Thirty years in Poland, backed by 100 years of global consumer knowledge

NielsenIQ history in Poland started in the 1990s with market transformation and the dynamic development of modern trade causing our clients to demand accurate retail data to build their strategies and make business decisions. Since then, we have developed and adapted our business and solutions to clients’ needs and the market demand. As a result, our business has helped make the lives of Polish consumers better for over 30 years.

English | Polski

Your guide in an ever-changing world

The FMCG market is the largest and most competitive in the retail market and is developing at an increasing rate.

NielsenIQ retail data, the most granular and accurate available, has become the common language of communication between retailers and manufacturers and the foundation of strategically sound business marketing decisions. With data analytics on one hand and granular analytics on the other, we help clients improve marketing and sales results from planning to in-store sales.

The heart of our measurement is technology . NielsenIQ technologies allow us to accurately measure and confidently plan the entire marketing and sales process—from what product, at what price, in what channel to put on the shelf, to analyzing the performance of each product item.

What lies ahead for the Polish retail landscape

Last year, the FMCG industry in Poland has been directly impacted by global geopolitical events, inflationary pressures, and changes in consumer behavior.

Recent research shows that consumer preferences and priorities are more dynamic than ever. According to NielsenIQ‘s 2022 Consumer Outlook survey, 37% of polish respondents have re-evaluated the importance of many aspects of their lives, which affects purchasing decisions now and in the future.

Here’s what businesses can expect to see in 2023 and beyond.

Omnichannel sales data and differentiated strategies for offline and online channels are already the fundamentals of the retail market. The rise of e-commerce has disrupted the course of the FMCG industry. With consumers becoming channel agnostic and redefining their expectations of retail, many are now mixing purchases across online and physical store channels.

E-commerce developments present many opportunities for current and future online retailers. The state of e-commerce in Poland offers the right momentum to enter and take advantage of the full omnichannel experience.

The analytics of the near future will take place in real-time and will focus not on analyzing past causes, but on modeling and adjusting future results. All to ensure that at any moment your business has an answer to the question: what’s next?

As consumers continue to become more price-sensitive with rising inflation and growing prices, manufacturers and retailers need to take a closer look at their pricing strategy. Maximizing profits goes beyond making the right pricing and promotion decisions, it also depends on making them in a timely manner and with the full context of key performance indicators.

Keeping all your products afloat and reaching the right customers can feel like a high-wire act. Setting a solid foundation that aligns to your end-customer will keep your assortment centered and steady.

Assortment and space optimization have always been a priority for category managers. But as the consumer shopping patterns that shifted out of necessity during the pandemic become ingrained habits, many retailers and CPG manufacturers are reassessing their assortment strategies. Unify and streamline your assortment and space strategies with an end-to-end, integrated data solution.

Today robust data analytics and insights are essential to adapt to market conditions and consumer expectations. It is paramount to be agile and pivot quickly in order to compete and survive. Striving for continuous development and the best and most accurate reflection of the market reality, NielsenIQ is revamping our core RMS product.

The new market read will offer increased data granularity and flexibility with weekly data for Total Country and all channels will provide new possibilities. This change allows for shorter processes and, ultimately, faster deliveries. The brand-new product—Market Track—is based on new, redesigned and significantly bigger 100% scanning, which will also allow more granular regional splits and new market definitions.

Growing economies are built on successful entrepreneurship. NielsenIQ data designed for entrepreneurs helps you keep track of market shares, stay on top of market trends, and build strategic plans. Understanding your customers, competitors, and the market you operate in is key to your growth.

With limited analytics budgets available for most SMBs, it is important to identify the opportunities and focus on the approaches that will matter most. The answers come in the data, which in turn

can build the map to growing your business. Accessibility to data that is easy to use is now possible with NielsenIQ.

Make bold decisions with superior data

Powered by true intelligence, collaborative data, and 30 years of knowledge. Learn how NielsenIQ Poland can help your business.

NielsenIQ

Warsaw – Gdanski Business Center – Building C

Inflancka 4B, 00-189 Warsaw, Poland

Phone numbers: +48 22 4342700, +48 22 4342701

How it all started

Let’s walk through some historical milestones to find out how it all started and how NielsenIQ Poland has been evolving with the Polish market and economy.

