeking greater assurance that the products they buy are free of risk and of the highest quality when it comes to safety standards and efficacy, particularly with respect to cleaning products, antiseptics, and food items.

In the short term, this intensified demand from consumers will require manufacturers, retailers, and other related industry players to clearly communicate why their products and supply chains should be trusted. In the longer term, and dependent on the eventual scale and impact that COVID-19 has on consumer markets, it may speed up a re-think on how shoppers evaluate purchases and the benefits that they see as the key factors to consider. COVID-19 is caused by a member of the coronavirus family that’s a close cousin to the SARS and MERS viruses that have caused outbreaks in the past.

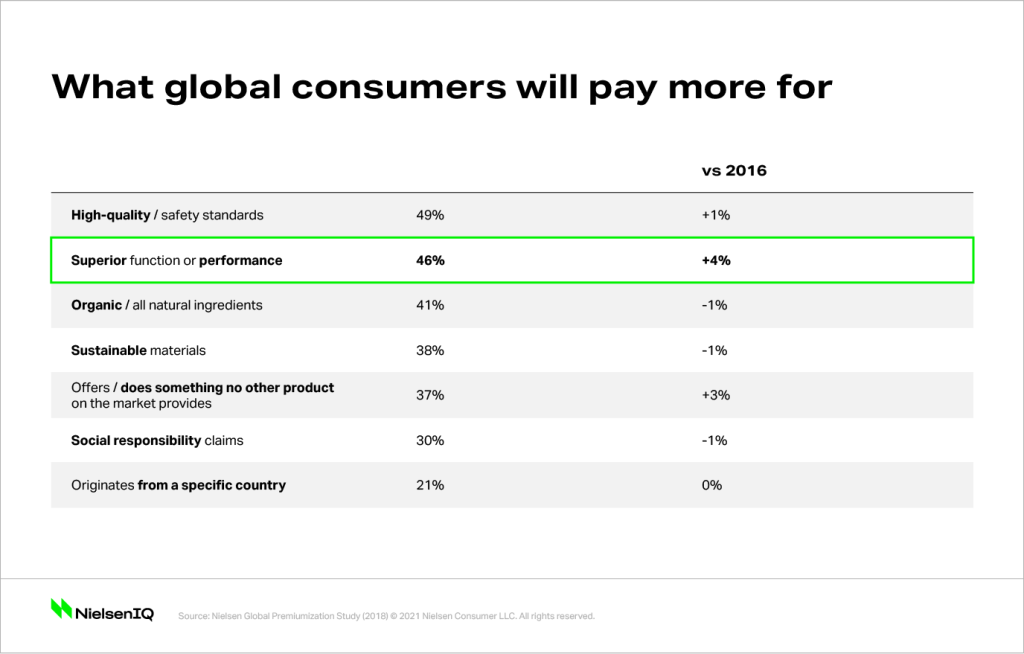

In an extensive global NielsenIQ study on premiumization, the product benefit consumers weremost willing to pay a premium for were those with high quality assurances and verifiable safety standards. Globally, 49% of consumers said they were highly willing to trade up in price for this benefit. In light of the COVID-19 outbreak and reports of stores around the world being stripped bare of sanitary and hygiene products, canned foods, and other pre-packaged durables that have these inherent guarantees built in against the virus—this need will only become more important.

Two markets that have been hardest hit by the health emergency, Vietnam and China, were among the markets with the highest sentiment pertaining to quality and safety assurances: 65% and 61% of consumers in those markets, respectively, were “highly willing” to spend a premium. And given the additional weight this insight carries, these assurances may be a guiding factor in establishing trust as consumers move back toward normalcy in these markets in particular. Hopefully sooner rather than later. For further perspective, 34% of people in the U.S. were interested in premium—smaller for sure, but still a meaningful third of the population, and that percentage will likely rise under current circumstances.