‘90

Transformation: Moving from centralized planning to an open market economy

The 1990s were full of events which led to the transformation of Poland and its economy. We can mark the beginning of the modern economic and market affair system in Poland with the parliamentary elections of June 4, 1989 that defeated the communist system. Not long after that, in 1990, the first democratic elections took place and Lech Wałęsa became the President of Poland.

With a legacy of a centrally planned economy, Poland faced many macroeconomic and structural imbalances, which had to be faced and solved. Throughout 1989-1990, radical economic reforms (“shock therapy”) transitioned the Polish market from an economy based on state ownership and centralized planning to a capitalist market economy. A stabilization program succeeded in bringing down the rate of inflation and restoring confidence in the Polish currency while the deregulation and liberalization measures helped foster a thriving private sector, leading to increased exports and economic growth.

The beginning of European Union accession process marks another historical milestone for Polish economy. On April 8, 1994, the 10-year route to joining the EU begun as Poland submitted its application.

FMCG market in Poland

In 1990 Polish market started opening to foreign capital and investments. In these years, several international retailers entered the market and became a model for growth and evolution. The dynamic development of Polish private sector had just begun.

NielsenIQ Poland

As the economy opened up, the FMCG sector required accurate data and market measurement. The Nielsen company, recognizing the potential of the market, launched in Poland and began to develop dynamically: a full store census was initiated, the first cooperation with retailers was established, first scanning data obtained. As the market was evolving new solutions were required and subsequently introduced in Poland.

1990 – 1995

Big retailers started entering the market:

Billa and Piotr i Paweł opened their first stores in 1990, followed by Alma and MarcPol in 1991.

In 1992 and 1993 5 more retailers opened: E. Leclerc, Hit, Rossmann, Rema 1000, and Statoil.

1994 was the year for Makro C&C, Albert, and Globi to enter Poland.

In 1995 7 more retailers opened its doors to Polish shoppers: Geant, Plus, Bomi, Biedronka,

Eurocash, Netto, and BP.

Beginning of Nielsen operations in Poland fell on 90′.

In 1992 Amer Marketing Company opened its office in Poland, expanding presence in Central and Eastern Europe.

In 1993 – Nielsen Marketing Research came to Poland. Amer Marketing company and Nielsen merge into ANR Amer Nielsen Research Sp z o.o in 1995, resulting in Nielsen’s global footprint expanding to 76 countries.

1996 – 1999

Auchan, Stokrotka, MiniMal and Spar entered the market in 1996, followed by Carrefour, Intermarche, Real, Drogerie Natura in 1997.

In 1998 and 1999, 6 more retailers opened: Żabka, Tesco, Hypernova, Dino, Delikatesy Centrum, and Allegro.pl.

First census of 100% Urban areas was completed in 1995.

While in 1996 sample census of 10% Rural areas was still in progress. From October 1996 till May 2001 Rolling Census covered 100% of Poland over 6 waves.

1996 was also the year of the 1st BASES study conducted in Poland.

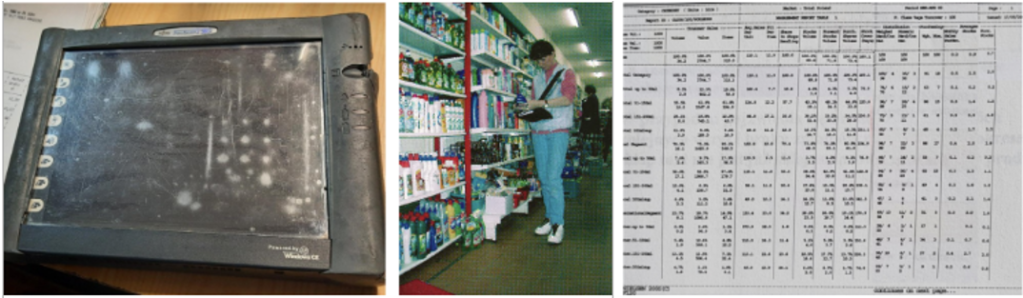

In 1997 first electronic bar codes’ scanner was used by Data Acquisition team to start collecting the retail data.

Panel started to expand with implementation of scanning data from Billa and Rossmann in 1998, and from Carrefour, Globi, Real, Savia, Spar, and Tesco in 1999.

In 1999 the new company ACNielsen Polska Sp z o.o. was created after Nielsen takes over ANR.

‘00

Economic development and investments driven by European Funds

The 2000s had a large impact on the Polish economy as two big events took place. On May 1, 2004, Poland entered the EU with nine other countries (Czech Republic, Slovakia, Hungary, Lithuania, Latvia, Estonia, Slovenia, Malta, and Cyprus). Now Poland had to operate based on EU regulations and keep up its standards at the same time, getting more opportunities with European funds. Entering the EU and joining the Schengen zone also opened opportunities for labor movement and traveling. The standard of living of Poles visibly increased, translating into their rising expectations and a change in consumer habits. The big hit came in 2008 with the beginning of the world economic crisis.

The FMCG sector continued its growth and the number of stores increased significantly by 2002. New formats were appearing in the market which changed the FMCG landscape. Private label products started to grow.

FMCG market in Poland

From the millennium on, the retail landscape in Poland began to change. The importance of large-format stores increased and attracted more and more consumers. At the same time, this period can be considered as the rise of Discounters, which were moving toward consolidation in the retail market.

NielsenIQ Poland

Nielsen was moving with the market, answering to rising needs. With new retailers entering Poland, Nielsen expanded cooperation with retailer chains to give better coverage to their clients. Thanks to the advent of new digital tools, Nielsen moved to electronic data collection and became faster. With the rise of discounters, new CSSI methodology for measuring this channel was developed.

Breakout sessions

2000 – 2005

Leader Price, PSH Nasz Sklep entered the market in 2000, followed by Kaufland and Super-Pharm in 2001 and Lidl in 2002.

Also, in 2000 Carrefour took over Champion and Globi, in 2002 Tesco acquired Hit, Biedronka took over part of Rema 1000 in 2003, and Carrefour bought out Hypernova in 2005.

Nielsen started to get scanning data from: Geant, Hit and Statoil included in the Retail Audit panel in 2000, and from Super-Pharm, Żabka, Champion, Intermarche, Julius Meinl, Ahold (Albert, Hypernova), Orlen, BP in 2002, from Auchan, Minimal, Jet Conoco in 2003, and from Drogeria Natura, Netto, Leader Price, Polomarket in 2005.

Meanwhile, in 2000 Hypermarkets line was implemented in the databases to represent stores with over 2 500 sqm and min 10 cash registers—including Geant, Hit, Tesco, Real, and Carrefour. Same time the Nielsen moved away from using paper questionnaire in audit to electronic data collection via Hand Held Terminals (HHT).

In 2003 Open Market channel for Tobacco Index was created.

In 2005 BASES office was opened in Warsaw.

2006 – 2009

Frisco.pl entered the market in 2006. In the same year Carrefour took over Albert, Real acquired Geant, Delikatesy Centrum and KDWT became part of Eurocash Group.

In 2007 Tesco bought Leader Price, while Carrefour got Ahold and Łukoil took over Jet. Biedronka opened its #1000 store.

In 2008 Biedronka purchased Plus and Aldi entered Polish market, and in 2009 E.Leclerc acquired Billa.

In 2006 Nielsen introduced Cash Slip Store Intercept (CSSI) methodology for Discounters channel. Nielsen started to get scanning data from: Rabat Pomorze, Lotos, Elea in 2006, from Alma in 2007, from Piotr i Paweł, Schlecker and Aster in 2009.

In 2007 Coffee and Tea categories were switched from bi-monthly to monthly delivery.

In this very dynamic period for retail chains in Poland, Nielsen was keeping pulse and sharing insights with clients via dedicated reports and industry events. Our close partnership with retail partners resulted in the very first endorsement letter from leading Drug retailer – Rossmann.

‘10

Further economic

development

Retail was recovering after the world economic crisis. Consumers became more and more demanding. The main request from consumers was convenience. They were demanding everything that could make their life easier—from product features to store formats and channels. Small format stores and e-commerce started to fulfil this quest for convenience, which led to the growth of these channels.