We’ll also likely see this flow into brand switching behavior as consumer priorities and decision processes become more fluid. A NielsenIQ study exploring “Disloyalty” and brand exploration highlighted the top ranked reasons for switching is value followed by quality, but given the climate, consumers may reprioritize quality in their consideration of a product. And price sensitivities may become far less relevant, at least in the near term. The study also found high levels of consumers in China, Vietnam, and the U.S. (37%, 40% and 38%) who said they were always influenced to try new brands because of better value. However, brands and products with strong quality stories may be better served by investing in bringing these factors front and center rather than trying to use price or value as levers in what will be a less price-conscious environment for some products.

In many cases, brands can deliver these quality and safety assurances by simply communicating (or highlighting) the steps that have been taken to ensure healthy, hygienic, and safe provision of products, especially for categories seemingly more susceptible to contamination, such as fresh products. Again, this might be something as simple as bringing existing practices and precautions to the forefront to allay shopper concerns or ramping up additional precautions like sealing fresh products in hygiene-monitored distribution centers. Certainly, the price that consumers would be willing to pay to avoid risk is likely to be higher. But brands and retailers should consider pricing adjustments carefully amid instances of extreme price gouging being outweighed by examples of retailers maintaining consistent prices on goods like face masks, which has paid off in goodwill and public relations.

Interested in more COVID-19 consumer insights?

The origin of products may also become a component of heightened consumer scrutiny, though this may again depend on the market in question. In recent years, we have witnessed a rising narrative from NielsenIQ market leaders all over the world pointing to the growing success of local manufacturers and products because of their focus on locally sourced inputs, such as ingredients in food products. We should expect consumers to gravitate even more to locally sourced products where distances travelled, particularly with foodstuffs, are as short as possible, thus minimizing possible exposure to COVID-19. And for countries faced with widespread cases, the inverse may be true as consumers seek sources from countries not facing a major number of COVID-19 cases. Again, pricing may come into play. NielsenIQ has also identified (pre-outbreak) that 21% of global consumers were willing to pay a premium for a product that originated from a specific country—Greek olive oil, Swiss chocolate, French wine, etc. Under current circumstances, the case may be even more so.

In a market like Vietnam for example, where three of the five categories where NielsenIQ saw the biggest declines (fresh meat, vegetables, and seafood), brands and retailers need to address the loss of confidence among consumers. Introducing product origin options in these categories may be one approach.

In China, we’re seeing this confidence gap being addressed in some very clever ways, which may help markets that move into quarantine like conditions. Delivery riders have been a lifeline for Chinese consumers stuck at home, delivering everything from restaurant meals to groceries, but had the potential to be carriers of the virus. To allay fears, some delivery companies have set up rigorous tests for their staff and communicated the health status and temperatures of their riders as they go about their deliveries. Many restaurants have also adopted this approach and actively communicate the hygiene steps they’ve taken as well as the temperatures of the kitchen staff to instill confidence.

Looking at the initial grocery reads across markets like South Korea, Vietnam, Singapore, Philippines, Malaysia, Australia, and Italy, we see some common themes across categories and product groups. Firstly, sales of products that can help protect people and ensure a sanitary environment like hand wash, face masks, disinfectants, and all-purpose cleaners have skyrocketed. Secondly, packaged foods, drinks, frozen, and canned goods are taking a similar trajectory as people start to ponder the ongoing potential of the situation. Early indicators of this “Pandemic Pantries” shopping behavior will be useful for markets that are starting to see the first impacts of COVID-19 emerge. Often, the growth rates from pantry stocking of sanitary goods and foodstuffs comes at the expense of fresh or non-packaged goods, signaling that people are concerned about these types of products being exposed to the virus.

As we watch this situation unfold and get a handle on the length of time COVID-19 may be in play, the ability to guarantee the quality and safety of products, environments, and consumption, coupled with the recognition of how important this will be to communicate to consumers for the foreseeable future, may help remove some of the potential panic from the consumer environment—and place the industry in a better position to avoid volatility. Visit our content hub for the latest global consumer insights into the coronavirus outbreak.