Euro Football Cup Poland – Ukraine in 2012 opened big opportunities for brands and brought more temporary shoppers to the market.

Regulations were changing as well; on March 1, 2018, a Sunday-trading ban was introduced which had a direct influence on the Polish FMCG sector.

The FMCG market continued its growth and the importance of channels changed according to consumers’ new needs. The economic crisis also made people more price-sensitive, which helped private labels become more popular.

FMCG market in Poland

Convenience was becoming the key for consumers. Retail was moving toward a “convenient store” approach. E-commerce was on the rise and started to develop fast, attracting more and more new online shoppers. With new state legislation, new challenges were faced by the retail players.

NielsenIQ Poland

The need for convenience and speed was also seen among Nielsen clients. Answering this need, Nielsen increased the frequency and granularity of collected and delivered data. The path to weekly scanning data from total market data began.

Breakout sessions

2010 – 2015

In 2010 Hebe entered the market and Auchan opened its online store – Auchan Direct. Tradis (Lewiatan, Groszek, Eurosklep, Gama) became part of Eurocash Group.

In 2012 Alimentation Couche-Tard (Circle K) took over Statoil, and in 2013 Carrefour acquired Rast. Store #3000 opened under Żabka banner.

In 2014 Eurocash bought 51% shares in InMedio. Online channel was growing: in 2015 Carrefour; Rossmann; Drogerie Natura opened their online stores.

In 2015 Carrefour took over Galerie Alkoholi and Rossmann and Delikatesy Centrum opened their #1000 stores.

Nielsen started to get scanning data from: Bomi in 2010 and from Ruch, InMedio & Relay for Tobacco in 2015. The new Delicatessen Index was introduced in 2010 (Alma, Bomi, Delima, Piotr i Paweł).

Salty Snacks (2010), Confectionery (2011) and Food (2015) categories were switched to monthly delivery.

In 2011 Perfumery Index was created, which included data from Sephora, Douglas, Marionnaud. Cash&Carry channel was integrated into reporting with the Key Account Data in 2012.

In 2015 Brandbank became part of Nielsen.

2016 – 2019

In 2016 Auchan took over Real, and Amic Energy took over Łukoil, as well as Maxima Group acquired Emperia Holding (Stokrotka) in 2018.

In 2016 Super-Pharm opened its online store. In 2017 Eko Holding and one year later Mila became part of Eurocash Group.

On March 2018 Sunday trading ban was introduced. Store #5000 opened under Żabka banner.

In 2019 Hebe opened online store, and first Carrefour Bio was opened. Spar took over Piotr i Paweł. Biedronka opened its #3000 store and chain Dino its #1000.

Nielsen started to get scanning data from: Kaufland, Eko, Ledi, Aldik Nova, MarcPol, Freshmarket, Dayli, In Medio/Relay in 2016; and from Biedronka, Chata Polska, Hebe,

Schiever, Mila, Tesco Online in 2017.

In 2016 Nielsen Operation Center was opened in Warsaw – one of 3 superhubs around the World.

2017 brought finalization of transition to CIP: single platform for all markets enabling new capabilities

In 2018 Drug categories were switched to monthly delivery. Open Markets and Multipurpose Stores channels were closed on Jan 2018. Same year Smartstore solution and Everyday Analytics were launched in Poland.

‘20

Entering the Covid-19 pandemic

In 2020, the world was shocked by the outbreak of Covid. No one was prepared. Consumer needs and preferences changed a lot, demanding safety, convenience, and flexibility from stores and products. The pandemic forced adjustments in store operations mode as well as as in the NIQ’s way of data acquisition, where scanning was not yet feasible. All FMCG players as well as NielsenIQ had to adapt to the new reality in order to keep up with the growing consumer needs.

2020 – 2022

In 2020 Eurocash bought 100% shares of Frisco.pl. In 2021 Sugar Tax was introduced. The same year Tesco left Polish market – Netto took over majority of its stores. Barbora.pl entered the market.

In 2021 NielsenIQ introduced E-commerce index with the growth of the channel.

In 2022 NielsenIQ is implementing Market Track: Total Poland weekly scanning data